Effects of Trump Administration for crypto and RITE

What are the effects of the new Trump administration for Crypto and RITE?

Campaign promises

During one of his running campaigns, Donald Trump addressed the crypto community at the Bitcoin Conference (July 27, 2024) in Nashville with a landmark pro-Bitcoin speech about making the U.S. the crypto capital and mining house of the world. Made possible by ending the Biden administration’s ‘war on crypto’ and doubling the US electricity capacity (Drill, Baby, Drill gas and oil).

He also pledges to establish a ‘strategic national Bitcoin reserve,’ dismiss SEC head Gary Gensler at day 1, and promised never to allow a CBDC.

Trump has vowed to Make America Great Again (MAGA) with flourishing dollar and BTC. Part of his campaign is to focus on innovation (AI) with the help of Big Tech industrial leaders such as Jeff Bezos (Amazon, Sundar Pichai (Alphabet/Google), Mark Zuckerberg (Meta/Facebook), and Elon Musk (X). All “prominent attendees” at the inauguration.

So, big promises… let’s see what happened in the first 2 months.

Between his inauguration (January 20, 2025) and his speaking at Blockwork’s Digital Asset Summit on March 20, 2025 to a crowd of crypto industry executives and observers, where he repeated, “Together we will make America the undisputed Bitcoin (BTC) superpower and the crypto capital of the world.”

Executive Orders

Below are the most important Executive Orders that may have impact on crypto…

- January 20, 2025. Unleashing American Energy (especially important for cost-effective BTC mining and AI leadership).

- January 20, 2025. Establishing And Implementing The President’s “Department Of Government Efficiency”.

- January 23, 2025. Strengthening American Leadership in Digital Financial Technology

- January 23, 2025. Removing Barriers to American Leadership in Artificial Intelligence.

- February 3, 2025. A Plan For Establishing A United States Sovereign Wealth Fund.

- March 6, 2025. Establishment of the Strategic Bitcoin Reserve and US Digital Asset Stockpile.

The Strengthening American Leadership in Digital Financial Technology Executive and Strategic Bitcoin Reserve executive orders are probably the most important for the crypto world.

The main purposes of the Strengthening American Leadership Executive Order:

To support the responsible growth and use of digital assets, blockchain technology, and related technologies across all sectors of the economy, by

(i) protecting and promoting the ability of individual citizens and private-sector entities alike to access and use for lawful purposes open public blockchain networks without persecution, including the ability to develop and deploy software, to participate in mining and validating, to transact with other persons without unlawful censorship, and to maintain self-custody of digital assets;

(ii) promoting and protecting the sovereignty of the United States dollar, including through actions to promote the development and growth of lawful and legitimate dollar-backed stablecoins worldwide;

(iii) protecting and promoting fair and open access to banking services for all law-abiding individual citizens and private-sector entities alike;

(iv) providing regulatory clarity and certainty built on technology-neutral regulations, frameworks that account for emerging technologies, transparent decision making, and well-defined jurisdictional regulatory boundaries, all of which are essential to supporting a vibrant and inclusive digital economy and innovation in digital assets, permissionless blockchains, and distributed ledger technologies; and

(v) taking measures to protect Americans from the risks of Central Bank Digital Currencies (CBDCs), which threaten the stability of the financial system, individual privacy, and the sovereignty of the United States, including by prohibiting the establishment, issuance, circulation, and use of a CBDC within the jurisdiction of the United States.

As specific part of this Executive Order, it orders to establish a “Working Group on Digital Asset Markets” with Sacks chairing the effort. The working group, if established, would consist of the US Treasury secretary, attorney general, Securities and Exchange Commission chair, Commodity Futures Trading Commission chair, members of Trump’s cabinet and other agency heads.

The working group will report:

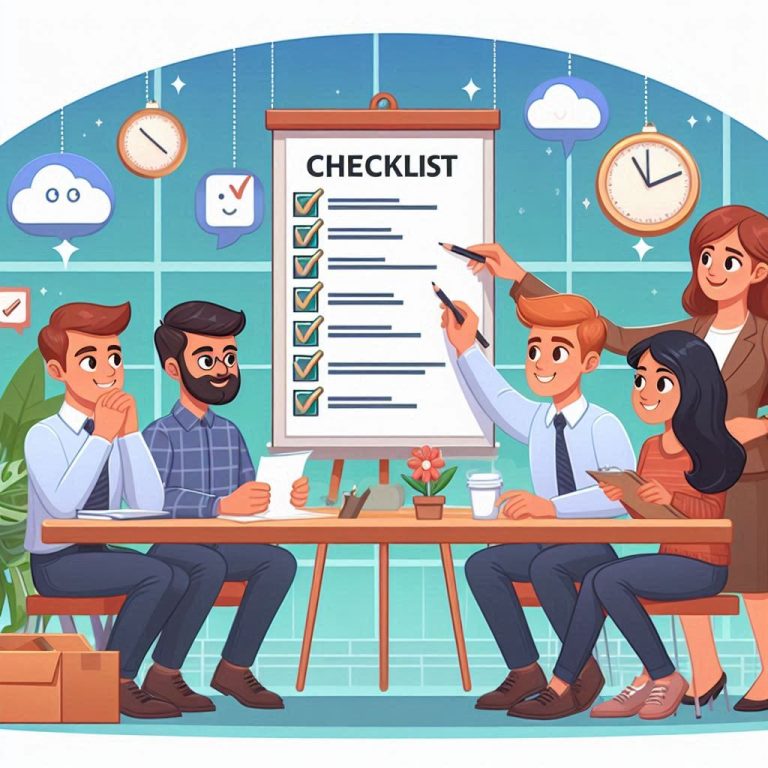

- Within 30 days, the Work Group shall identify all regulations, guidance documents, orders, or other items that affect the digital asset sector.

- Within 60 days, each agency shall submit to the Chair recommendations with respect to whether each identified regulation, guidance document, order, or other item should be rescinded or modified, or, for items other than regulations, adopted in a regulation.

- Within 180 days, the Working Group shall submit a report to the President, which shall recommend regulatory and legislative proposals that advance the policies established in this order. In particular, the report shall focus on the following: (i) The Working Group shall propose a Federal regulatory framework governing the issuance and operation of digital assets, including stablecoins, in the United States. The Working Group’s report shall consider provisions for market structure, oversight, consumer protection, and risk management. (ii) The Working Group shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts.

So, this is the order and “guidance”, and the 180 days deadline proofs “urgency”, but everything has to be implemented and passed by the Senate and the House.

The Republican Party now has total control over the United States Senate, the Executive Branch, and the House of Representatives where the Senate Banking Committee and the House Financial Services Committee will play pivotal roles in shaping pro-crypto policies.

As Trump has promised to usher in crypto-friendly regulations, he picked crypto backers for key government positions.

Hence, let’s start with…

New Appointments and work groups

Special Advisor for AI and Crypto (aka as the White House AI & Crypto Czar)

Trump installed David O. Sacks as the “White House A.I. & Crypto Czar“, who will lead policy initiatives in artificial intelligence and cryptocurrency, areas Trump describes as “critical to the future of American competitiveness.” Trump highlighted Sacks’ mandate to advance U.S. leadership in AI and cryptocurrency while addressing issues like online free speech, tech industry bias, and legal clarity for crypto markets.

House Financial Services Committee

Congressman French Hill was selected as Chairman of the House Financial Services Committee in December 2024 and is highly critical of the regulatory approach under the previous administration.

Following the appointment, Hill said introducing a crypto market structure bill within the first 100 days of the legislative session was a priority for the GOP leadership.

House Committee on Oversight and Government

On January 24, the House Committee on Oversight and Government Reform launched an investigation into Operation Chokepoint 2.0 and sent letters to (6) crypto industry leaders and advocacy groups requesting input.

Chair James Comer said the oversight committee would explore claims that either financial institutions or representatives of the US government attempted to debank certain individuals.

“The Committee seeks to ensure that entrepreneurs are not unfairly targeted and, by extension, that all Americans are able to participate in US markets without fear of retaliation through illicit measures undertaken by financial institutions or federal regulators,” wrote Representative Comer.”

Interesting, at February 6, 2025, during the Congressional hearing “Operation Choke Point 2.0: The Biden administration’s Efforts to Put Crypto in the Crosshairs”, the two political parties actually seemed to be in agreement on steps to be taken to prevent future regulatory ‘overreach’ — even while arguing about past practices.

The Senate Banking Committee

Senator Tim Scott, chairman of the Senate Banking Committee, is pro-crypto and promised sweeping regulatory reform for digital assets prior to the 2024 United States elections.

“We have to get rid of the folks who are in the way,” Scott told pro-Bitcoin voters in the Summer of 2024. Scott also promised Bitcoin voters: “The one thing I will absolutely guarantee will be done is watching your legislation get a vote, pass the Banking Committee, and we’re going to fight to make it a law in the United States of America.”

Senate Banking Subcommittee on Digital Assets

Wyoming Senator Cynthia Lummis was appointed by Scott to chair the Senate Banking Subcommittee on Digital Assets in January 2025.

Lummis said the primary goals of the subcommittee included passing comprehensive digital asset legislation and preventing overreach by government regulatory agencies.

The Senator added that legislative initiatives would include a comprehensive market structure bill, stablecoin regulations, and provisions for a Bitcoin strategic reserve. Yes, this is the same Senator who introduced a Bill to have the government buy 1 million bitcoins over five years as “a hedge against economic uncertainty and monetary instability,” similar to the gold bullion kept by the Federal Reserve.

US Treasury Secretary

As US Treasury secretary, pro-crypto billionaire hedge fund manager Scott Bessent will have sway over fiscal policy, financial regulations, international sanctions and overseas investments.

Scott Bessent will will also take on the role of acting director of the Consumer Financial Protection Bureau (CFPB) following an order from President Donald Trump after Trump fired Rohit Chopra.

Securities and Exchange Commission (SEC)

Mark Uyeda was appointed as Acting Chairman of the SEC chair ahead of Paul Atkins’ succession on June 5, 2026 (who also joined the Commission but in another temporary role).

On his first day, Uyeda immediately announced a Crypto Task Force dedicated to developing a comprehensive and clear regulatory framework for crypto assets. Commissioner Hester Peirce (her nickname is “Crypto Mom”) will lead the task force.

And Peirce took immediately action… on January 23, 2025, the SEC introduced SAB 122, effectively rescinding SAB 121, a controversial crypto accounting rule.

The Staff Accounting Bulletin (SAB) 121 rule was introduced by the SEC in March 2022 as part of its efforts to regulate cryptocurrency custody. It required financial institutions to list any crypto assets they held on behalf of customers as liabilities on their balance sheets. For more background info why SAB 122 is much better for the crypto world, check out this explanatory article.

Commodity Futures Trading Commission (CFTC)

The CFTC’s acting chair, Caroline Pham, has made significant changes to the agency’s top positions just days after being appointed by US President Donald Trump.

Pham announced the CFTC’s new leadership in a Jan. 22 statement naming interim officials to top spots, including new directors for the agency’s market oversight and enforcement divisions and a top position for the CFTC’s crypto outreach.

Last update… Pham says the CFTC is ending regulation by enforcement.

Trump reportedly plans to select Brian Quintenz — the head of policy for the crypto subsidiary of venture capital firm Andreessen Horowitz (a16z) — as chair of the CFTC.

Trump’s intention to pick Quintenz as the next head of the CFTC was revealed in a document sent to the White House to Capitol Hill, Bloomberg reported on Feb. 12.

Quintenz formerly served as a Republican commissioner of the CFTC during the first Trump administration between 2016 and 2020. During his tenure at the CFTC, he heavily backed the integration of digital asset derivatives and crypto products into the federal agency’s regulatory framework.

In 2021, Quintenz joined the board of Kalshi, a crypto-friendly prediction market that successfully sued the CFTC under the Biden administration for the right to list political betting contracts. He started as a16z’s head of policy in 2022.

If Quintenz is confirmed to head the CFTC, it’s widely expected that he will push for pro-crypto policy moves and establish his agency as the primary regulator for the crypto industry over the Securities and Exchange Commission.

FED

The Fed is the outlier as the Fed is still controlled by democrats, and Trump won’t have the ability to appoint a new Fed governor until January 2026.

So, a clear shift in political direction backed by the executive order, key pro-crypto appointments, and new departments and working groups aiming to achieve more legal clearance about digital assets for all parties involved… a very bullish direction for the crypto world.

Although it will take some time before the Working Group on Digital Asset Markets, Crypto Task Force, SEC and CFTC will come with new initiatives and legislation, the expectations are high.

Let’s look at some main current problems, and predict what may happen…

Token Issuers vs SEC

Until the new administration, the SEC relied heavily on the Howey test to determine whether a crypto company or product is subject to SEC law. (Note that the SEC requires registration and approval for issuing securities).

The Howey Test is based on 4 elements:

- A party invests money

- In a common enterprise

- With the expectation of profiting

- Based on the efforts of a third party

The SEC had struggled to categorize digital currencies and the thousands of altcoins that now exist. Many cryptocurrencies, tokens, and exchanges got penalties from the SEC.

In 2019, the SEC ruled that Bitcoin, the most popular and highest valued cryptocurrency globally, does not pass the Howey Test. However, other blockchain-based offerings were unlikely to receive the same treatment from the SEC. In many cases, companies agree to a settlement with the SEC and pursue registration.

In 2020, the SEC sued Ripple Labs over its XRP token, claiming that the token is an unregistered security.

In this highly publicized case, Ripple claimed that its XRP token does not pass the Howey Test and thus does not qualify as a security. Ripple challenged the SEC and requested that the agency unveil its process for conducting the Howey Test. To date, the case remains unresolved before the court.

On March 19, 20205, Ripple CEO Brad Garlinghouse announced that the SEC will drop its appeal.

This is a “resounding victory for Ripple, for crypto, every way you look at it” (quoted by Brad Garlinghouse).

The SEC also dropped cases and investigations against major “exchanges” like Coinbase, OpenSea, Uniswap and Robinhood, among others regarding assumed “violations with respect to spot securities trading”.

Furthermore, new initiatives and proposal Bills have started to end the debanking of crypto companies.

So, the aimed Federal regulatory cryptocurrency framework must address property rights, ownership protection, secure custody solutions, and most importantly, which agency regulates cryptocurrencies (SEC or CFTC), as well as when, and how, it is categorized as a security or commodity under SEC (Howey Test) – decided in 1946 by the U.S. Supreme Court – or a commodity.

But the direction is clear… a more crypto-friendly treatment based on upcoming new legislation and clearance vs the SEC’s prior enforcement strategy.

CASPs vs SEC/CFTC/DOJ/US States

Crypto Assets Service Providers (CASPs) such as Binance, Coinbase, and Kraken, were also lacking clear guidelines. As a result of the SEC’s strict regulation-by-enforcement approach, many had to pay fines for violating SEC laws and/or improper AML/KYC procedures.

In fiscal year 2024, $17.1 billion was comprised by enforcement actions involving crypto cases. $2.6 billion in civil monetary penalties (CMP) and $14.5 billion in disgorgement and restitution.

Coinbase was sued by the SEC in June 2023 which alleged that Coinbase was never registered as a broker, national securities exchange, or clearing agency, while also alleging the crypto platform evaded disclosure requirements. The SEC alleged that Coinbase listed over a dozen crypto tokens it deemed to be securities.

Coinbase, led by its chief legal officer Paul Grewal, had strongly opposed the lawsuit from the onset, characterizing it as a regulatory overreach while also slamming the commission for filing a suit after approving the company’s public listing on the Nasdaq stock exchange in April 2021.

On February 27, as result of the new “administration”, the SEC has dismissed its lawsuit with crypto exchange Coinbase, ending the case permanently.

The agency has also dropped lawsuits against Consensys, Robinhood, and Gemini in the same week.

Again, this was a huge victory for the crypto world.

What about Binance?

SEC and Binance seek 60-day pause in crypto case

The US Securities and Exchange Commission (SEC) and Binance filed a joint motion to pause their legal case for 60 days, marking the first move toward halting major cryptocurrency litigation since Mark Uyeda took over as acting SEC chair.

The motion, filed on Feb. 10, asked to pause the case against the exchange for 60 days, citing the establishment of the SEC’s Crypto Task Force.

Hence, I expect this case to be dropped as well… or at least that major parts (the securities trading violation part) will be dropped.

But some other legal cases involving CASPs are still outstanding.

Think about cases about Leverage and Derivatives (futures/options/CFDs), Margin, Lending, Staking, and Stablecoins (earnings).

Fortunately, this whole field of a lack of clearance for CASPs, is now aimed to be resolved by the new Working Group on Digital Asset Markets and its subsequent actions such as new legal structure.

I also expect a shift from SEC crypto market regulation responsibilities to the CFTC…

On May 22, 2024, The House of Representatives passed H.R. 4763 with broad, bipartisan support, the “Financial Innovation and Technology for the 21st Century Act”. FIT21 provides the robust, time-tested consumer protections and regulatory certainty necessary to allow digital asset innovation to flourish in the United States. And it limits the “digital assets” authority as currently claimed by the SEC by transferring part of it (as digital assets will be more treated as commodities) to the CFTC.

As this Act has still to pass the Senate, I expect it will be used as “valuable input” for the Working Group.

What about CASP requirements differences between U.S. vs European Union?

As per December 30, 2024, the Markets in Crypto Assets (MiCA) framework entered into force in the EU and unified requirements for crypto asset providers for all associated countries. In short, MiCA mandates that a company open an office in the EU, adhere to AML/KYC guidelines (including restriction from offering anonymous crypto transfers in the EEA, and travel rule mandated), implement data security services, and follow the rules on marketing materials to serve EU-based clients.

These rules are relatively “intensive” and comes with costly implementation. Hence, smaller crypto businesses will likely struggle to comply in Europe and will often move their operation overseas.

The US might become one of the more attractive destinations given the potential decrease in SEC’s outreach and the pro-crypto stance of the new administration.

After the implementation of the new legal framework, TradFi can enter this market as financial institutions are eagerly awaiting for more legal “clearance and approval”.

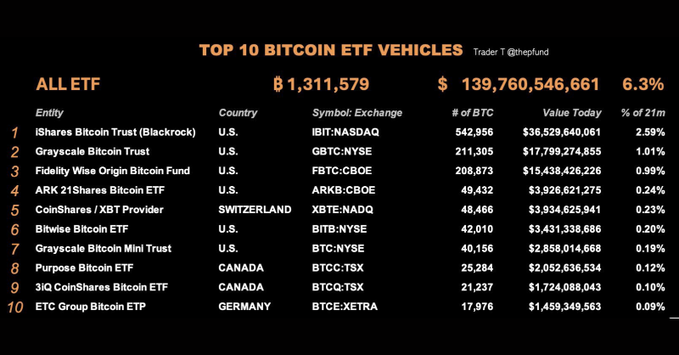

Crypto Exchange-Traded Funds (ETFs) listings

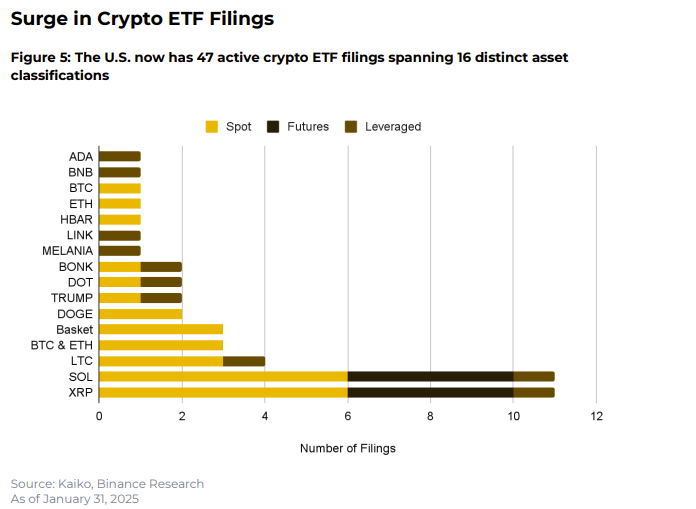

At the moment, only the EFTs for BTC and Ethereum (or mix of them) are approved by the SEC. But there is huge interest to launch ETFs for other (Top-10) crypto tokens such as XRP and SOL, and/or crypto “index” ETFs.

However, under the prior SEC Chair (Gary Gensler) and Commission, it could take years for final approval (if given).

Now, there is hope for faster and “unlimited” approvals.

So, expect many more crypto-related ETF listing requests to follow…

Crypto ETFs other issues

There is hope for more clearance about (node) staking.

For example, Ethereum co-founder Joe Lubin says issuers are confident that staked Ether ETFs will be approved under new SEC leadership.

There is also hope for other ETF improvements… For example, the Nasdaq proposed “to allow for in-kind transfers of the Trust’s Bitcoin,” as per a Jan. 24 filing with the SEC.

The filing stated that Authorized Participants — institutions that facilitate the creation and redemption of fund shares — would be able to use either cash or Bitcoin to create shares or receive cash or Bitcoin when redeeming shares. This model is more efficient for ETFs, as it avoids bid/ask spreads and broker commissions from selling the basket to raise cash for issuing shares.

Crypto and Crypto Options and Futures Listings approvals by CFTC

The U.S. Commodity Futures Trading Commission (CFTC) is the primary regulator of the U.S. futures and options on futures markets. CME, CBOT, NYMEX and COMEX are separate CFTC-registered and regulated Designated Contract Markets (DCMs) with self-regulatory responsibilities.

Until today, in practice, the CFTC only approves options and futures listings if the underlying “securities” (or commodities) are approved by the SEC.

But with the new upcoming (legal) digital assets classification, we may expect that the “supervision” will shift from the SEC to the CFTC.

US Stablecoins legislation

(USD) Stablecoin legislation is also part of the new Working Group…

“promoting and protecting the sovereignty of the United States dollar, including through actions to promote the development and growth of lawful and legitimate dollar-backed stablecoins worldwide”

The US wants to bring stablecoins onshore as explained by David Sacks, the Special Advisor for AI and Crypto.

As Federal Reserve governor, Christopher Waller explained… “US-pegged stablecoins will broaden the reach of the dollar across the globe and make it even more of a reserve currency than it is now.”

“Stablecoin issuers have become some of the biggest buyers of US government debt in the world”.

These firms use government securities to overcollateralize their fiat tokens and thus drive demand for the US dollar — prolonging its status as the standard in global capital markets.

Waller later added that banks and non-banks should be allowed to issue their own stablecoins and work with state regulators to ensure compliance with existing regulations.

So, what’s the current status?

On March 13, 2025, the Senate Banking Committee approved the GENIUS Act, which is an acronym for Guiding and Establishing National Innovation for US Stablecoins.

And now, the United States lawmakers are on track to pass legislation setting rules for stablecoins and cryptocurrency market structure by as soon as August, Kristin Smith, CEO of industry advocacy group the Blockchain Association, said during Blockworks’ 2025 Digital Asset Summit in New York.

EU (MiCA) stablecoins legislation

As the EU already introduced their Markets in Crypto Assets (MiCA) stablecoin legislation (in effect as of June 30, 2024), it’s interesting to see whether the U.S. will follow the same legal framework.

For example, the MiCA classifies stablecoins as either e-money tokens (EMTs) or asset-referenced tokens (ARTs), each with specific regulatory requirements for issuers. And major stablecoins like Tether and USDC face stricter oversight due to their market impact, including higher capital and liquidity requirements.

From the major stablecoins, only Circle’s USDC is fully compliant with MiCA regulations and authorized to operate in the EEA, while Tether and MakerDAO’s DAI are not authorized under the new framework, limiting their availability in the region.

As per MiCA requirements, E-money token issuers must provide holders with a claim against the issuer at any time and at the same value as the currency referenced by the tokens. They are required to be fully collateralized by liquid reserves and are obliged to hold at least 30% of their collateral as cash in a

segregated account with a credit institution. Also, they must authorize the stablecoin (token) prior to its listing.

These combined requirements are a “problem” for Tether in Europe as they don’t want to comply to all associated rules.

But for the US, Tether is actively “lobbying” and in talks with Congressional lawmakers in the United States to help craft stablecoin regulatory policies at the federal level.

Hence, I expect Tether to have a higher chance to become fully compliant with US regulations.

Another difference between EU and US…

MiCA regulations have ended the possibility of earning yield rewards for stablecoin holders.

I don’t think that the Working Group will follow this restriction as one of the purposes is to allow people to participate in mining and validating… and in line with upcoming expected approval for “staked” ETH ETFs… I expect that stablecoin holders will be allowed to earn yield. Especially if backed with U.S. Treasury Bonds. Hence, making the U.S. more competitive and interesting for stablecoin issuers and holders in comparison to the EU.

Finally, for MiCA, it’s worth noting that many experts have already expressed their doubts about the EU’s enforcement capabilities. Currently, it’s unclear in what capacity the EU authorities will go after stablecoin issuers that don’t follow the new rules (and when they will start their enforcement).

So, to recap… I expect new legislation but with less stringent rules in the US in comparison to EU for dollar-backed stablecoins, giving the US an advantage above EU and additional support for the dollar as reserve currency and most used fiat and stablecoin in the world.

TradFi and crypto regulatory clarity

The first important rule change already took place after the introduction of SAB 122 (see above). Now TradFi can hold (clients’) crypto currencies much easier and start new crypto custody service (including payments, brokerage and trading).

For example, Franklin Templeton CEO, Jenny Johnson predicts that the new Administration will converge TradFi and crypto with regulatory clarity, and that blockchain will ultimately be used to build ETFs and mutual funds because of the technology’s efficiency.

Brian Moynihan, Bank of America (BoA) CEO says… Banks eager to enter crypto if regulators allow.

Just as Morgan Stanley CEO Ted Pick confirmed this week speaking with CNBC at the World Economic Forum’s Davos summit. Pick: “For us, the equation is really around whether we, as a highly regulated financial institution, can act as transactions.”

In another interview with CNBC at the same Forum, Moynihan said if proper regulations make crypto payments “a real thing,” then the “banking system will come in hard on the transactional side of it.” In such a scenario, crypto transactions would simply be considered another payment type alongside credit cards, debit cards and Apple Pay.

However, as the market doesn’t want to wait too long, Coinbase urges US regulators to remove crypto banking barrier.

Coinbase sent a letter to the Office of the Comptroller of the Currency (OCC), the Federal Reserve Board of Governors and the Federal Deposit Insurance Corporation (FDIC), asking them to provide clarity on the status of banking services to crypto, Bloomberg reported on Feb. 4. Coinbase requests an official clear statement and confirmation that banks are free to provide services to crypto businesses.

So, 2025 will be the start of TradFi really entering crypto. Starting to offer crypto services such as transactions (deposits, withdrawals, payments), brokerage, trading, custody, lending, deposits/staking, and more… not only to current crypto holders… but to all their other (85%+) clients who trust their “banks and brokers” and rely on existing “Web2” product and services.

This development is huge and very important for crypto mass adoption. And with the approved BTC and ETH ETFs, we have just seen the first baby steps…

Privacy and Freedom

In line with a more crypto-friendly environment and point (i) of the purposes of the Executive Order, Trump also pardons “Bitcoin Legend”, Silk Road creator Ross Ulbricht who was sent to prison (2x lifetime sentence) for operating this darknet drug marketplace. Silk Road was one of the first peer-to-peer exchanges accepting BTC, though for illicit purposes. Ulbricht is believed to have launched Silk Road in 2011 and helped bring Bitcoin to prominence during its early days.

Coincidentally with the new Administration or not… at the same time, the US court overturns Tornado Cash sanctions in pivotal case for crypto.

Memecoins

You probably all have heard about the Official $Trump and $Melania Memecoin Launch on Solana (launched in the weekend before the Inauguration).

In the span of 48 hours, the $TRUMP coin pumped to a high of $73.43, bringing its total market capitalization at almost $15 billion (and FDV at $73.43 billion as there are 200M tokens in circulation, but maximum token supply is 1 billion coins).

However, the value of TRUMP coin decreased after the president admitted he didn’t “know much about it” and the hype was slowing.

It’s clear that Trump, or better his family understand crypto. He was the first to accept campaign donations in BTC and other crypto… and his (family) wealth and crypto portfolio has significantly increased…

And what’s so fascinating…

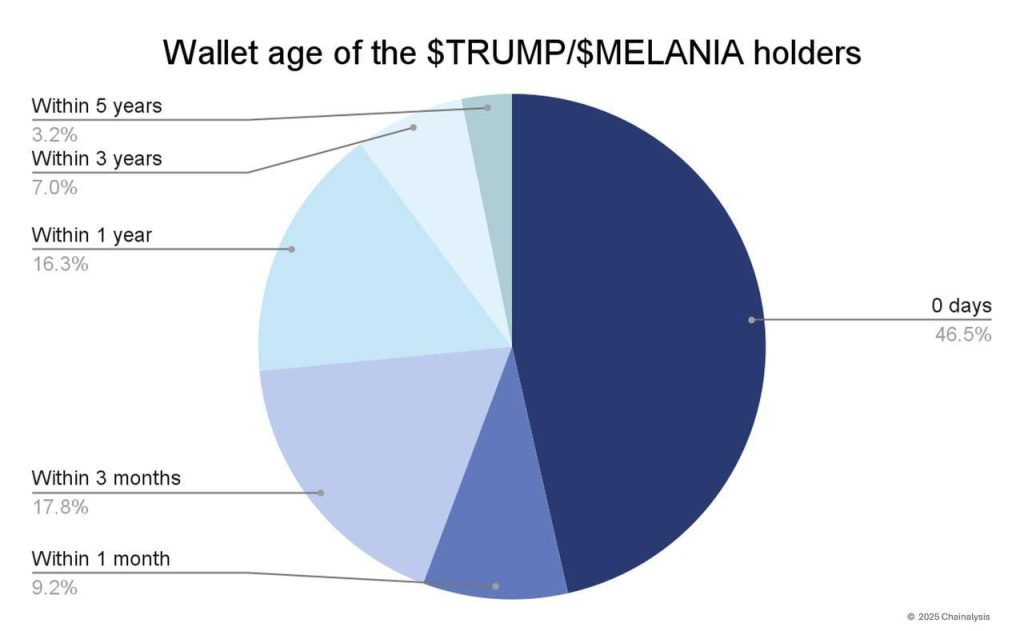

- 50% of $TRUMP and $MELANIA holders have never bought any crypto besides these two.

- 46% of these tokens holders created their wallet just to buy these two tokens.

So, you may like or may not like Memecoins as these are very speculative and prices can be very volatile.

If you analyze memecoin performances for 2024… reveals memecoins were the best-performing category of altcoins in 2024. The marketcap weighted price performance of the 900 largest memecoins was more than 1600% year to date. However, this number excludes the vast number of unsuccessful

launches on platforms such as Pump.fun or Moonshot. 98% of 5.2 million tokens launched on pump.fun failed and went to zero.

Nonetheless, the share of the total crypto market capitalization held by memecoins has risen to nearly 3%. Although this percentage remains relatively small, the memecoin trend attracted significant attention from retail investors.

Appearing on Fox News on Jan. 23, Sacks, Special Advisor for AI and Crypto (see above), said digital assets come in many forms — some are securities, while others are collectibles like non-fungible tokens (NFTs) or memecoins.

“I think the Trump coin is a collectible […] claiming that the controversial token doesn’t represent a conflict of interest for the new administration […] It’s like a baseball card or a stamp,” Sacks said. “People buy it because they want to commemorate something,” he said.

But be aware that these memecoins have no “obligations” for the issuer at all, and subsequently, the memecoin holder has no rights. You can only buy/sell/trade memecoins.

That’s a huge difference in comparison to other fungible or non-fungible tokens (NFTs). Most of the time, crypto tokens were issued (at ICO or IDO) with a whitepaper where the issuer “promised” to create the “ecosystem” for the token with specific token “utilities”. And for NFTs, each can have its own unique characteristics and token benefits. For example, the popular and expensive Bored Ape Yacht Club NFTs (Collections) give exclusive member rights.

But NFTs can also be used for example for fractional ownership of (real-world) assets with revenue-sharing… giving them more “security” characteristics.

So, it’s difficult to classify all these different NFT types.

For memes in the form of NFTs or memecoins (if without any obligation for the issuer), for sure, these are not securities if you follow the Howey test.

On the positive side… if people become first-time Web3 users this way… it may be the start for further interest and crypto adaption…

So, what happens with all the money Trump (and his family) received as result of the memecoin sales?

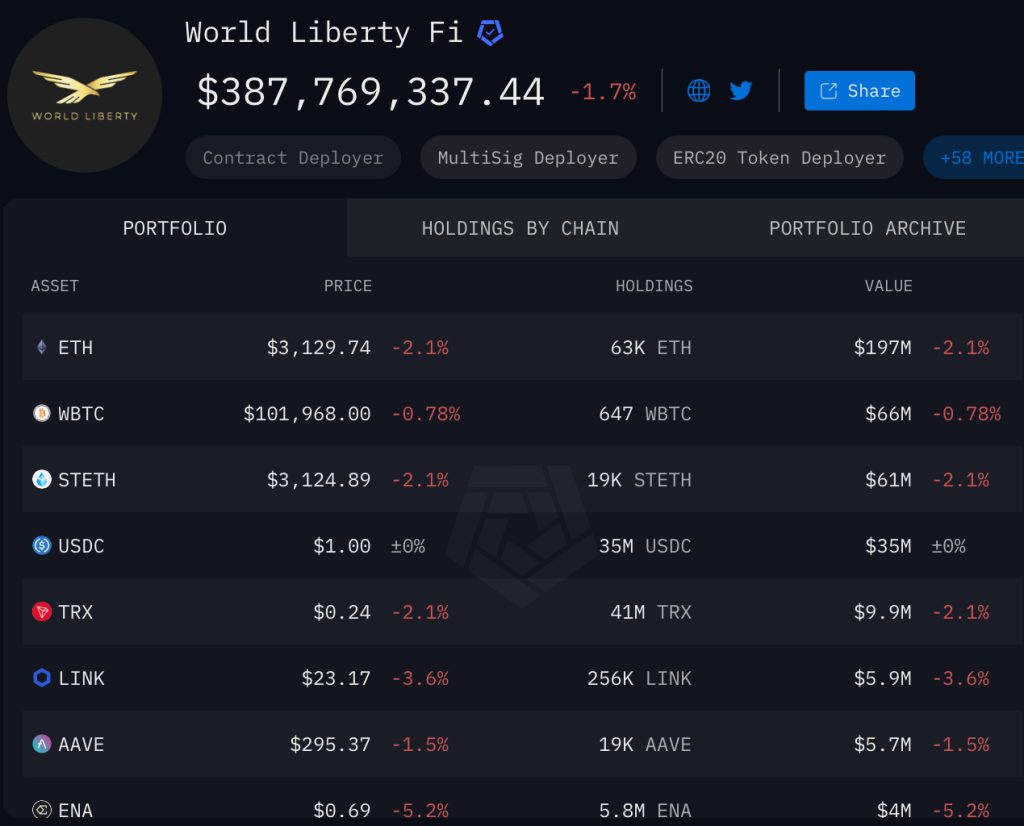

Well, it’s no “surprise” that his backed World Liberty Financial (WLFI) cryptocurrency project did a series of strategic purchases, including Ethereum, wBTC, TRON, AAVE, LINK, and ENA, after the memecoin sales, after the memecoin launches.

And that’s not all…

On January 29, we got this press release… Trump’s media company launches Truth.Fi, a fintech with crypto ambitions… that will invest up to $250 million in traditional investment vehicles, SMAs, ETFs, bitcoin and “similar cryptocurrencies or crypto-related securities.”

So, you may conclude that part of these memecoins receipts “indirectly” benefits other crypto tokens.

And if Trump can launch a memecoin (without any obligations)… any “celebrity” can launch a memecoin… without having to be afraid to be attacked by the SEC and other authorities.

Unless of course, a specific memecoin launch turned out to be a scam or rug pull, or “fake” memecoins are issued. Here some consumer protection is needed.

Taxation of crypto assets

Trump has also mentioned that US-based crypto assets could be exempt from capital gains taxes, which would cause a massive influx into this assets…

Although, changing that tax law would require a vote from Congress. As most Congress members are pro-crypto today, I think that’s a realistic possibility.

IRS DeFi Broker Rule

On March 11, the House of Representatives voted 292 for and 132 against a motion to repeal the so-called IRS DeFi broker rule that aimed to expand existing IRS reporting requirements to crypto.

The rule which the IRS issued in December 2024 and wasn’t set to take effect until 2027, would force DeFi platforms, such as decentralized exchanges, to disclose gross proceeds from crypto sales, including information regarding taxpayers involved in the transactions.

The rule was regarded by major industry lobby groups as burdensome and beyond the agency’s authority.

Speaking after the vote, Republican Representative Mike Carey, who submitted the repeal motion, said, “The DeFi broker rule invades the privacy of tens of millions of Americans, hinders the development of an important new industry in the United States and would overwhelm the IRS.”

Hence, again a more crypto-friendly decision as it relaxes reporting obligations for DEXs.

Bitcoins Strategic Reserve and US Digital Asset Stockpile

Trump first proposed the idea for a “Strategic Bitcoin Reserve” at the Nashville Bitcoin Conference (July 27, 2024). He wants cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts to serve as the core of this strategic reserve. And his policy would be to never sell any BTC. According to BitcoinTreasuries, a website that tracks cryptocurrency ownership, the U.S. owns almost 200K BTC.

A national BTC (or crypto) reserve could conceptually function as a strategic asset akin to traditional reserves like gold. Proponents argue that cryptocurrency reserves would reduce the national debt, free up U.S. dollars for other uses and position cryptocurrencies as long-term financial assets.

Such a reserve could also act as a stabilizing factor, regardless of whether the digital assets are classified as securities, commodities or currencies, and foster reliability and credibility to full faith in crypto.

The idea has gathered momentum after Senator Cynthia Lummis, a Republican from Wyoming, introduced a bill to have the government buy 1 million bitcoins over five years as “a hedge against economic uncertainty and monetary instability,” similar to the gold bullion kept by the Federal Reserve.

The proposal involves converting Fed gold certificates into bitcoin and establishing a strategic reserve with a 20-year minimum hold period. The bill also addresses current regulatory challenges, proposing clearer distinctions between securities and commodities to simplify compliance for crypto businesses. The bill includes specific funding mechanisms and regulatory frameworks, shifting oversight from the SEC to the U.S. Commodity Futures Trading Commission for certain crypto-assets.

However, on March 6, Trump signed a new Executive Order Establishment of the Strategic Bitcoin Reserve and US Digital Asset Stockpile.

Section 3a) “The Secretary of the Treasury shall establish an office to administer and maintain control of custodial accounts collectively known as the “Strategic Bitcoin Reserve,” capitalized with all BTC held by the Department of the Treasury that was finally forfeited as part of criminal or civil asset forfeiture proceedings or in satisfaction of any civil money penalty”.

Sec 3c) The Secretary of the Treasury and the Secretary of Commerce shall develop strategies for acquiring additional Government BTC provided that such strategies are budget neutral and do not impose incremental costs on United States taxpayers. However, the United States Government shall not acquire additional Stockpile Assets other than in connection with criminal or civil asset forfeiture proceedings or in satisfaction of any civil money penalty imposed by any agency without further executive or legislative action.

And although many were (initially) disappointed that the current EO only applies to forfeited BTC and digital assets, and lacks a “direct” order to “acquire” additional BTC… Lumnis’ original idea to use the “profits” regarding the Fed gold certificates to acquire BTC is still a real option as this strategy is budget neutral without costs for taxpayers as Bo Hines, executive director of the President’s Council of Advisers on Digital Assets, said in an interview. But this Council of Advisers may come with other “strategies” to acquire additional Government BTC.

US States Strategic BTC Reserves

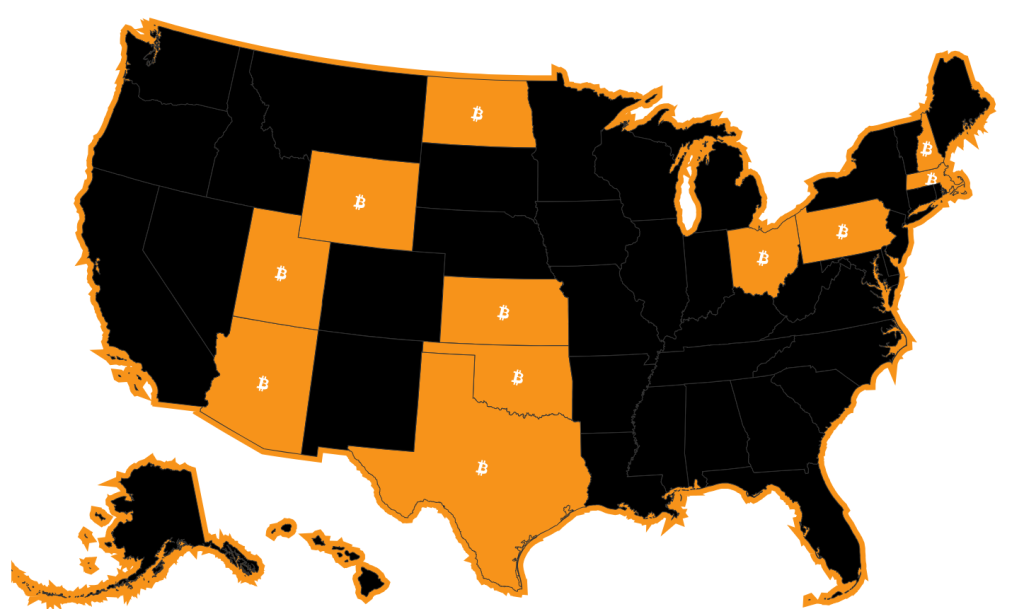

Source: bitcoinlaws.io

There are 21/50 US states have now proposed a strategic $BTC reserve bill, with 19/50 still active. Utah leads the race after passing both Chamber 1 and Committee 1 phases.

For example, the Arizona bill, Strategic Bitcoin Reserve Act (SB1025) would allow up to 10% of a government entity’s or public fund’s capital to be invested in Bitcoin and other digital assets. It also opens the door for pension funds to allocate resources to Bitcoin, potentially increasing public interest in cryptocurrencies.

Of course, if this Strategic National Digital Asset Stockpile policy will be implemented, this will be extremely bullish for BTC and the whole crypto world.

Sovereign Wealth Fund

Besides this Executive Order, on February 3, 2025, the President also signed this Executive Order… A Plan For Establishing A United States Sovereign Wealth Fund (SWF).

The Secretary of the Treasury (Scott Bessent) and the Secretary of Commerce (Howard Lutnick), in close coordination with the Assistant to the President for Economic Policy, shall develop a plan for the establishment of a SWF and jointly submit this plan to the President within 90 days. Such plan shall include recommendations for funding mechanisms, investment strategies, fund structure, and a governance model. The plan shall also include an evaluation of the legal considerations for establishing and managing such a fund, including any need for legislation.

Wyoming Senator Cynthia Lummis suggested this executive order creating a US sovereign wealth fund was a “big deal” for Bitcoin.

So, don’t be surprised if this SWF will include significant investments in BTC and US based crypto assets…

Other companies looking to Bitcoin as a reserve asset

You have probably heard about MicroStrategy that’s holding 471,107 Bitcoin (as per February 2, 2025), purchased for $30.4 billion at average price of $64,511.

(Update: MicroStrategy has rebranded to Strategy and adopts the Bitcoin icon in its logo)

But other companies are also starting to buy BTC for different purposes as strategic reserve and hedge against (dollar) inflation.

Healthcare firm Semler Scientific and streaming platform Rumble have announced multimillion-dollar BTC buys in the last 60 days, while crypto mining company MARA held 44,394 BTC as of Dec. 18.

Made in America

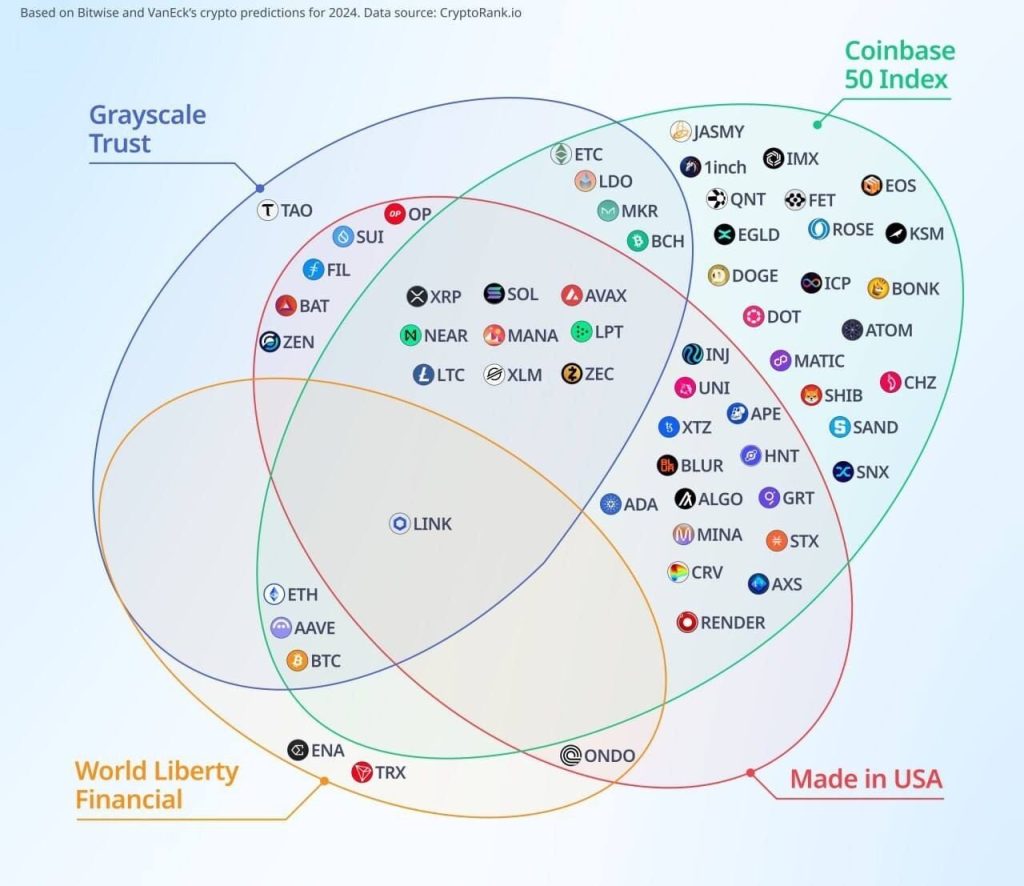

Despite the “unclear” laws and the SEC’s “non-cooperative attitude”, there are still many “Made in America Tokens”. CoinMarketCap and Coingecko even have categorized and ranked them based on marketcap. CMC shows a total $540 billion marketcap (out of total $3.5T), and Coingecko $507 billion. About 15% market share of total crypto MC, and if you leave out BTC, it’s about a 36% market share.

And this “Made in America” narrative and dominance will grow further under the Trump administration.

For several reasons…

- The new legal framework will attract new crypto initiatives and many crypto projects and businesses to come back to the US. First example is Andreessen Horowitz that will close its UK office to focus on US crypto efforts.

- The forming of the potential new National Digital Asset Stockpile and/or SWF will lead to more trust in crypto in general, and stronger focus on “American-first” crypto currencies and tokens.

- Usage of American-made blockchain technology by the new DOGE Department (lead by Elon Musk) to track government spending and reduce the federal deficit.

Something to be aware of for your crypto investment decisions…

Overall direction and conclusion

It’s clear that the Trump administration took a head start and is on its way to make the U.S. the crypto (and AI) capital of the planet as Trump promised.

The Strengthening American Leadership in Digital Financial Technology Executive order combined with all the new pro-crypto appointments on the most important strategic positions, and recently introduced new proposals and bills, will “guarantee” that this order will be executed, and lead to a new legal framework with the long waited clarity for everyone.

So, think about…

- A flood of new crypto projects and crypto assets in all segments (cryptocurrencies, tokens, NFTs, memecoins). Including billions of real-world assets tokenization (such as stocks and bonds).

- TradFi and U.S. Government using blockchain for better transparency and saving costs.

- TradFi (Financial institutions) to enter into crypto with all kinds of financial products (custody, trading, borrowing and lending, OTC, staking/earning rewards). Where TradFi will compete and merge with current CAPS (CEXs, DEXs, Custody, Digital/Fiat transmission), and only the best will survive.

- Many new crypto asset listings on TradFi exchanges such ETFs and (CME) options and futures listings.

- Strategic reserves. The aimed U.S. BTC reserves and the National Digital Asset Stockpile (Strategic Reserve). Followed by State level and probably many other Countries and/or States.

- More companies and (investment and pension) funds to hold BTC and crypto assets for strategic purposes.

- Crypto assets as accepted “payment” method for products/services by merchants facilitated by TradFi. And for all other regular “money” transfers/usages such as crypto-backed debit/credit cards.

- No more debanking for crypto token issuers and crypto service providers.

All resulting in higher crypto asset adoption by everyone, not only in the U.S. but worldwide.

So, a very bullish development…

It’s just a matter of time before the current global crypto market cap will reach $10T, and cryptocurrencies (including stablecoins) will be “treated” as regular payment vehicles.

Of course, TradFi (financial institutions, investment funds, ETF issuers) will first focus on and only support the “top” crypto assets (including stablecoins) with the highest MC and transaction volumes. So, these will benefit the first and probably the most.

And now you may wonder… what’s left for the low-cap projects such as RITE?

Effects for RITE

I hope that everyone understands that overall global higher adoption of crypto assets will benefit all current crypto projects, large or small, as the more people holding crypto assets will benefit the total crypto market.

But why should someone buy $RITE and not stick with other crypto assets?

The short and simple answer is… read everything on this website and especially about the $RITE tokenomics.

So, there are sufficient reasons… but let’s focus how RITE should avoid to be nearly invisible as tens of thousands of new crypto project and assets will flood the market in the coming years.

Or to say it in other words… the total pie (crypto assets MC) will increase… but how to ensure that our part of the pie won’t decrease?

Before I answer that question… let’s first look at the pie and our part of the pie.

A simple method and metric to use is by looking at the total crypto marketcap and compare with the $RITE marketcap.

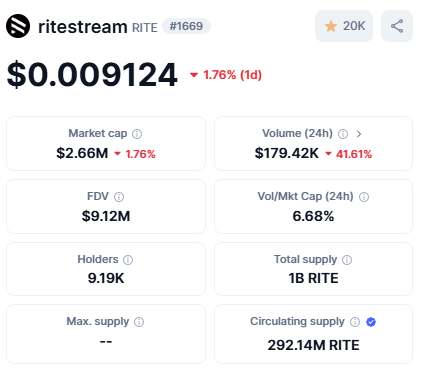

If we look at Coinmarketcap (status January 28, 2025), we can see that the total crypto marketcap is $3.64M, and the reported MC for $RITE is $2.66M, based on 292M Circulating Supply, and the ranking is #1669.

But you probably know that CMC uses outdated data, and that the current Circulating Supply is (much) higher 512.7M resulting in a MC of almost $4.7M.

And if you take this updated number… the ranking should be about #1464 (205 places higher).

(Note: a MC of $10.0M will move $RITE up to #1175. And a MC of $16M to enter the top 1,000)

So, my first advise for the RITE team… inform CMC (and Coingecko) about the latest CS details… and $RITE will move up in the MC rankings and becomes easier “visible”.

So, what about RITE’s visibility in this flood of new crypto projects and assets?

Well, what’s the case for $RITE is the case for every (small cap) crypto project…

They all need marketing exposure…

And guess, who is going to deliver this exposure for the most promising new projects?

Yes, it’s the CryptoKnights Show that will be aired to hundreds of millions of eyeballs via main streaming platforms.

Just check out all details yourself about this… start with this link… CryptoKnights Show and Launchpad.

CryptoKnights is a global reality investment TV-show where people will learn about game-changing new Web3 and crypto projects as founders pitch their project concepts in front of a panel of Knights, the judges, who may if convinced (financially) participate in these promising projects… and where you as viewer can invest yourself in these projects via the CryptoKnights Launchpad at very interesting token prices otherwise only available to VCs and insiders… with guaranteed token allocations on the principle the more $RITE you stake the higher the allocations.

So, of course, after watching one of the CK show episodes, potential investors in one or more of these projects will analyze the $RITE tokenomics, and if interested they need to buy and stake $RITE to participate in one of these projects.

Also, all CryptoKnight Show participants will promote the CK show and (indirectly) the $RITE token. Think about the streaming platforms who inform their hundreds of millions of subscribers. But also about the Knights, the Hosts, the Projects, and other Partners who will promote the CK Show to their “followers”.

This is all “free” mass exposure… targeting not only current active crypto asset holders but most and for all, a new public of current Web2 users who may purchase their first crypto asset based on the CryptoKnights Show…

So, to summarize…

With the new crypto-friendly Trump administration… it’s without doubt that “public” interest in crypto assets will increase… and people want to learn more about crypto assets in an easy to consume format…

And that’s what the CryptoKnights Show is all about… crypto education and entertainment.

And if someone is interested in one of the featured projects and want to get a discount, they need to buy (and stake) $RITE… with expected price appreciation as result… moving $RITE up in the marketcap rankings… and making the $RITE token more liquid with higher transaction volume… and hence more interesting for professional and “whale” investors… such that $RITE will become one of the top tokens… and will ultimately be listed on Tier1 CEXs and potentially listed as ETF and/or on the CME options/futures markets… and who knows part of a State or National Strategic Reserve…

Yeah, I know this last sentence is probably exaggerated… but $RITE should be included in any long-term “strategic” investment portfolio. (And of course, more liquidity and a higher MC is needed first before “whales” and institutional investors will step in… but if you can step in now at $0.01… let the “whales” step in later at $1 and above.

BTW, this scenario is just based on the CryptoKnights Show and Launchpad… please be aware that there are 2 other narratives, the ritestream+ streaming platform, and (upcoming) Film/TV-show Crowdfunding platform which will attract and onboard movie and TV show lovers who become $RITE holders.