Everything you need to know about the $RITE token

Token contract address

TOKEN CONTRACT ADDRESS: 0x0808bf94d57c905f1236212654268ef82e1e594e

This address is the same for both the BNB chain and the Base chain:

On BNB chain: https://bscscan.com/token/0x0808bf94d57c905f1236212654268ef82e1e594e

On Base chain: https://basescan.org/token/0x0808Bf94d57C905F1236212654268EF82E1e594E

If you can’t see you $RITE token inside your wallet, you probably have to “add” (aka import) the token to display the $RITE token. For most wallets, it’s a simple process. This is the how to add token link for the MetaMask wallet.

Where can you buy $RITE?

If you visit this page https://www.ritestream.io/get-rite, you see these options…

Let’s discuss them one by one… but first get an idea about liquidity and volumes by visiting CoinMarketCap…

Fiat or Credit card purchase

Banxa (perfect for easy purchase with CC or Google Pay)

If you click on the Banxa link, you can immediately buy $RITE tokens with your Visa/Mastercard or via Google Pay. You need a wallet that is supported by WalletConnect (many wallets are supported). It’s a suitable option for smaller $RITE amounts, and for easiness as the RITE token is already selected for you. (Note that you can only buy the $RITE token on the BNB chain).

Decentralized Exchanges (DEXs)

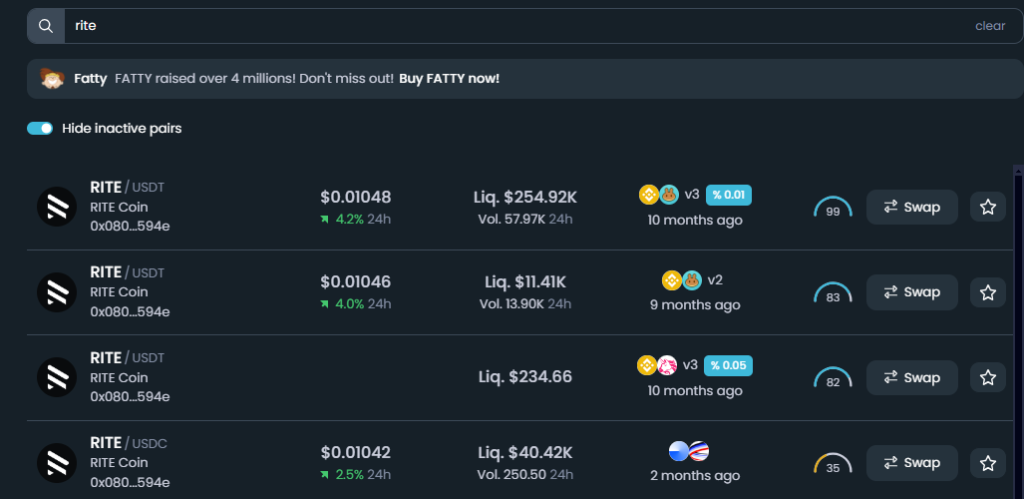

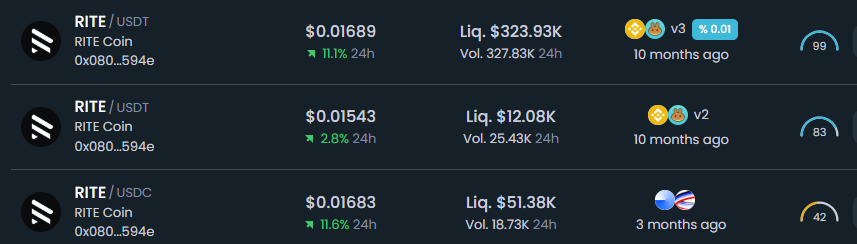

Tip: Besides using CoinMarketCap or Coingecko to find all exchanges (CEXs and DEXs) where you can trade a token, you can also use DEXtools.io to find the best DEX with the best liquidity.

Warning: always check if you see/use the correct token contract address (see above).

The first one with the highest liquidity is the best option (Pancakeswap v3) with highest liquidity and volume.

Let’s look at the DEXs individually…

PancakeSwap

If you click on the Pancakeswap link, the $RITE token on the BNB chain is already selected with the proper v3 Liquidity Pool pair $RITE-USDT. If you wan to buy the $RITE token on Base Chain, you have to switch (in the right top corner) to the Base chain first.

Although, you can use Pancakeswap for $RITE on the Base Chain as well, we advise you to use…

Aerodrome

If you click on the Aerodrome Link, you are redirected to the $RITE-USDC LP pair on Base chain. Note that the default slippage tolerance is set at 1%… you maybe lower that first (and try 0.5% for example). Note that volume for $RITE on Base chain is at the moment relatively low… but this will change in the future as the Watch-to-Earn $RITE rewards are paid out on Base chain.

To summarize the DEXs…

Our simple advise… use PancakeSwap for $RITE on the BNB chain, and use Aerodrome for $RITE on Base chain.

DEX Aggregators

Instead of using the DEXs themselves… you can also use DEX aggregators such as ParaSwap, Rubic.exchange, or RocketX.Exchange. (Note: it’s possible that you first have to import the token by adding the contract address)

The above hyperlinked DEX aggregators do support $RITE. So, my advise is to use one of these.

The main advantages of using DEX aggregators above the individual DEX is threefold:

- (often) Better protection against MEV-exploitation by bots (front- and back running, sandwich attacks). So, less slippage.

- You can often swap more (different) tokens instead of the tokens supported by the DEX (as the transaction may be split up and executed among different DEXs. Even multi-chain swaps are sometimes possible.

- Optimal route selection and lowest price impact. By analyzing all possible routes to execute the swap in often multiple steps among different DEXs (and or Bridges), the best swap route is found for the cheapest price.

That said, DEX aggregators earn income by keeping all (or part of) the “positive slippage”, and do sometimes charge transaction fee markups.

Centralized Exchanges (CEXs)

Although you can also trade $RITE on BitMart and Bitpanda, our advise is to stay away from them. BitMart has low and unreliable liquidity (see CMC above). Bitpanda acts as a “broker” for Gate.io. and doesn’t allow you to withdraw your $RITE tokens from the platform to your own wallet.

So, there are 2 CEX choices left… Gate.io and MEXC. Both are recommended to use.

These 2 CEXs are more or less comparable with respect to liquidity, volume, and expected “slippage” (explanation below).

For those of you who still don’t know about all the differences between a CEX and a DEX, I found this article that explains it in depth.

So, it also depends on your “experiences”… are you feeling comfortable to use a DEX, or (still) prefer a CEX?

We all know that traditional investors who want to invest in their first crypto token prefer reliable CEXs above DEXs (often seen as too complex and too risky)… but the DEXs are winning market share.

And it’s RITE mission to onboard the next 1 billion people into Web3… And, you can only call yourself a Web3 user… if you have your own non-custodial wallet holding one or more cryptocurrencies or tokens.

That’s something different in comparison to investors who only have a custodial CEX account…

We as RITE fans want $RITE to be used in the ecosystem for its decentralized utilities such as staking… not just for passive holdings (on a CEX).

So, the first question is…

What do you want to do with your $RITE?

(Also look below for the differences in utilities between BNB and Base chain).

For example, if you want to stake $RITE, you need a non-custodial wallet anyway. But of course, you can first purchase $RITE on a CEX and later transfer the tokens to your wallet.

So, the other question to be answered is…

What’s the exchange with the best liquidity, lowest price impact, and lowest slippage?

I answer this question below by first giving the definitions, followed by the explanations of some different liquidity metrics, and finally using these metrics to get an impression about the liquidity for the $RITE token, and giving some tips to avoid “bad fills”.

The answer is very simple…

The RITE team can’t comment because if they are in negotiation with a CEX, or even if the “contracts” are already “signed”, there is always an NDA (Non Disclosure Agreement). So, the team can’t say anything without violating the NDA terms.

Let me explain the typical CEX listing procedures…

All CEXs have a “request listing” procedure. Often there is a form that the project “applicant” has to fill in to give more details about the project and token.

Thereafter, the applicant has to wait if the CEX has any interest or not.

As thousands of projects want to get listed (on as many CEXs as possible)… the CEXs usually don’t reply at all. The applicant can try to get contact… but the answer will always like this “If we are interested, we’ll contact you”.

The CEXs will only list a token if they expect sufficient trading volume and related fee income.

Plus CEXs want to ensure that there are no large token holders who can “dump” the token at any moment. Hence, the applicant has to give specific details about token distribution.

CEXs also require that there is always sufficient liquidity to avoid that price can be “manipulated”.

Now, there are 2 solutions…

Either the applicant has to “hire” one or more market makers (MMs) – who have to be approved by the CEX) – or the CEX will select/assign the (main) market maker(s).

In both cases, the market makers need tokens to start with as they can’t “make the market” if they don’t hold tokens to sell (set the ask prices).

So, either the CEX (on behalf of the market makers) or the MMs have to make a “deal” with the project about how many tokens they will “get” and for what prices.

Often, the project has to “fund” this “liquidity” in the form of a “token deposit” to the CEX (and/or market makers).

Of course, this comes with a “price”… giving away tokens or for “cheap”… can be seen as a payment for “market makers commission”.

And the CEXs require minimum transaction volumes… if the volume is lower for a specific (contractual agreed) period… the CEX may de-list the token… and this often (contractual) means that the tokens won’t have to be transferred back to the project… (a loss for the project).

Furthermore, CEXs often require a “listing fee” or “marketing contribution” in the form of free project tokens. Sometimes CEXs use these tokens to reward their platform users and/or CEX token holders via airdrops. But often these tokens are a payment for the listing… and you can expect the CEX to sell these tokens… one of THE main reasons why the token prices often decreases after the listing.

However, CEX listing procedures and requirements are a “grey area”… The CEXs don’t want the “world” to know about the exact “rules”, and they want to avoid that smart investors will “front run” a listing. So, that’s another main reason why there is a NDA.

Another reason for the NDA is that not all Projects are equal. Of course, CEXs do prefer projects with high volume elsewhere (on other exchanges) to take a piece of the pie. And these projects maybe listed “for free” while others have to pay significant “listing fees”.

So, the listing rules and requirements are different for each CEX AND for each individual project.

But “newbies” always think that a tier 1 CEX listing is possible (often it’s not as the CEX has no interest), will increase the token price (often only “insiders” profit from an initial token price appreciation and thereafter the token price decreases), and is good for them (yes, maybe in the short term, but what about the long term?)… and they assume that the CEX will list the token for free. And if not free… the project should just pay the fees without knowing the associated costs.

Well, have a look at this article “Coinbase hit with $300M token listing allegations by Sun, Cronje“…

According to Tron founder Justin Sun, Coinbase asked for a $330M in total fees to list TRX. While Andre Cronje from Fantom stated that Coinbase asked fees between $30M and $300M.

Moonrock CEO, Simon, who was dealing with Binance for a Tier 1 project listing claimed that Binance asked 15% of their total token supply, worth $50M-$100M.

But that’s not all. Many new listings will fail with lower prices (and only some insiders making money). Read this “shocking” article about the latest Binance listings… The crypto exchange listing conundrum continues: Why newly listed tokens keep crashing.

So, if from now on, after reading this above, you are still going to ask “when CEX listing” all the time… that classifies you as a “troll” who doesn’t know what he is talking about.

Also notice that only 240 tokens are listed on Coinbase, and just over 500 on Binance. So, it’s not as easy to get listed there…

The chances for getting a Tier 1 listing will increase the more awareness about $RITE, the more transaction volume and liquidity in $RITE, and the more people a project will bring to the CEX.

Tier 1 CEXs also look at what Tier 2 CEXs are doing. If a token has sufficient volume and liquidity on CEXs such as Kucoin, OKX, or Upbit… the Tier ones know that the token will succeed on their CEXs.

So, for $RITE the next new CEX listing may be on one of these instead of Binance or Coinbase.

However, Kucoin and OKX compete with Binance and Coinbase and they don’t “like” to support tokens on BNB and/or Base chain. Just check it out yourself which token chain formats are allowed to deposit/withdraw on Kucoin and OKX…

So as the $RITE token is “only available” on BNB and Base chain… to get a Kucoin, OKX or Upbit listing, the $RITE token should first be “available” on the Ethereum network as well.

Note: the reason why Gateio and MEXC don’t support the $RITE Base chain format (yet) is kind of similar. They don’t like to “support” chains from competitors. But there is another more economical reason as well. The global transaction volume on Base is still substantial lower than on Ethereum and BNB chain.

And, you may wonder… Did the RITE team had to pay Gateio and MEXC “listing fees” and “commissions or token distributions” for market making services?

Yes, but the listing requirements and fees on both exchanges are “lower” in comparison to a listing on a Tier 1 CEX.

BTW, the $RITE airdrops around the TGE/IDO and free tokens given to these 2 exchanges in March 2022… were one of the reasons why the $RITE token price decreased in price shortly after the initial listings on Gateio and MEXC.

So, to summarize, a CEX listing is often not free and hard to get for a Tier 1 CEX listing and beyond the control of the RITE team… We only can hope that (Tier 1 and the next tiers) CEXs become interested in listing $RITE as a result of sufficient interest, transaction volume and liquidity in $RITE.

Local CEX listings (below Tier2 level) may sound interesting but most of them have limitations such as Local clients and regulations, (too) low liquidity, and often act as “brokers” for other main CEXs.

Just to give you one example… BitPanda is a broker for Gateio. The customer tokens on BitPanda are held inside Gateio wallets, and (as a result) BitPanda users can’t withdraw $RITE from the platform. (The same no-withdrawal feature applies for Uphold in USA for example).

More listings also lead to fragmentation and are not always better for overall liquidity. Just think about it… if we have a few more local CEXS… the team has to split liquidity and pay higher fees to the market maker (who is the only one profiting from “arbitrage”).

And listing on “shit” exchanges where you can’t deposit/withdraw the $RITE token or where your tokens are “at risk” is not what to aim for.

So, the current focus for the RITE team is not on getting listed on new CEXs… listen to what Riaz, the CEO, said about this topic… as a CEX listing is not as beneficial as many think… (question answered in minute 54-57 inside this AMA).

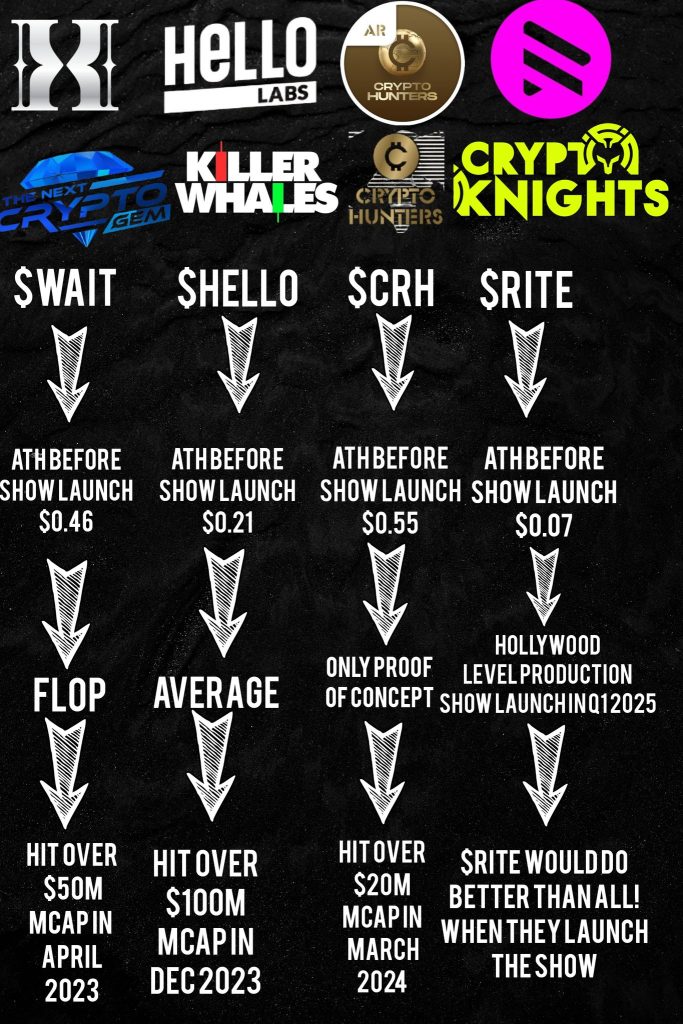

This above should be treated in respect to the current (too low) regular organic $RITE transaction volume… but what may happen if…

Hundreds of millions of eyeballs will watch the CryptoKnights Show and/or seeing the marketing exposure…

You bet that CEXs, DEXs, or wallet providers want to be on front of these millions of (current) Web2 users who are interested to invest in crypto and Web3 projects.

So, a sponsorship with one of the main CEXs, DEXs, or wallet providers is just “around the corner”.

For example, they may sponsor the $250K winners prize, or “facilitate” viewers to set up their first wallet (MetaMask or Coinbase Wallet) and do their first swap.

And part of the team’s negotiations with these main CEXs… should be to get a free CEX listing for the $RITE token.

Hence, it’s just a matter of time before we get a Tier 1 listing… but asking this same “when CEX” question won’t help as the team won’t answer as explained above.

The RITE team is smart and knows that free CEX listings will come… just be patient. The success of the CK Show will accelerate this process.

Also be aware that… the more streaming platform users… the higher the token velocity, transaction volume, and better the liquidity… which should be noticed by the CEXs sooner or later.

Before we answer that question, let’s first give some definitions and theoretical background info…

- Liquidity:

Liquidity refers to the ability to buy or sell an asset quickly and at a fair price without significantly affecting the market price. In other words, liquidity measures how easily an asset can be traded without causing a significant price movement. A liquid market has many buyers and sellers, which allows for smooth and efficient trading.

- Price Impact:

Price impact refers to the expected effect that a trade has on the market price of an asset. For CEXs, the effect/impact is usually calculated by using the order book bid quotes (for a sell order) or order book sell quotes (for a buy order). So, by assuming that the market order may be executed as per the CEX order book quotes. Or for DEX swaps that nobody else will execute a swap just before your order is being executed.

Unfortunately, between the order entrance and actual execution, the order book may change and/or other trades may be executed just in front of your order execution, with as result…

- Slippage:

Slippage refers to the difference between the expected price of a trade and the actual price at which the trade is executed. Slippage can occur due to various factors, such as market volatility, liquidity issues, or frontrunning.

For CEX market orders you can’t set a maximum slippage percentage, but for DEX orders you can set a maximum slippage percentage (to avoid unwanted negative differences in price). In case a DEX order can’t be executed within the slippage percentage setting range… the order will be automatically canceled.

How to measure liquidity?

These are the most common methods to measure liquidity…

A) Price impact.

For a DEX (market) order, you can just enter the order and for almost all DEXs (and DEX aggregators), the price impact (in a percentage) of your order is shown.

For CEX (market) orders, often the (expected) average buy/sell price is shown, and you can calculate the price impact (percentage) yourself.

B) Market depth

If you look at CoinMarketCap or other crypto data providers, you can see the market depth for CEXs. For CMC, it’s the amount (in dollars) that you can buy or sell with maximum 2% price impact. Others may use a 1% or other “depth” percentage.

C) MarketCap

The MarketCap is the equivalent dollar value of all public available tokens free to trade (Circulating Supply times Token Price). It’s a measurement of the total maximum dollar amount free to trade, and indicator of the (maximum) market size.

D) Transaction Volume and Volatility

Actual transactions change the order book (as orders are executed and “leave” the order book), the price impact, and the market depth… And each transaction may lead to a “market response, for example, new order entries (limit orders) or new transactions (market orders).

Of course, the higher the volume and volatility, the higher the chance that LIMIT orders may be executed at the wanted prices.

But for MARKET orders, higher volatility may lead to unwanted higher slippage, and the shown price impact may “unachievable” as prices and quotes change frequently.

So, if you combine the last 2 metrics, you can calculate…

E) Volume/Marketcap (24 hours)

This is a percentage, and the higher, the better (in terms of liquidity).

I really like this measurement as it takes into account the Marketcap. So, it’s better for comparison of tokens taking into account the difference in “size”.

If you want a rough classification:

- <1% is bad

- 1%-3% is mediocrate

- 3%-5% is adequate

- 5%-10% is good

- >10% is excellent

F) Liquidity Scores on CoinMarketCap

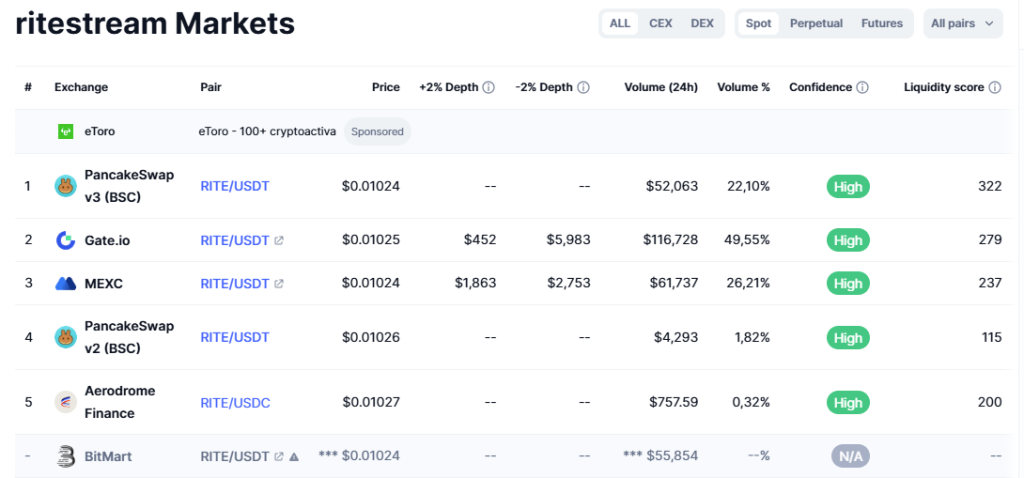

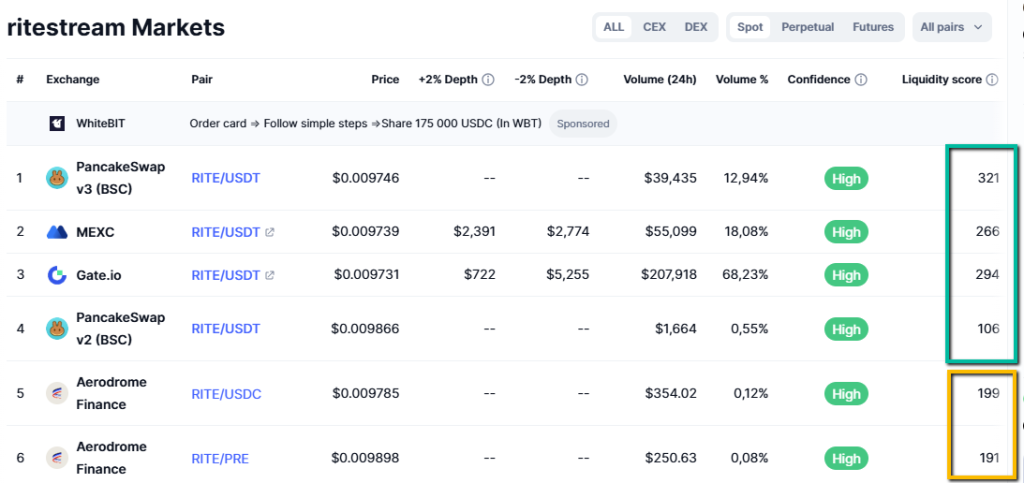

Note that I marked the liquidity scores BNB chain pairs in “green” and the Base chain pairs in “brown”. (Date screenshot: January 16, 2025)

The Liquidity Score (for each market pair) can range from 0 – 1,000, with 1,000 reflecting the most liquid of markets and 0 for the most illiquid.

- A perfect Liquidity Score of 1,000 means that the market has a very low slippage for orders up to $200,000 in size.

- The lowest Liquidity Score of 0 means that the order books have less than $100 in total value on either the buy or sell side — a very illiquid market.

It’s an easy to use indicator but it lacks 1 on 1 comparison as a score of 500 doesn’t mean that it has 2x the liquidity as a 250 score. It’s also not perfect for comparing different tokens. But in general, if you compare this score (for the same token), the higher the score the better the liquidity (relatively in comparison to the other pairs).

G) For DEXs… Volume (24h)/Pool Liquidity

Again, the higher this percentage, the better (in terms of liquidity).

OK, all theory… let’s answer the question… How Liquid is $RITE?

The “problem” in answering this question is that the “liquidity” changes all the time.

Especially on CEXs as people (and trading and market making bots) change their orders and quotes frequently and often within fractions of a second. Also, the liquidity can be biased to either the buy or sell side.

For DEXs, the liquidity is determined by the (dollar) size of the Liquidity Pool. However, always with a “balanced” buy and sell side as the AMM (Automated Market Making) mechanism has an implied balanced order book (for each swap (dollar) amount, the buy and sell price impact is the same).

OK, if we understand that liquidity is just a “status” at a given moment, let’s look at the numbers for a “random” day, today December 5, 2024, as I write this update.

Remarks:

- The reported Circulating Supply is 292M while the actual number is higher, check out the actual number below.

- The screenshots were taken in a half hour time period, not exactly at the same time, but for this purpose good enough to use.

- In contradiction what many think… the total DEXs volume exceeds the CEXs volume.

- The 2% Market Depth on PCS v3 is about $3,200 (see above) on both sides (buy and sell) which is better on the sell side in comparison to the 2 CEXs above.

Let me be clear from the start…

$RITE is a small cap… and you can’t expect that large orders, let’s say a $100K order can be absorbed immediately by the market without having a significant price impact.

So, if a “whale” wants to trade/invest in swaps of $100K, $RITE is just not for him (for now)… unless he accepts that he has to split his order in multiple smaller orders and accepts that it takes time to accumulate/sell and give the market time to react and set a new equilibrium price… whereafter he can execute another new order.

For this example day…

The numbers are relatively “good”.

A reported Vol/Marketcap of 13.13% is excellent even if you correct for the outdated and too low used Marketcap (if corrected this percentage is about 10%)

The DEX ratio Volume/Liquidity for PCS v3 is about 1… meaning that the full liquidity is traded in the last 24 hours… and that’s an “excellent” score.

The Market Depth on the main DEX PCS v3 with $3,200 for 2% depth is “sufficient” for a MC of $6.8M.

But often I hear people complaining about the high price impact and that the team should increase the liquidity.

Often, these “complainers” didn’t read my advises above, used the wrong DEX or trading pair, or confuse slippage with price impact.

Furthermore, they only look at the positives of increased liquidity, i.e. lower price impact.

However, “too liquid” may result in a “stable” price pattern as it takes too much “money” to move the price. Hence, less volatility (with lower transaction volume as result), and a lower change that the price will “pump”. That’s the negative side often ignored.

Also, there is a maximum that the RITE team can do. So far, they used 50M $RITE tokens for liquidity (the full amount allocated in the Whitepaper as you can see below in the token vesting current status.

The team can’t just add all their tokens into LPs… and what if they think that the current $RITE token price is too low? Should they add $RITE liquidity at the current “low price” level… and sell the treasury tokens too cheap via the LPs? Or should they wait until the $RITE token price is at least above public IDO price?

(You know as $RITE investor… do you like that “someone” offers millions of $RITE tokens on the market… as that’s what happening if the team ads liquidity at current price level…)

Or should they let the market do what needs to be done… new token accumulation with fast price increase the moment demand kicks in?

Also, higher price volatility is not always bad… as this also increases awareness of the token. People don’t talk about a token in the “boredom” zone but if the price is highly volatile… it’s the talk of the town.

And you know, the higher the token price… by definition, the higher the MC and the higher the liquidity, and the more attractive $RITE is for “whales” and professional investors.

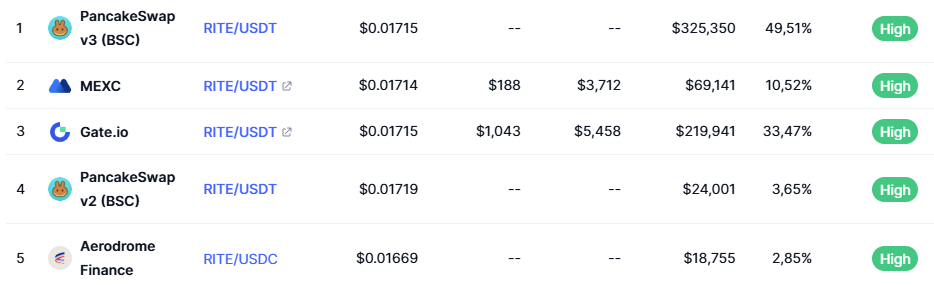

So, on “good” days with significant volume and volatility… look for at example at the last week of January 2024… the daily volumes were significantly above $1M with almost $5M (24h) volume the highest.

Hence, the market will adjust and can absorb higher volumes. It’s not just the visible order book on CEXs that determines the volume… also the actual volume and “invisible” order book that drive prices. As often increased volume results in even more transactions as it gives potential “sideline watchers” the opportunity to step in and do their wanted trades.

Locking liquidity is NOT a good idea as the possible benefits don’t outweigh the potential disadvantages. I’ll explain to you…

Benefits of locking up liquidity

Liquidity locking is often done for new projects to give new potential investors the “trust” that it’s not a scam project. It’s meant to ensure that there is always sufficient liquidity, and that the team can’t “run away” or rug pull the project by removing all liquidity (after selling/dumping the token).

(Note: vesting is also a measurement to avoid that the team or insiders will dump tokens on the market)

However, $RITE isn’t a new project… the $RITE TGE/IDO was almost 3 years ago (March 2022), and (almost) all “team” tokens are already unvested. So, if the team wants, they can sell 400M+ $RITE tokens and “run away”. The locking up of about 13M $RITE tokens in the $RITE-USDT (Pancakeswap v3) Liquidity Pool is just a “marginal” amount, and “insufficient” for additional “trust”.

So, almost no additional benefits… Let’s look at the…

Cons of locking up liquidity

Technical reason… Liquidity pools are no longer just set-and-forget pools as with Uniswap v2 (and comparable “clones” of other DEXs and EVM-related chains). Since v3 (the $RITE LPs on PCS and Aerodrome are v3), the LP must be rebalanced if prices move out of “range”. A rebalance equals a withdrawal and a new deposit in the LP. With a locked LP, this won’t be possible anymore.

Risk reason… Sometimes the LP needs to be “halted” for trading by taking out all pool liquidity. An excellent example was the hack on January 6, 2024. If the LP was locked… the team could NOT take out the liquidity, and the hacker could dump all his (remaining) tokens via the LP. Also, due to the hack, the team introduced a new token contract… with the locked LP… these tokens couldn’t be “converted” to the new contract. A real pain in the ash… as I know another project is still suffering.

Strategically, the RITE team should be flexible when changing the liquidity strategy. For example, when the RITE-USDC LP was introduced on Aerodrome, this pool was partly filled by removing liquidity from the PCS v2 RITE-USDT pool.

Another reason to take out pool liquidity is in case the community itself may add sufficient liquidity… Think about the current RITE-USDT PCS v2 Staking Pool with up to 20% APY.

So, I hope you can understand now that the potential disadvantages of locked up tokens in LPs outweigh the benefits of showing the community trust that the team will continue to support the liquidity pool.

Some trading tips to avoid bad fills

- First analyze what’s the best marketplace CEX or DEX to execute you order with the best liquidity.

- For DEXs, try to use the default Liquidity Pool swap pairs (RITE-USDT on PCS, and RITE-USDC on Aerodrome). Especially on PCS… using other pairs will often result in too high price impact. The way to solve this is to do a 2-step execution. First swap to UDST, followed by another (default) pool swap USDT->RITE.

- Always set your slippage percentage in line what you want to pay at a maximum for slippage. Just increasing the slippage by ensuring that your order will be executed is often not that smart as MEV bot exploitation will guarantee that your slippage will be eaten up, and you get a bad fill.

- For CEXs, use limit orders.

- For CEXs and DEXs, split larger orders into smaller orders and be patient.

Differences between $RITE on BNB chain vs Base chain

At the moment, $RITE on BNB chain has more “utilities” in comparison to $RITE on Base chain.

| Utility | BNB Chain | Base Chain |

| $RITE staking possible | Yes | No (but upcoming) |

| $RITE W2E/W2W rewards | No | Yes |

| Supported by Banxa | Yes | No |

| Supported by Pancakeswap | Yes | Yes |

| MEXC support | Yes | No |

| GATE support | Yes | No |

| Gas fees | Low | Lowest |

Luckily, you can always use the bridge to swap from token format.

That’s very simple… there is just one bridge… and you can find the bridge widget on the Get RITE page.

For more background info about the bridge, read this announcement $RITE Bridges to BASE for Enhanced Accessibility.

The bridge works by locking tokens on one side and minting equivalent tokens on the other side. It’s based on Layerzero OFT standard. You can track the bridge status on Layerzero scan. It uses industry-standard security protocols and practices to ensure safe and reliable transactions. The adapter contract has been full audited by QuillAudits.

The bridge supports popular wallets such as MetaMask, Trust Wallet, and OKX and many other EVM compatible wallets.

The bridge is super easy to use and fast (it takes about 30 seconds)… The transaction fee is 0.5% and the related number of $RITE tokens are always burnt automatically on the BNB chain.

So, if you swap 100 $RITE on BNB chain to Base chain, you get 99.5 $RITE on Base… and the 0.5 RITE is burnt automatically by transferring the amount to the BNB chain burn address.

And for the opposite swap 100 $RITE on Base chain for BNB chain format… you’ll receive 99.5 $RITE on BNB chain and again 0.5 $RITE on BNB is sent to the burn address.

Base can be added as a custom network to any EVM-compatible wallet.

For example, to add Base as a custom network to MetaMask:

- Open the MetaMask browser extension.

- Open the network selection dropdown menu by clicking the dropdown button at the top of the extension.

- Click the Add network button.

- Click Add a network manually.

- In the Add a network manually dialog that appears, enter the information as per table for Base mainnet:

- Tap the Save button to save Base as a network.

| Name | Value |

| Network Name | Base Mainnet |

| Description | The public mainnet for Base. |

| RPC Endpoint | https://mainnet.base.org |

| Chain ID | 8453 |

| Currency Symbol | ETH |

| Block Explorer | https://base.blockscout.com/ |

You should now be able to connect to the Base by selecting it from the network selection dropdown menu.

Thereafter, you can import the $RITE token on the Base chain. For MetaMask follow this guide.

($RITE Token contract address: see top of this page)

$RITE is currently a multi-chain token on the BNB and Base chains. Are there any plans to support other chains such as the main Ethereum Network and/or other L1 or L2 chains?

Well, it all depends on future chain developments and what features and (token) utilities can be used and added to the $RITE ecosystem and tokenomics.

Just supporting more networks/chains may only lead to more fragmentation. Fragmentation in liquidity as each chain requires “liquidity” to easily swap/trade tokens. And/or (often) fragmentation in token utilities as chains have different advantages and disadvantages.

For example, the RITESTREAM+ W2E and W2W $RITE rewards are paid out on the Base chain as this chain has relatively low gas fees needed for all on-chain small payment transactions.

And for $RITE staking, the BNB chain is used as most of the tokens are still on the BNB chain… and to set up new staking pools on the Base chain comes with an extra “setup fee” of at least $10K. So, the RITE team waits until the activity on the Base chain increases to avoid unnessary costs.

That said, the used Layerzero OFT standard and $RITE bridge can be easily implemented and expanded, for example, for the Ethereum Network.

So, suppose a Tier1 Exchange wants to list $RITE and “requests” for Ethereum Network support… this can be supported and rolled out very fast.

Or if the team wants to release memecoins (Film/TV-show) and the $RITE token to be supported on Solana… in these cases…

The RITE team is prepared, flexible, and can support other chains if and when needed quickly.

Cross-chain transactions for $RITE

Often you may hold a stablecoin (USDT, USDC) or another token on another chain than the preferred token chain for your $RITE token (either on BNB chain or Base chain).

In that case, you have to do a cross-chain swap.

I often use app.xy.finance to swap stablecoins (or other tokens) from on chain to another. It’s one of the cross-chain apps where you can set relatively low slippage percentages. For stablecoins I often use 0.3%-0.5%, while other platforms required you to use a minimum of 2% slippage setting.

Note that you can also cross-swap stablecoin on chain X for the another stablecoin on chain Y.

An example…

Let’s suppose you hold USDC on the Ethereum network. Now, you use app.xy.finance to (cross-chain) swap these to USDT tokens (on BNB chain). And thereafter, you can directly swap this USDT for $RITE (single-chain swap on BNB chain).

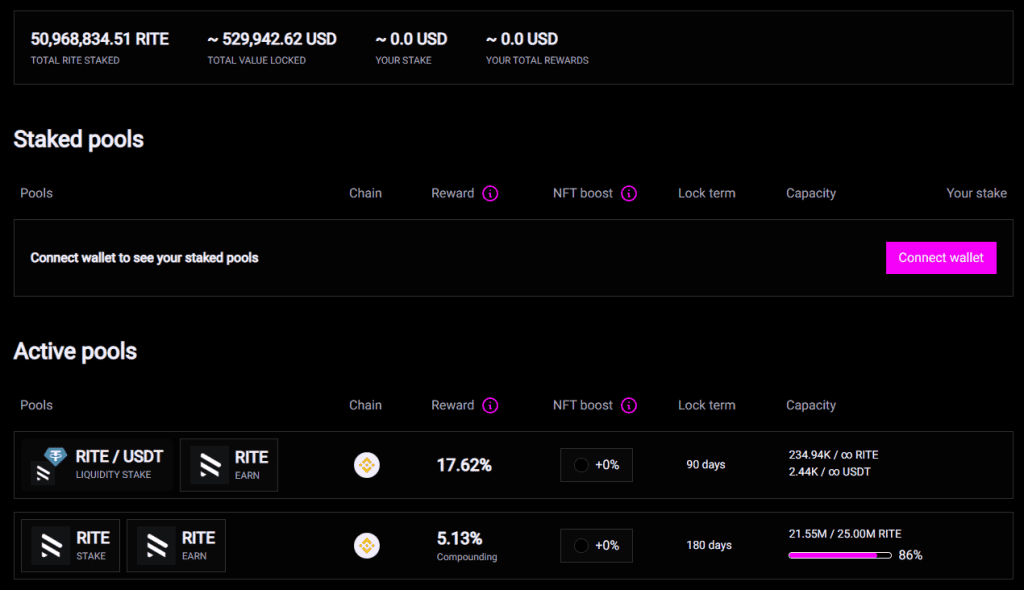

How to stake?

Note that staking is currently only possible with the $RITE BNB chain token format.

Screenshot taken November 15, 2024

Staking is straightforward… just visit this link… https://staking.ritestream.io/ and follow the steps.

Note that the staking page also mentions “NFT boost”… but this is just a built-in (optional) feature (offered by the staking platform) and is not in effect yet. So, there are no NFTs boosters.

There are 2 open staking pools:

- As single-token ($RITE) pool with fixed 5.13% APY and 180 days duration with maximum pool size 100M tokens. If filled a new pool will be opened.

- Staking the RITE/USDT Liquidity Pool with dynamic APY rewards up to 20%, and 90 days duration. (This staking option is currently unavailable but will be added (again) later).

Can you stake more $RITE if you already staked before, and does extra staking have any consequences?

Yes, you can just deposit additional $RITE to your current staking pool (or the new pool if applicable when your pool was full and closed for new deposits). The system counts up your staked total from all deposits to calculate airdrops distributions and/or token allocations. The original staked number still has its original 180 duration (with 5.13% APY). And the additional staked $RITE, of course, will have its “own” 180 days lockup period (and APY calculation) starting from the moment of the additional deposit.

(Note that if you visit the staking page… the showed “Lock end date” is always 180 days away from the current moment. Only if you connect your wallet and see your staked “stats”, you can see the actual Lock end date based on the moment of deposit)

What kind of $RITE token holder are you? Shrimp, Crab, Octopus, Fish, Dolphin, Shark, Whale, or Humpback?

Always wanted to know what type of “sea animal” you are?

Just count up all your $RITE holdings in your wallet(s) and/or staked, and check below…

| Type | $RITE | $RITE Staking Pool | BTC | |

| Blue Whale | 10M+ | Pool 9 | ||

| Humpback | 5M-10M | Pool 8 | >5,000 | |

| Whale | 2.5M-5M | Pool 7 | 1,000-5,000 | |

| Shark | 1M-2.5M | Pool 6 | 500-1,000 | |

| Dolphin | 750K-1M | Pool 5 | 100-500 | |

| Fish | 500K-750K | Pool 4 | 50-100 | |

| Octopus | 250K-500K | Pool 3 | 10-50 | |

| Crab | 100K-250K | Pool 2 | 1-10 | |

| Shrimp | 50K-100K | Pool 1 | <1 | |

| Unclassified | <50K |

So, now you know what to do to climb up in the ranks.

Explanation: the “sea-animals” classification is based on the Staking Tiers (see below). We just gave all Pool tiers a name. If you look at the numbers above, it immediately becomes clear that a $RITE whale (or any other sea animal) is not the same as a BTC whale. The BTC whale has a “worth” of at least $85M (BTC used price $85K). While a $RITE whale is “just” worth $25K ($RITE used price $0.01).

So, it’s all relative, based on your token holdings in comparison to the circulating and/or maximum token supply. And not based on the related dollar value.

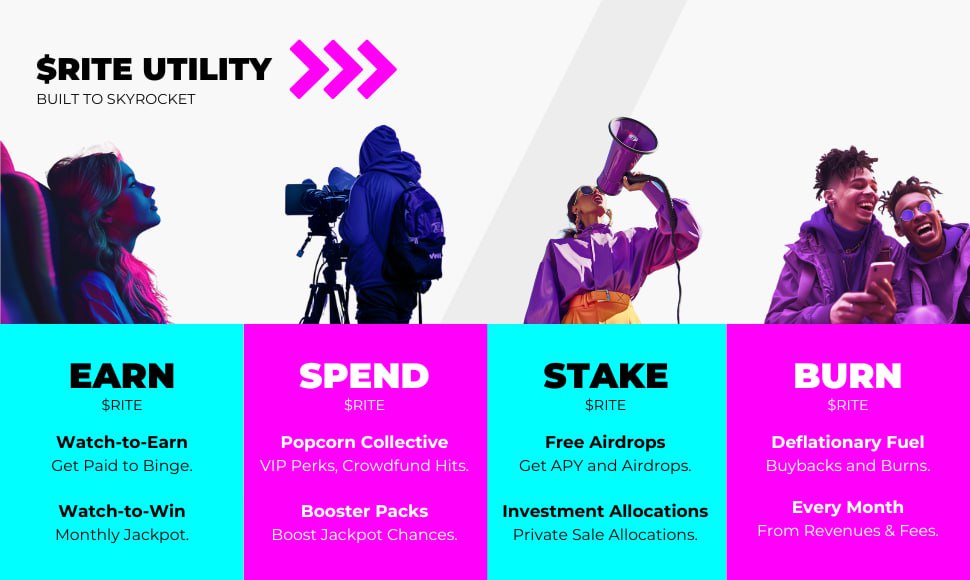

So, now you know how to acquire, trade, and bridge the token… but why should you buy, hold and/or stake the $RITE token anyway?

Let’s look at the…

Tokenomics and Ecosystem

If you click on both links above, you can read the News announcements. Below, I split the tokenomics into:

- Token Utilities per narrative (Earn & Spend).

- Staking Benefits, how to stake, and staking stats.

- Additional token benefits for 500K+ $RITE holders.

- Token Burn mechanism.

- Revenues generating capacity.

Token Utilities per narrative

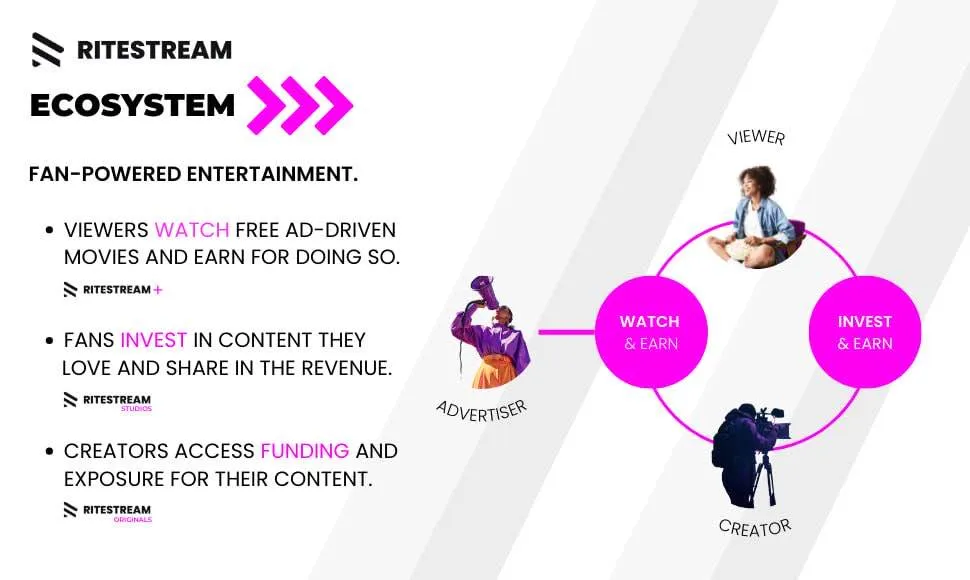

As there are 3 main activities, we just have to look at how you can use $RITE is these 3 different ecosystems.

RITESTREAM+ The streaming platform

40% of all streaming platform ad income is used for Watch-to-Earn (20%) and Watch-to-Win (20%) rewards. The ad income is in dollars, while the rewards are distributed in $RITE. So, the team first has to “convert” these dollars in the $RITE token by buying the tokens on the open market (or use some of the $RITE “treasury”, but the treasury is not unlimited)…

This causes a constant $RITE token buying pressure… and the more ads are shown… the higher the $RITE rewards and the higher the required $RITE purchases.

And the more users, the better the token distribution among new platform user’s wallets.

There are currently over 9K wallets holding $RITE. Be aware that some wallets hold tokens for many investors such as Central Exchange wallets and the staking pools wallets. And some owners will use multiple wallets. But overall, the actual number of people holding $RITE is actually higher than 9K.

And you can expect that this number will increase significantly in time as each month (later weekly) the $RITE W2E and W2W rewards will be distributed.

But yeah you may think… $RITE rewards can be sold, and if everyone immediately sells the tokens… the combined buy pressure and sell pressure will be zero… and the token distribution will stay the same, and no upwards price effect will happen.

Even if this should happen… there is still a positive effect… higher token velocity, higher transaction volume, and better liquidity…

The other positive aspect is that after getting $RITE, most new holders will investigate what to do next with their $RITE… This may lead to $RITE accumulation (for purposes outside the steaming platform ecosystem, for example, as investment or for staking to ensure Launchpad allocations). At least, it will lead to “awareness” of the $RITE token(omics).

That said, yes, it’s important that these new $RITE holders will have a reason to hold their tokens, or spend them within the RITE streaming ecosystem (instead of selling the tokens immediately).

The streaming platform went just live in October, 2024, and there is (yet) no option to use earned $RITE on the streaming platform.

But this will change soon if $RITE can be used for example for:

- Pay-per-View Premium content.

- Monthly subscription for Premium content.

- Monthly subscription for Popcorn Collective.

- Buying Watch-to-Win Boosters. (These Boosters increase your chance to win prizes in the Watch-to-Win pool).

I expect many streaming platform users to seek their fortune and use the earned $RITE to boost their chances to win prizes in the lottery pool. (You know, if you have a small dollar value in $RITE, why not grab your chance for winning a larger sum?)

BTW, it’s in the planning to reward $RITE stakers with these W2W Boosters as well. So, increasing the staking benefits… which is, of course, positive for the tokenomics.

RITESTREAM Studios The Crowdfunding Platform

Not all details are known yet…

So, we don’t know yet what the benefits will be for using $RITE on the Crowdfunding platform.

Probably $RITE is required for the monthly Popcorn Collective subscriptions.

Or there will be another role for the $RITE token, for example, needed to pay for the Platform fee, or to invest in the crowdfunded “projects”.

And we may expect that $RITE stakers will get staking benefits in the Crowdfunding ecosystem. Probably based on the principle the more you stake, the higher the allocations. Or that $RITE staking is required to get (exclusive or guaranteed) allocations (or allocation discounts).

We have to wait and see, but the aimed goal is that $RITE should be (an essential) part of all the “narratives” and related ecosystems.

CryptoKnights and CK Pad (the first RITESTREAM Originals’ funded and created product)

Here, the $RITE token benefit is clear… staking gives access to exclusive, guaranteed, and/or higher CK Pad sales allocations. And the more $RITE you stake, the higher the allocations.

Also, $RITE stakers receive free token airdrops from featured projects in CryptoKnights (see below under staking).

But it’s not just about access to allocations… it’s also about getting price discounts and/or participating in IDOs at private sales prices… otherwise only available to VCs and “insiders”.

To summarize all 3 activities together…

The W2E and W2E reward system with payouts in $RITE will lead to constant buy pressure, broader token distribution, increased token velocity, higher transaction volumes, better liquidity… and ultimately to token price appreciation. While the TV & Film Crowdfunding and CK Private Token Sales Launchpad will attract new investors who need to buy and stake $RITE to get exclusive, guaranteed, and/or higher allocations with token price discounts, and interesting “surprise” token airdrops.

Let’s dive into all staking benefits…

Staking benefits

Current staking benefits:

- 5.13% APY for single-token staking pool (or up to 20% for $RITE-USDT Liquidity Pool staking).

- Free Token airdrops (from featured projects in the CryptoKnights shows), starting April 1, 2025.

- Exclusive allocations and discounts for CK Launchpad platform.

- Exclusive allocations and discounts for TV & Film Crowdfunding platform.

Future (possible) staking benefits:

- Free Boosters to increase W2W chances on the streaming platform.

- Voting rights and Governance (DAO).

Let’s discuss these current staking benefits one by one.

Benefit 1: Default Staking APY (5.13%) for every staker

The default APY staking benefit is straightforward… you earn 5.13% APY. You can wait to claim your $RITE rewards until the end… or you can “harvest” your accumulated rewards along the way.

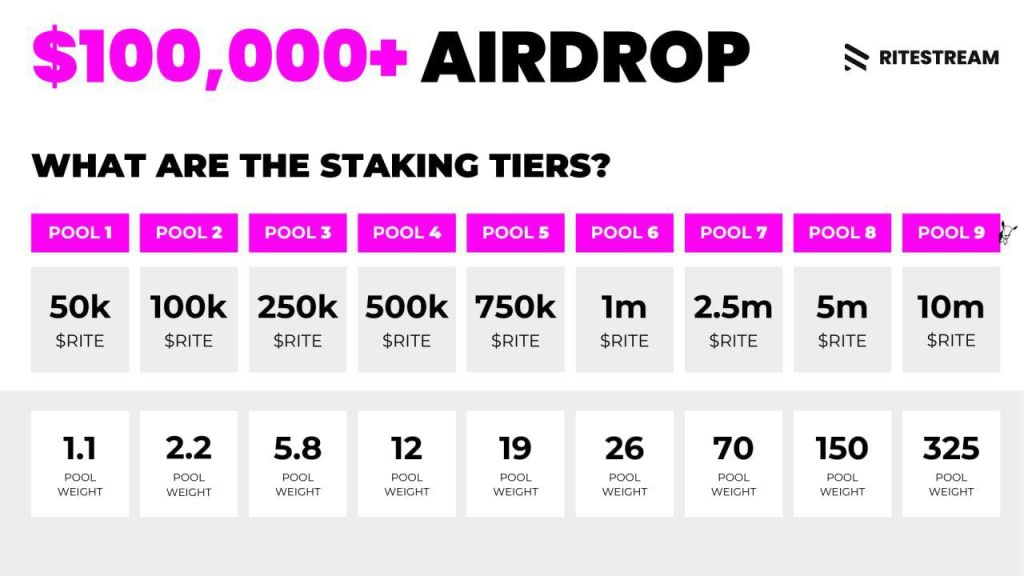

Benefit 2: Additional $100K+ token airdrops (Tiers-based)

Source: official news announcement about this $100K+ airdrop

The concept is simple…

The earlier and more you stake, the (relatively) higher the (free token) airdrops (tokens that are featured in the CryptoKnights Show), and it’s based on a tier system.

The ($100K+) Airdrop will run over 12 months, starting from April 1, 2025.

Below some FAQs.

Tokens from projects featured in CryptoKnights Season 1…

Via the upcoming dashboard you an see analytics, like total pool weight, your individual pool weight, how much you’ve accumulated, staking leaderboard, etc, etc.

The airdrop staking rewards are calculated daily. So, the earlier you stake, the more you “accumulate” of the total airdrop (in comparison to other stakers who joined later).

Along the way, token distribution moments are “assigned”, where you can claim part of the airdrop as and when project tokens become available to the team.

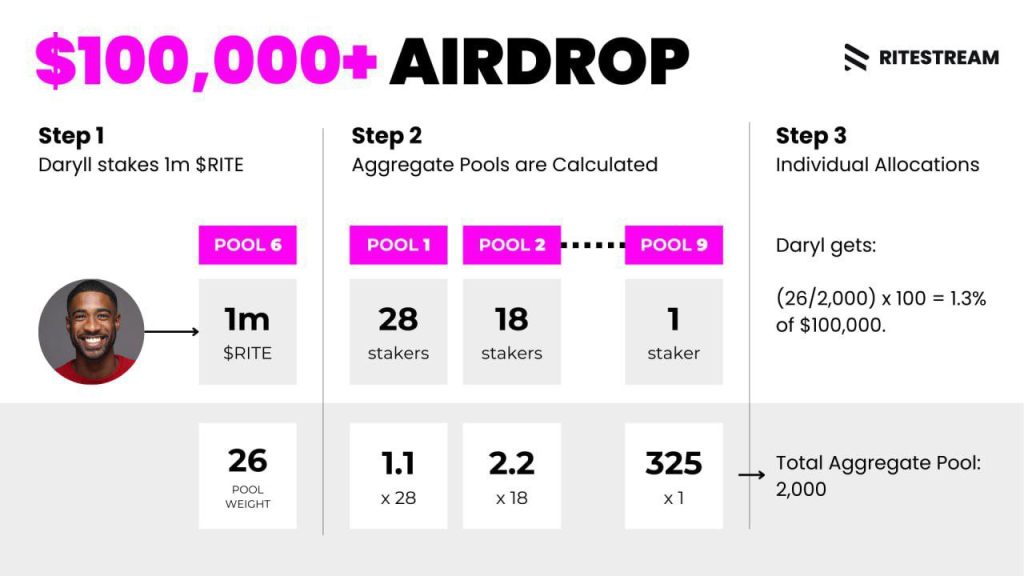

Let me explain by giving an example…

Step 1: Determine your pool weight. Identify the staking tier you qualify for based on how much $RITE you have staked.

Step 2: The (daily) snapshot determines the total pool weight: the sum of all pool weights from all staking participants.

Step 3: Individual allocations. Your proportional weight equals your pool weight divided by the total sum of all pool weight.

Step 4: Determine your (maximum) entitlement: multiply the total airdrop amount by your proportional weight.

For example, Daryll stakes 1M $RITE, his pool weight is 26. If the total pool weight of all participants is 2,000, his proportional weight would be 26 / 2,000 = 0.013 or 1.3%. If the total airdrop amount is $100,000, his maximum allocation would be 1.3% of $100,000, which is $1,300.

And this (maximum) allocation amount (in dollars) consists of a “bunch” of individual token airdrops (released and claimable during the year).

As people enter the staking pool, the total pool weight changes and hence your allocation also changes.

When your current pool expires, and you don’t re-stake into a new one, you won’t be able to accumulate more of the airdrop.

Starting April 1, 2025… Every day a “staking”-snapshot is taken, and your airdrop rewards are allocated (and calculated) based on your proportional pool weight.

The stakers who staked from the start (April 1, 2025) will get relatively higher airdrops as others who joined (i.e. staked) later and missed the prior daily airdrop allocations.

However, it also make sense to stake as much $RITE as possible as the Tier system is “progressive”… the higher the pool, the higher the “bonus” pool weights.

Below the table for the calculated “bonus” Pool Weights… (difference between used progressive pool weights vs linear calculated pool weights).

| Pool 1 | Pool 2 | Pool 3 | Pool 4 | Pool 5 | Pool 6 | Pool 7 | Pool 8 | Pool 9 | |

| RITE Staked | 50K | 100K | 250K | 500K | 750K | 1M | 2.5M | 5M | 10M |

| Progressive Pool Weight | 1.1 | 2.2 | 5.8 | 12.0 | 19.0 | 26.0 | 70.0 | 150.0 | 325.0 |

| Linear Pool Weight | 1.1 | 2.2 | 5.5 | 11.0 | 16.5 | 22.0 | 55.0 | 110.0 | 220.0 |

| Bonus Pool Weight | – | – | 0.3 | 1.0 | 2.5 | 4.0 | 15.0 | 40.0 | 105.0 |

No, on the contrary, as the distribution is progressive… it doesn’t make sense to use multiple wallets to try to increase your airdrop amounts.

That said… if you know (upfront) that you won’t reach the next Pool Tier… it may be “handy” to use a second wallet for the “excess” part. Let me give an example…

Suppose you have 800K $RITE. This is between 750K (Pool 5) and 1M (Pool 6)… The best way to stake now, is to stake 750K $RITE and reach Pool 5… and stake another 50K RITE by using your second wallet to get the 1.1 extra Pool Weight (as per Pool Tier 1). This way you’ll get 19.0+1.1=20.1 Pool Weight (instead of just 19.0 if you had staked 800K and use a single wallet).

Hence, you can determine your optimum based on the Tier system and number of excess tokens… but in practice… you never need more than 2 wallets. And most will just stick with one wallet and try to reach the next Pool Tier.

Starting April 1, 2025… Every day a “staking”-snapshot is taken, and your airdrop rewards are allocated (and calculated) based on your proportional pool weight.

Benefit 3: Exclusive allocations and discounts for CK Pad and TV & Film Crowdfunding Launchpads

Source: https://www.ritestream.io/news/unlock-private-token-sales-of-cryptoknights-projects

By far the most intesting staking benefit are these private token sales as the discounts given to $RITE stakers can generate high APYs as will be explained below.

But in short, what are we talking about?

Soon, as $RITE staker, you can you invest in these game-changing CK featured projects at (private sale) discounted prices, otherwise only available to “insiders” and venture capitalists.

The same above Staking Pool Tier system that is used for the (free) Airdrop allocation, will also be used for the CK Private token sales…

The more $RITE you stake, the higher the benefits (i.e. the higher the allocations).

Starting Q3 2025, $RITE stakers can also participate in upcoming TV & Film Crowdfunding launches. The details have to be worked out. But again, expect exclusive, guaranteed, and/or discounted allocations based on the principle the more you staker, the higher the benefits.

What’s the expected total staking APY combining all staking benefits?

Well, the answer is short and simple… it’s dynamic and depends on the actual staking benefits (numerator) and the actual investment base (denominator) as ROI/APY percentage is total benefits value/total investment value (for a 1-year period).

The total investment base amount is, of course, the total staked $RITE times the (expected) token price.

And the staking benefits consist of 3 components:

- Default 5.13% APY (for every staker).

- Airdrop APY (based on $100K airdrop and staking tier system).

- Allocation APY. Calculated Launchpad discounts based on average private sales discounts on raised amount.

Side note: as it’s hard to predict the Allocation APY… we only report the combined “Default + Airdrop APY” on the RITE Stats Page, and Token Distribution Table (see below). Hence, “ignoring” the Allocation APY.

Allocation Remarks:

– The idea is that $RITE stakers will get discounts on private token sales price (in comparison to actual market or IDO prices). These percentages may vary for each token sale. But to get an idea… for the CK NFT seed/private sales… these discounts were 40% and 30% respectively. In the tables below… I’ll use a “conservative” 25% discount percentage. (Note: it doesn’t matter if the CK team will offer these CK NFTs again for season 2 and beyond, or decide to just to private token sales as in both cases… the buyer will get project tokens. In the former, all 20 project tokens, and in the latter, just a specific project token).

– Allocations are not only based on individual staking “tiers”, the more you stake, the higher the allocations… but also based on whitelisting. Hence, it’s not necessary that each staker has to participate in each raise… So, we assume that in that case other stakers will “fill the gap” and get a higher number of whitelisted tokens (higher than if every stakers actually participates). Or in other words… that each raise will be “placed” for 100% among the group of $RITE stakers.

– A (new) project can do its IDO via several launch partners, including CK Launchpad as one of them. But CK Pad can also become the primarily or only project Launchpad partner (as it has as main advantage that it can attract hundreds of millions of “eyeballs”). Especially, if you take into account that more projects are addressing the Low Float, High FDV problem… leading to imbalanced token distribution, extreme price volatility, and community disengagement. And the solution is… offering more (or all) tokens for sale during the IDO (just as Memecoins are often doing… I mean all tokens in circulation right from the TGE start).

Staking Remarks:

How many $RITE tokens can (and will) be staked at a maximum? Well, only those $RITE tokens that are (already) in circulation (i.e. not controlled by the RITE team) can be staked.

The current number is about 500M $RITE tokens… assuming that 80% of these tokens will be staked at a maximum… results in 400M $RITE tokens which can be staked at a maximum.

Of course, if the RITE team brings in more tokens into circulation (from their “treasury”)… this maximum number may be higher. But before this 80% maximum is achieved, this can take quite some time… and maybe it will never reach that maximum percentage.

So, to make APY predictions, you have to make “estimates” about expected:

So, let’s use some possible scenarios (for 2025) based on these 4 variables (marked with *). All other numbers in the table below were calculated by using these variables.

Scenario Analysis (for 2025)

| Calculated APY | Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 | Scenario 5 |

| Default APY | 5.1% | 5.1% | 5.1% | 5.1% | 5.1% |

| Airdrop APY | 27.8% | 13.3% | 5.0% | 2.2% | 1.3% |

| Allocations APY | 113.6% | 66.7% | 37.5% | 22.2% | 15.6% |

| Total APY | 146.5% | 85.1% | 47.6% | 29.6% | 22.0% |

| Used Variables: | |||||

| # RITE Staked* | 60M | 75M | 100M | 150M | 200M |

| $RITE Price* | $0.006 | $0.01 | $0.02 | $0.03 | $0.04 |

| Investment Base | $360K | $750K | $2M | $4.5M | $8M |

| Airdrop APY | 27.8% | 13.3% | 5.0% | 2.2% | 1.3% |

| Private Sales* | $2M | $2M | $3M | $4M | $5M |

| Discount %* | 25% | 25% | 25% | 25% | 25% |

| Allocation Discount | $500K | $500K | $750K | $1.0M | $1.25M |

| Allocations APY | 113.6% | 66.7% | 37.5% | 22.2% | 15.6% |

So, very interesting APYs with lots of room for additional staking and $RITE token price appreciation as you probably understand that high APYs will be noticed… and attract more stakers who increase the investment base (and often the token price).

And as you have probably noticed… the Allocations APY is the most important. Or in other words… the more private token sales raised on CK Pad… the higher the total discounts for stakers… the higher the APY (ceteris paribus).

And while the the default 5.13% APY reward in $RITE tokens stays the same as it doesn’t matter if total staked $RITE and/or token price will move up… for the $100K+ airdrop and Allocation discounts… it does matter a lot as you can see in the table above… the total APY decreases if the investment base increases (either by $RITE token price appreciation and/or total $RITE staked).

However, over time we can expect the total raised amount on the CK Pad (and Crowdfunding) Launchpad to increase… and this is the main driver for more people who want to stake and get access to the private token sales discounts (on top off default 5.13% and the airdrop APY).

Or to say it in other words… if the expected total staking APY is high… people will buy and stake more $RITE.

But how long will this continue?

The simple answer… as long as the APY is interesting enough to buy/stake more.

Now, let’s assume that $RITE stakers want to get a minimum of 10% total APY…

We can use this “assumption” to calculate the theoretical $RITE token price by using the remaining variables (expected total $RITE staked, and total Allocation discount value).

A model to calculate the $RITE token price based on total expected staking rewards

So, we use the same scenario analyses as above, but now for 2026 and beyond, where we expect:

- the ecosystem to grow with more CK Pad Private Token Sales.

- the number of staked $RITE tokens to increase.

- the $RITE token price to increase based on wanted total staking APY of 10% minimum.

| Calculated APY | Scenario 6 | Scenario 7 | Scenario 8 | Scenario 9 | Scenario 10 |

| Default APY | 5.1% | 5.1% | 5.1% | 5.1% | 5.1% |

| Airdrop APY | 0.8% | 0.6% | 0.4% | 0.2% | 0.1% |

| Allocations APY | 4.1% | 4.3% | 4.5% | 4.7% | 4.8% |

| Total APY | 10.0% | 10.0% | 10.0% | 10.0% | 10.0% |

| Used Variables: | |||||

| # RITE Staked* | 100M | 150M | 200M | 300M | 400M |

| $RITE Price* | $0.12 | $0.12 | $0.14 | $0.18 | $0.26 |

| Investment Base | $12.3M | $17.5M | $27.7M | $53.4M | $104.7M |

| Airdrop APY | 0.8% | 0.6% | 0.4% | 0.2% | 0.1% |

| Private Sales* | $2M | $3M | $5M | $10M | $20M |

| Discount %* | 25% | 25% | 25% | 25% | 25% |

| Allocation Discount | $500K | $750K | $1.25M | $2.5M | $5.0M |

| Allocations APY | 4.1% | 4.3% | 4.5% | 4.7% | 4.8% |

I gave these scenarios above not as independent scenarios but as a “growth” pattern… where everything increases over time (number of token sales, staked numbers, $RITE token price).

Compare that with the current token price ($0.006) and total staked $RITE of about 62M… and it’s clear that the price can do “easily” 20x-50x if potential investors become aware and agree with this “valuation”…

So, a $0.26 $RITE (theoretical) token price relates to a $260M Fully Diluted Value (as the maximum token supply is 1 billion tokens)…

This should be “achievable” if you know that “competitor” Launchpad tokens earlier (in the last bull run), achieved FDVs ranging from $300M+ up to $1.5 billion.

Especially, if you look at the expected number of yearly raises… It should be possible do 80 project raises with $250K per sale, getting $20M raised total value… bringing CK Pad immediately in the “Top-10” Launchpad platforms, both based on the number of raises and total raised amount.

Why is the actual $RITE token price lower than the calculated fundamental price?

For me, it’s clear what’s the current “problem” is…

Not many (potential $RITE) investors are (yet) aware of the upcoming $RITE staking rewards related to the CK Launchpad token sales discounts… and/or underestimate the related numbers and/or CK marketing exposure effects.

Investors just haven’t “seen” the CK show and any CK Pad token sale (yet). The moment they understand that CK Pad will do 70-80 token sales each year, where you need to stake $RITE to get “access” to these game-changing project tokens at discounted prices… and the more $RITE you stake, the higher the allocations… it will lead to a run on $RITE.

Especially, if they do the (simple) math as above… this should open up investors’ eyes.

Sooner or later, smart investors will notice the $RITE token price potential… it’s just a matter of time.

So, take advantage while you can…. (no financial advise, DYOR, please read our disclaimer)

Of course, this fundamental analyzes of the (potential) $RITE token price is no guarantee that this price will be achieved as we are living in a “crazy crypto world” where prices may be overvalued based on hype and where “quality” projects are undervalued due to lack of knowledge (or vibe). Plus, crypto markets are very volatile… in bear markets at the lowest prices, most tokens are undervalued, and the opposite in bull markets at highs… tokens are often overvalued. So, use it as a “guide”, or maybe first goal for the $RITE token price to achieve.

Staking stats

As you can see, $RITE staking became popular around the CryptoKnights NFT sales where investors had to stake $RITE to get allocations for these NFTs. Thereafter, the interest declined over time… but this can change quickly the moment staking is required for the first CK Launchpad token sale as described above.

Benefits for holding or staking 500K or more $RITE

Holding 500,000 or more $RITE tokens is a milestone that should be celebrated. It was used in the past as threshold to participate in the riteFUND. At the moment, the additional benefit of reaching this milestone is that you can become a member of the RITE Private Club Telegram Group.

If you qualify and want to join this group, reach out to Aman, Community Lead of RITE’s Telegram Groups.

You have to prove that you actually hold the threshold number of $RITE tokens, either in private wallet(s) and/or staked tokens. (Tokens held on CEXs don’t count)

What are the benefits of the RITE Private Club Telegram channel membership?

As it’s a private chat group, you can ask direct questions to the (management) team. It’s also a place for “early” (news) announcements and “open discussions” about new products and features, tokenomics, and other aspects related to RITE and/or CryptoKnights (Pad).

The benefit for the RITE team is of course that they can sometimes “test” or “discuss” announcements, product and features, and more before being released and announced.

Think about pre-announcements about (upcoming) CK NFT (and riteFund) distributions, airdrops, product releases (and new features), agreements with partners… and discussions for example about how to “structure” the upcoming Crowdfunding platform.

It’s also a chat group for real RITE fans as they are committed and have a “real” stake in $RITE.

So, it’s strongly advised to become a member.

Burn mechanism

There are 2 burn mechanisms

- A percentage of all the Platform income will be used for $RITE token burns. There are at least 3 income sources:

- A) Ad income from the streaming platform (the 20% management fee part),

- B) Management fees from the Crowdfunding Platform (Ritestream Studios),

- C) Income from Ritestream Originals productions (for example, the riteFund and CK NFT sales funding for CryptoKnights, or fees related to the CK Launchpad token sales).

- 0.5% bridge BNB<>Base chain transaction fee is automatically burnt.

The actual number of burnt tokens can be seen below.

Revenues generating capacity and revenue-sharing

Holding and investing in the $RITE token is only interesting if you expect the token price to increase over time.

This price increase may come from improved tokenomics and higher interest in and demand for the token … but in the end… the RITE team should generate generate sustainable (and increasing) revenues before they can share this among token holders and stakers.

You know, if $RITE stakers will get APY rewards and streaming platform users get W2E and W2W $RITE rewards… these have to be funded somehow. Of course, the RITE team may use the treasury, but there comes a time that the treasury has to be filled with $RITE tokens. And there is no other way for the team except to generate (dollar) revenues/income to buy $RITE on the open market. Or to offer products/services where people have to pay with $RITE.

So, let’s just look at CK and CK Pad for the next seasons…

Assuming that there will be about 80 featured projects per year (2026 and beyond), you may expect the total CK revenues for a full year to be $20M or more… ($6M+ for the distribution rights and $14M+ for CK Pad project token sales, 80 * $175K).

(Note that there will also be revenues from sponsorships and partnerships, but as we have no insights in these revenues… it’s not being included for now)

And now you can calculate the…

Revenues per token

In analogy with Revenues per Share, we can calculate the (yearly) Revenues per token.

Just divide the total revenues for a year (2026) and divide by the number of tokens in circulation (=Circulating Supply).

So, for example, with $20M revenues and Circulating Supply of 400M tokens, the Revenues per token are $0.05.

(As the CS is changing all the time, I used 400M as an example. For most actual CS… scroll down)

Or you can use the…

Revenues/MarketCap or MarketCap/Revenues ratio

The Revenues/MC is often easier to calculate and to use for comparison with other tokens.

With $20M in revenues and Marketcap of $4M, the calculated Revenues/MC ratio is 5.

So, this ratio gives the same 5x factor (and is logical as the formula is… MC = CS * price).

Just compare this ratio with other Web3 crypto projects with less revenues and often having ratios far below 1.

I hope you can understand this math, and come with the same conclusion as me about under- vs overvaluation.

“Similar” projects have 0.1 Revenues/MC ratios (or even lower)…

Or in other words… if we switch the numerator and denominator, giving the MC/Revenues ratio (aka as revenues multiplier)…

Similar fast-growing crypto or Web3 projects are valued at a 10x revenues multiplier.

In that case, the MC for $RITE should be $200M… (or 50x as high as the current $4M MC, resulting in a $0.50 token price).

Instead of the MC, we can also using the FDV (Fully Diluted Value)…

FDV/Revenues ratio

Be aware that the MC is based on the circulating supply and this number can be different for each project, making it more difficult to compare projects. Hence, by looking at the FDV, it’s often a better metric.

If the $RITE price is 1 cent, the FDV is $10M, and the FDV/Revenues ratio is 0.5 ($10M/$20M).

Again a relatively low ratio if you compare for example with other Launchpad tokens with current ratios between 5x-10x (and much higher multipliers at ATHs during bull runs).

Note: these ratios look at the total revenues (streaming platform income + CK pad sales). Above, we used another model to “calculate the fundamental $RITE token price”… but by looking from the viewpoint of “staking benefits” for $RITE stakers (and wanted minimum APY).

Also, be aware that we have just looked at the CK Show and CK Launchpad revenues. We didn’t look at the revenues for the other two “narratives”, the streaming platform, and the crowdfunding platform.

Can you now understand why we are RITE fans?

Not just as we like RITE’s mission… but also because of the potential $RITE price appreciation (no investment advice, DYOR, read our Disclaimer).

But for CryptoKnights, it’s not just about these revenue/token stats… it’s also about $RITE token “awareness”…

What will happen if hundreds of millions of people watch CryptoKnights and will heard and know about $RITE?

And that’s just for the CK and Launchpad narrative…

The streaming narrative is also highly scalable… as it has an built-in Content Flywheel, with as result that if ad revenues increase, $RITE buyback increase as 40% of ad revenues is automatically distributed in $RITE tokens each month (later more frequently).

Resulting in more and more streaming platform users and $RITE token holders… with as result that the intrinsic value of $RITE will increase in accordance to the Metcalfe’s Law…

The value of a network or ecosystem is proportional to the square of its active users. Essentially, as more people use a network, its value grows exponentially.

For more about intrinsic value and Metcalfe’s Law, read this article… https://cointelegraph.com/news/intrinsic-value-of-crypto.

So, the revenue generating capacity (with actual revenue sharing among $RITE stakers), and expected growth in ecosystem users are 2 very strong reasons to buy and invest in $RITE.

Token Distribution and Vesting

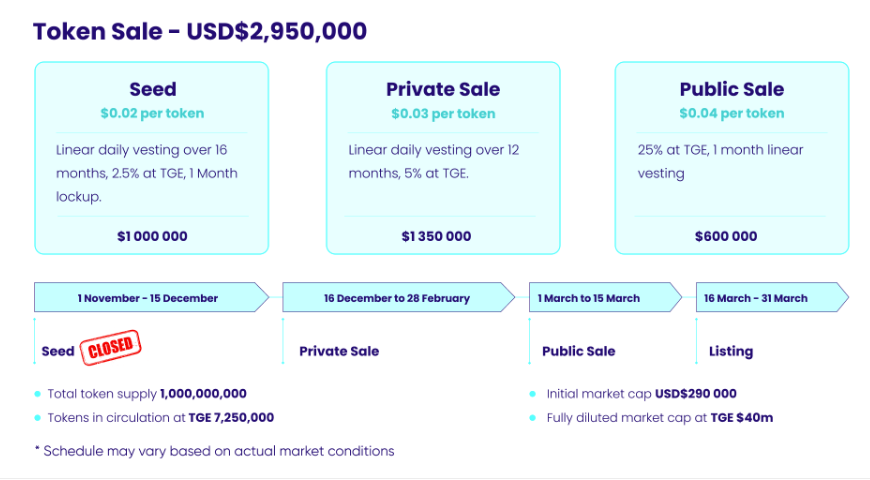

IDO March 2022: Token Sale, Distribution and Vesting

As per Whitepaper…

Token Sale

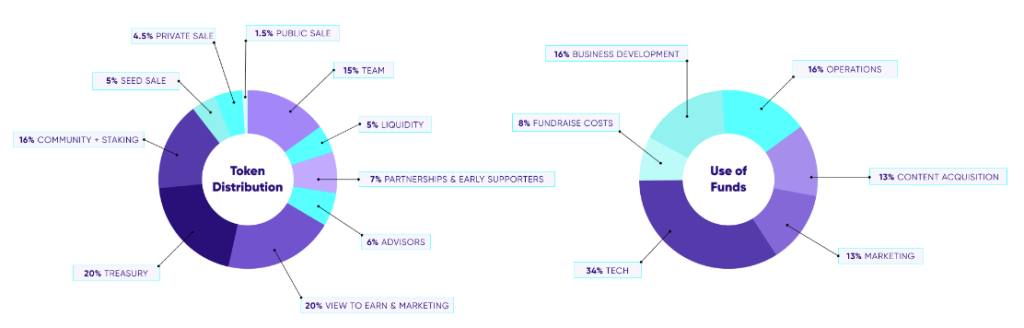

Aimed Token Distribution and Use of funds

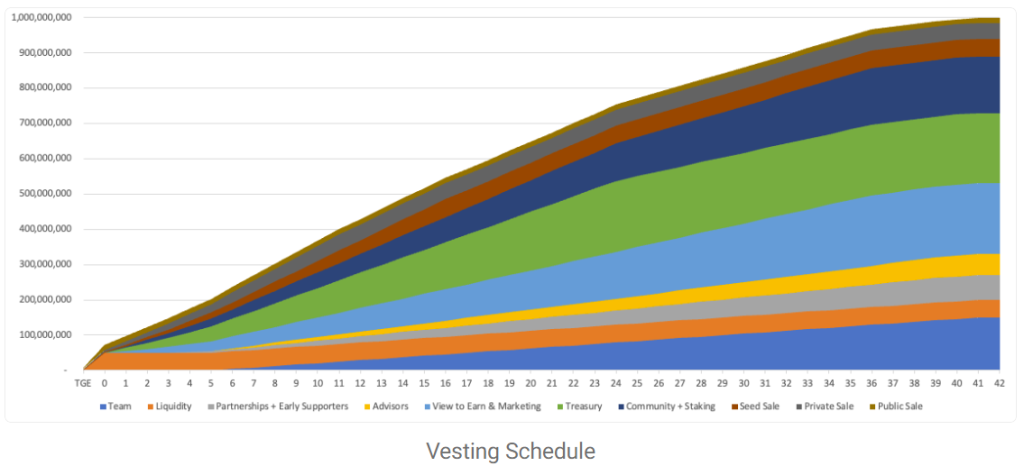

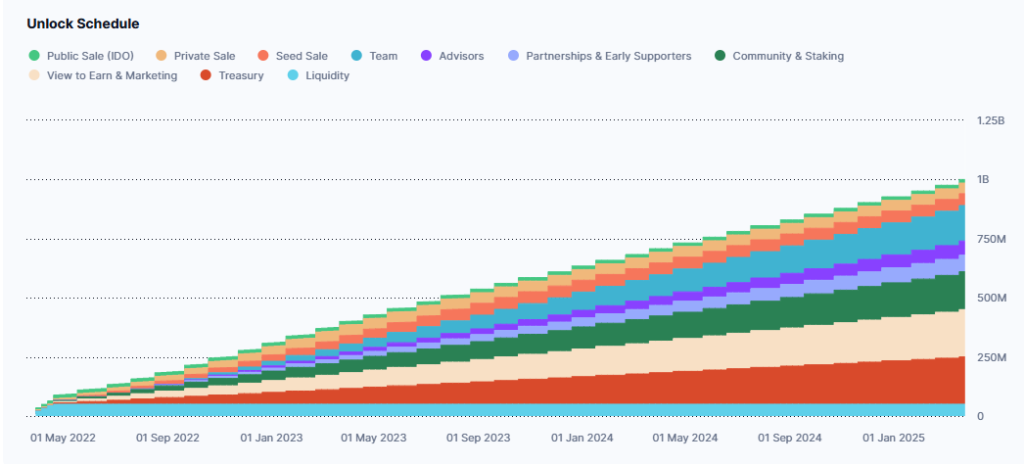

Aimed Token Release Scheme (Vesting Schedule)

Actual Token Vesting

Below the status (as per April 13, 2025), as reported on CoinMarketCap

All tokens are unlocked. The last vesting ended on March 24, 2025. All earlier vested tokens are now free to use by both the public (if not staked) and the company. (That’s why the reported Unlocked Circulating Supply equals the Maximum Supply, both at 1 billion tokens)

So, all investors (including partners and advisors) could have claimed their tokens, and you never have to be afraid anymore for new token sales as result of new unlocks.

That said, the team managed to “use” fewer tokens in the last 3 years as they were “allowed” as per the TRS (token release scheme)…

Actual $RITE token usage vs “allowed” tokens as per vesting scheme

So, as per March 31, 2025, the team used 602M tokens while they could have used 1 billion tokens.

As a result, the team still controls 398M $RITE tokens…

Actual $RITE token usage vs allocation as per original whitepaper

| Purpose | Allocation | Used | Leftover |

| Token Sale (Public, Private, Seed) | 110 | 110 | – |

| Partnerships & Early Supporters | 70 | 70 | – |

| Liquidity | 50 | 50 | – |

| Operations: -Marketing (360M) -Treasury (200M) -Team & Advisors (210M) | 770 | 372 | 398 |

| Total | 1,000 | 602 | 398 |

Hence, you can conclude 2 things:

First, that the RITE team was very “careful” on spending $RITE tokens in the last 36 months and didn’t spend all available tokens in the bear market. The team especially saved allocated marketing and operations tokens. Resulting in a “significant” available marketing budget, and sufficient token “treasury” to expand the products/services and ecosystem further.

Secondly, that the team uses the company tokens gradually over time without dumping tokens on the market, and only brought tokens into circulation when needed (to improve the ecosystem).

So, you don’t have to be afraid for the next vesting unlocks or potential tokens dumps…

There are no upcoming vesting unlocks anymore. The last unlock happened on March 24, 2025.

So, all investors (including partners and advisors) could have claimed their tokens, and you never have to be afraid anymore for new token sales as result of new unlocks.

That said, the RITE team managed to use/spend less tokens as they aimed to use as per Token Release Scheme (TRS) in the Whitepaper.

Hence, the team still controls a significant number of $RITE tokens (for the latest number check out the RITE Stats page), that they can “use” immediately. They don’t need to wait for vesting unlocks.

However, the RITE team only spends the tokens when needed, and so far they didn’t dump token on the market, but just used them “gradually” over time.

So, nothing to worry about.

Note: if the team sells tokens on the open market, of course, this may have a price pressure effect as with any new “supply”. However, the team uses a market maker with as main task to sell the tokens without “disturbing” the market price (or in other words without dumping the tokens).

And yes, in periods of a “bear market” and in times of low liquidity, it’s harder to sell tokens without any “negative” price effect. But be aware that new supply on the open market will always have some effect… and it’s hard to predict the market for anyone (including the RITE team).

So, gradually selling company tokens in both “good” and “bad” times, is like the often used and advised DCA-strategy for buying tokens (but can be applied for selling tokens, and taking profits as well).

As the opposite… waiting for the RITE time, i.e. waiting for high(er) $RITE token prices and only sell tokens after the price spiked… will first “kill” this spike and won’t be appreciated by the token holders.

So, there is never a good moment to sell company tokens…. Hence, gradually selling when tokens are needed is probably a “good” strategy to avoid lack of liquidity during bear markets… and forcing the team to sell even more tokens (at too low prices).

But more important…

There is a huge difference between a “whale” selling tokens and the team selling tokens…

The whale, let’s assume a VC who invested and got tokens with a discount (as Seed or Private Sale investor)… just steps out… while the team is using the receipts to build and expand the ecosystem, with benefits for all $RITE token holders.

So, in other words…

It’s actually a very good “sign” if the team brings in new tokens into circulation as the team is using the tokens wisely with expected positive ROI (where the team actually uses tokens for regular expenses and investments… but both leading to growth of the ecosystem).

And it’s awesome that the team still holds a significant number of company tokens for further growth financing.

Actual Token Distribution, Circulating Supply and MarketCap

Note that the data is updated about once a week… check out the date at the bottom of the table.

Used definitions in words:

Circulating Supply (CS) = the number of tokens held by the public free to trade.

Market Capitalization (MarketCap) = a liquidity measurement to present the total (dollar) valuation of the maximum liquidity, calculated by multiplying the CS with actual token price.

Formulas used:

Circulating Supply (CS) = Max Supply – Burnt Supply – Company-controlled Supply – Locked Supply (including public staked tokens)

Unlocked Circulating Supply (UCS) = Max Supply – Burnt Supply – Locked Supply (as per Token Release Schedule, i.e. vesting schedule, public staked tokens are not included in locked supply). (Definition CoinMarketCap)

Market Capitalization (MC) = Circulating Supply * Token Price

Unlocked Market Capitalization (UMC) = UCS * Token Price

FDV= Fully Diluted Market Capitalization (aka Fully Diluted Value) = Max Supply * Token Price

Be aware that the Circulating Supply is dynamic and changes whenever: A) the Max Supply changes (for example after token burns), or B) the Team-controlled tokens changes (for example after team transfers or sells tokens), or C) the number of Locked tokens changes (for example as a result of staking, unstaking, adding or claiming APY rewards).

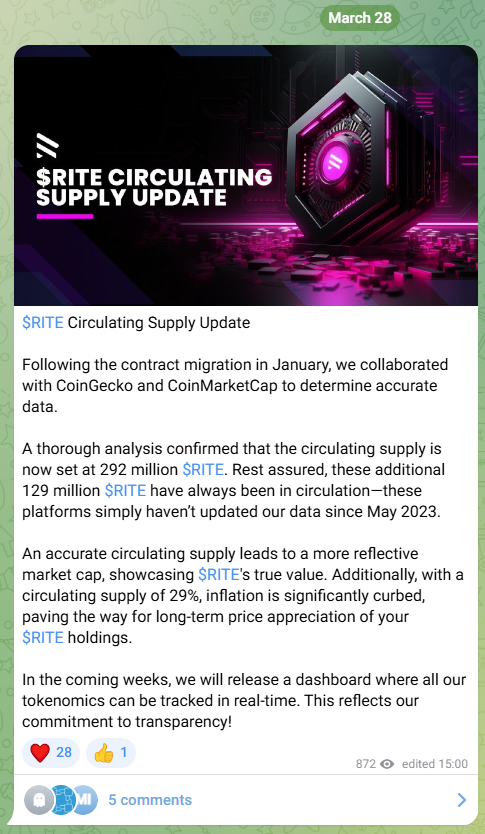

The simple answer… Because they use outdated token distribution data.

The reported verified Circulating Supply on CoinMarketCap (CMC) is 292.4M $RITE tokens. This is the number the RITE team shared end March 2024 with CMC in an update (and to the community, see above). Since that moment, this number hasn’t been updated.

For Coingecko (CG) it’s even worse, the reported Circulating Supply is 181.9M (the same number since July 2023!)

This is how it works… the RITE team sends (periodically) a list of all wallets that they control (the total treasury) to these crypto data provider sites with request to update the information.

Of course, the number of $RITE tokens in these wallets change over time… but CMC and Coingecko (CG) have no real-time system in place to update the totals of these wallets. They only have these (internally) developed systems for the larger tokens. So, for most of the smaller tokens (with lower MC), the CS is not update, while the MC is updated (as the daily token price changes) but based on the “outdated” CS.

And as Blockchain scanners such as BSCscan also use data from CMC or CG… you often find the same outdated data for the Marketcap on the blockchain scanners. For example, BSCscan is using CG data… Yes, the outdated data as per July 2023.

Also be aware…

On the Get RITE Page… the used data is imported from BSCscan… and we know now that this data is outdated (as fed by Coingecko)… Hence, showing outdated CS and MC.

So, lessons learned…

Don’t trust reported CS and MC data on CoinmarketCap, CoinGecko, blockchain scanners, and other data providers as they all use the same wrong outdated sources.

And instead, visit this page to get the most recent CS and MC stats (updated at least every month).

(Note: the RITE team informed us that early April, 2025, they informed CMC and Coingecko about the latest data… However, these haven’t been processed yet)

Historical Token Distribution and Circulating Supply

As you can see… the CS gradually increased from 316M $RITE tokens (as per January 31, 2024) to 547M (as per March 31, 2025). While the total staked number fluctuates. It started at 31M $RITE tokens, increased up to 76M (July, 27, 2024) and decreased thereafter gradually to 23M (January 31, 2025), and in March 2025 it increased to 55M as the team announced the free token airdrop (starting April 1, 2025).

Of course, if you add up the CS and staked number, you will get the total number of $RITE tokens held by the public (602M as per March 31, 2025).

If you look at above chart, you’ll notice that the team is gradually using company-controlled tokens which come into circulation.

As any start-up… it takes time and money to build the business, ecosystem, and improve the tokenomics.

The original Whitepaper can be seen as part of the IDO “agreement” between investors and the RITE team. Inside the whitepaper, the aimed plans are described with details about token allocation and vesting scheme (Token Release Scheme).

So, the RITE team executes all the plans as per whitepaper and roadmap(s) and uses the $RITE tokens as allocated and aimed.

Some of these (allocated) tokens have to be sold on the open market, others are “given away” for staking, (social media) marketing campaigns, RITESTREAM+ rewards, and to pay out staff and all other company expenses.

So, it shouldn’t be a surprise that the team uses these tokens and that the company-controlled number of tokens gradually decreases over time with subsequent circulating supply increases.

Hence, it’s a good sign that the team is spending tokens as it’s in our benefits to improve products, ecosystem, and tokenomics.

You can’t expect the team to do “nothing” and keep all tokens in the “treasury” and never bring them in circulation…

On the other hand, it’s actually a good sign that the company still holds a significant percentage of the tokens as it increases the chance that in the end, the ecosystem will be sustainable and profitable.

You have to treat these tokens as “treasury” to use for expenses, investments, and pre-funding with expected positive ROI… to improve the $RITE ecosystem.

But in the end, most of the tokens will be in circulation, and if the company-controlled tokens are low… the team has to buy the needed $RITE on the open market.

Think about needed tokens to pay out RITESTREAM+ or staking rewards. Or to say it in other words… revenues earned in dollars will be (partly) spent to buy $RITE on the open market to pay out the $RITE rewards causing a continuously buy pressure with expected token price appreciation.

So, you may better hope that all current company-controlled tokens will come into circulation as soon as possible (and the ecosystem to become sustainable) as this will start the upward price movement.

Just looking at increasing Circulating Supply and assuming that this has a negative on token price as token supply increases is an over-simplification.

Instead, you should look at how the team is spending the tokens for better or worse…

And as we have seen above, the team is spending the tokens wisely and only when needed.

I think you understand that we as fans, are happy with the current balance between remaining “company-controlled treasury tokens” vs project progress. We “accept” that the circulating supply hs to increase over time as it just reflects the “business progress”.

It’s all part of the game when you fund a project by minting tokens that will be used sooner or later by the team.