Altcoin season and RITE

Is $RITE ready for the upcoming altcoin season? What is altcoin season and how to take advantage?

It looks like everyone is waiting for the altcoin season to come and trying to find those alts that will outperform.

And many are wondering…

Is the RITE team ready for the upcoming altcoin season and will $RITE outperform or not?

So, let’s first look at what is commonly meant with altcoin season…

Altcoin season is the season when altcoins outperform BTC.

How is this measured?

If 75% of the top 100 coins outperform Bitcoin in the last 90 days, it’s Altcoin Season.

Note that stablecoins like Tether and DAl, as well as asset-backed tokens such as WBTC, stETH, and cLINK, aren’t included in these top 100 coins.

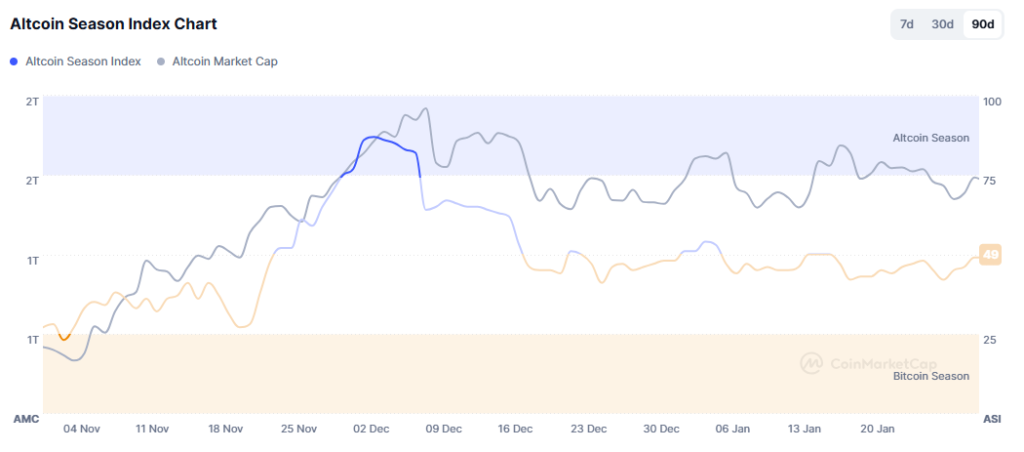

CoinMarketCap publishes the CMC Altcoin Season Index. The index has a value between 0 and 100, and it simply counts the number of top 100 tokens that outperformed Bitcoin in the last 90 days.

(BTW, BlockchainCenter.net uses a similar Altcoin Season Index but now applied for the top-50 altcoins. Plus you can analyze this index for the last month and last year, instead of just last 90 days. And it shows the individual 50 token performance percentages in a chart).

But let’s use the CMC index. So, a number of 49/100 (status January 31, 2025) means that there were 49 tokens that outperformed BTC, while 51 under performed.

Hence, when this index is 75 or higher… it’s altcoin season.

So, now at 49, BTC and Top 100 altcoins are performing “equally” in the last 90 days.

Of course, a “handicap” of this index is that it only compares BTC with the top 100 altcoins (including Ethereum), and doesn’t loot at the other altcoins group (outside the top 100).

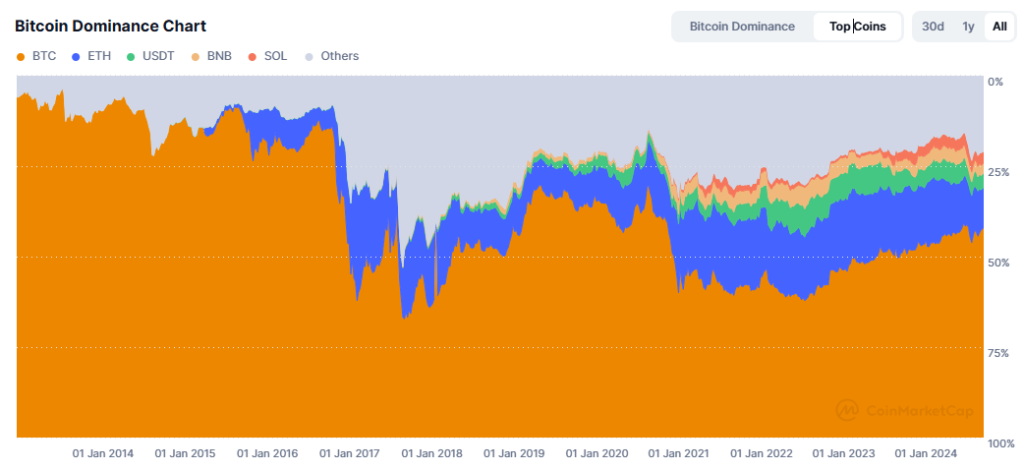

Another measurement to compare altcoins with BTC is by looking at the Bitcoin Dominance.

Bitcoin (BTC) dominance is a metric used to measure the relative market share or dominance of Bitcoin in the overall cryptocurrency sector. It represents the percentage of Bitcoin’s total market capitalization compared to the total market capitalization of all cryptocurrencies combined.

Again, you can analyze this metric on CoinMarketCap…

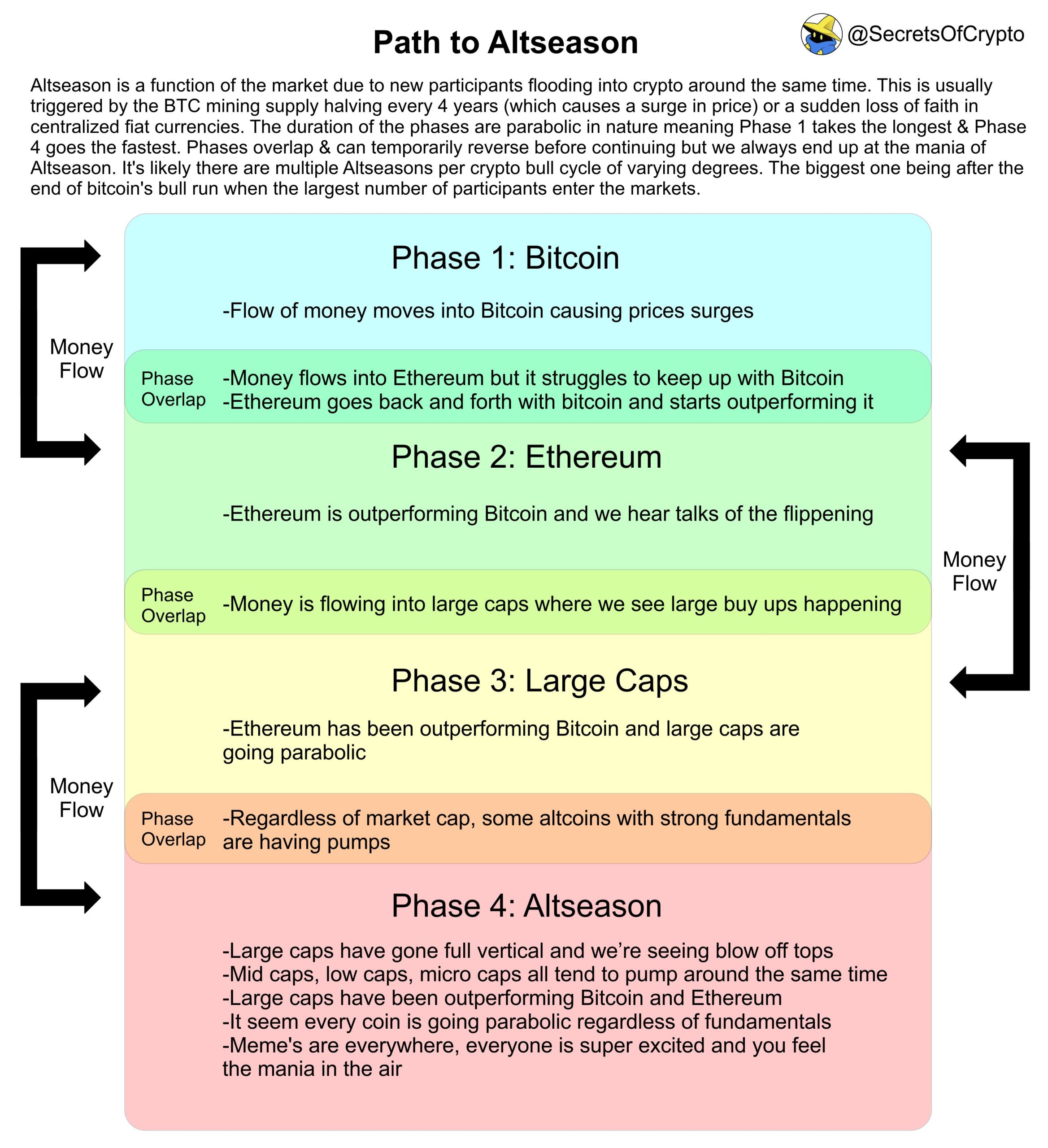

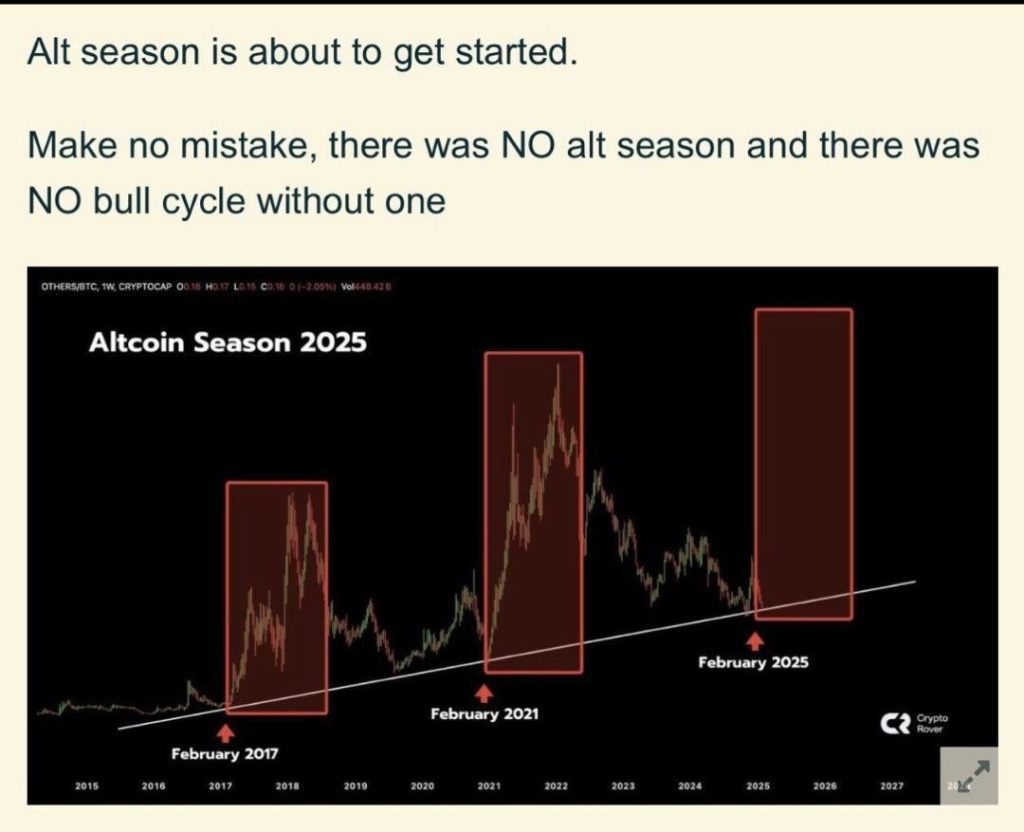

If you look at the chart above (green arrows)… you can clearly see the 4-year cycle where the BTC dominance sharply decreased while the Ethereum and Others dominance increased. This is the altcoin season…

The “positive” of this CMC chart is that the others group include all tokens (except BTC and ETH), but as “handicap”, it also includes stablecoins (and wrapped BTC tokens).

So, you better filter down and select Top Coins in this chart…

(Note that just USDT is shown separately as one of the Top Coins… but the Others group still includes other stablecoins such as USDC and DAI).

So, with some ups and downs, overall, BTC is outperforming altcoins for more than 2 years.

And overall, the Others group was losing market dominance in the last 4 years (partly caused by SOL and BNB outperforming), except for a short spike up in November, and early December 2024.

Many thought that this was the “start” of the alt season. You can also notice this in the first week of December, 2024… the only 8 days that the Altcoin Season Index was above 75 (in the last 90 days).

But a very important “handicap”…

Both the altcoin season index and bitcoin dominance are relative metrics. They only “compare” bitcoin with altcoins relatively… but don’t look at (price charts and) the overall Crypto Market Cap…

So, let’s look at the Crypto Market Cap…

And split this chart into altcoins, by only showing ETH (blue) + Others (grey)…

And compare the altcoins with BTC… (and taking out stablecoins)

And now it all makes more sense.

Note: as Ethereum is losing market share to BNB, SOL… I don’t just look at ETH anymore, but I count up the 3 main EVM L1s (Ethereum, BNB, and SOL).

4-year BTC-cycle

Many investors believe in the 4-year BTC cycle where BTC first moves up, followed by ETH and top altcoins, and finally followed by the other lower marketcap tokens, where the smaller the MC, the higher the volatility… Hence, small caps can multiply 5x or more while, while the larger caps will see lower multipliers.

So, if you extrapolate earlier 4-year cycles (and by excluding stablecoins)… what levels may be reached in Q4 2025?

Possible Market Cap Tops upcoming altcoin season

- BTC price: from prior ATH $69K to $200K (3x)

- Crypto Market Cap: from prior ATH $2.8T to $10.0T (3.5x), split into:

- BTC Market Cap: from prior ATH $1.25T to $4.0T (3.2x) (40% dominance)

- Altcoins Market Cap: from prior ATH $1.5T to $6.0T (4x) (60% dominance)

Of course, there is no guarantee that this scenario will take place… it’s just an extrapolation of prior cycles.

But even if you don’t believe in the 4-year cycle and expect the market to act differently…

There comes a time when the total Crypto Market Cap will be $10T, and you can make your own assumption about the BTC-dominance percentages at that time.

In this post, I “calculate” with a 40% BTC-dominance percentage (and by definition the other 60% are altcoins).

To make this happen… there needs to be at least 1 “season” when Altcoins outperform BTC…

So, as from this moment of writing, the BTC marketcap (and price) has to double (2x), while total altcoins marketcap needs to quadruple (4x) as altcoins just have to “catch up” as they were “lagging” during the last bitcoin season.

Note that for the altcoins… a 4x MC increase doesn’t have to be caused by an 4x average token price increase. (You know Market Cap = Circulating Supply * Token Price).

As the individual Circulating Supply for each token may change over time (for example due to unvesting and other token unlocks, minting/burning), and new tokens come and “unsuccessful” tokens go each day, the altcoins landscape is changing every day.

Also, the crypto asset market will grow naturally as more and more (real-world) assets will be tokenized.

For example, if stocks, bonds, real estate, and other financial products will be tokenized… the Crypto Market Cap may increase without (other) altcoin prices having to rise at all… to make the $6T altcoins MC target achievable.

But for simplicity, let’s “ignore” new (and failing) tokens and let’s assume that the total current existing altcoins group will do 4x in MC (and price) from the current level (almost $1.5T MC).

Simple trading strategy?

So, from the outside it looks easy… just wait until altcoins are starting to outperform BTC… and step into ETH and other top alts, followed by the smaller caps to make life-changing income.

But is it really that simple?

No, it’s not as it’s very hard to predict the “turning point” by just looking at either the BTC dominance or the Altcoin Season Index.

For example, on December 1, 2024… the Altcoin Season Index went above 75 (see chart above)… but it only stays above 75 for a single week… So, it was a “false” indicator for the start of the altcoin season.

And also 90 days is a relatively long period in the crypto world… crypto asset prices are volatile and can multiply in a few days… and the index is still “neutral”… and you are too late.

The same if you focus on the BTC dominance chart… you can draw TA lines and switch from BTC to altcoins if dominance break through the “resistance” line… but more often than not… it may be a “false” signal.

Only in hindsight, you can say whether the altcoin season has started or not… but then you are probably too late.

Let alone that on big “green dildo days” with high upward price spikes… it’s psychologically “hard” to enter at much higher prices.

So, you better look from a more macro perspective, and switch from BTC to altcoins after a longer period of time of BTC dominance (but still in the early bull phase)… as you know that the altcoins season will come sooner or later… So,

Where are we now in the cycle, and when will the altcoin season start?

BTC and altcoins are both in a bull phase for about 2 years that started in January 2023 (swing MC low).

However, BTC outperformed altcoins during the last 2 years (BTC dominance increased from 38% to 58% today).

So, in the last phase of the bull cycle, most expect the altcoins to outperform BTC (before a bear market starts). In my used numbers above ($10T Crypto Market Cap)… from today, I expect altcoins to do 2x better in comparison to BTC, and the peak will be reached somewhere in 2025 (probably in Q4).

And of course, for the altcoins, there are winners and losers… So, it’s a matter of picking the right tokens.

Strategies to pick altcoins

There are many strategies. Just to give some options…

- Pick the most hyped narrative and select one of the top performers. This way you expect the top narratives and top performers to do even better. For example, select memecoins and SOL.

- Pick the ones who had high multipliers in the past cycle. Some argue that these are “proven” winners during altcoin season(s).

- Just pick the one or more of the top altcoins. These have high liquidity and will be bought by “many” during the altcoin season. For example, some believe that ETH will always “catch up” in price (compared to BTC).

- Pick tokens with lower market caps as these are more volatile and can generate higher multipliers.

- Pick the most undervalued tokens with strong fundamentals (for example $RITE). The reasoning… most “lagging” altcoins will be noticed sooner or later if profits generated from other “leading” tokens will be invested in the laggards to make the same “multiplier” again.

So, what’s the best strategy?

I don’t think there is one best strategy (out of the ones above). There is no guarantee that one strategy will perform better than the other… as the past isn’t always the best predictor of the future.

And tokens that outperformed in the past, can tank very quickly if (market) sentiment changes. And the other way… under performing tokens may get noticed but also keep that status and will never outperform.

But what’s making selecting probably the most complex factor, is that not all altcoins have their altcoin season at the same time. The narrative focus changes quickly… as Miles gave some examples.

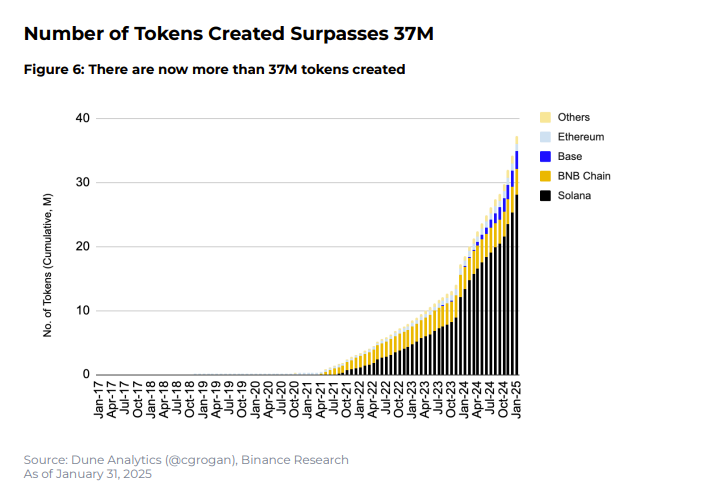

Alt picking becomes harder… this is one of the highlights in the last Binance Research – Monthly Market Insights – February 2025…

The advent of token launchpads and the memecoin mania has led to the creation of over 37M tokens, with projections exceeding 100M by year-end. This growth has fragmented capital, making it harder for tokens to sustain prices and achieve high valuations. The influx of new tokens fuels speculation, reduces attention spans and discourages long-term holding. Despite the surge, most tokens have negligible market capitalization, with the top 100 tokens comprising around 98% of the total crypto market capitalization.

So, how to pick out the best one out of 37M tokens… or should you just stick to the top 100 tokens?

What about timing?

We know that the bulls may end up parabolic, but bulls can also take a long time with gradually increase of prices. The same for the end and start of the bear market… but in general… the more parabolic the up trend, the sharper the decline that follows.

Also, bulls usually end “unpredictable” after a major (news) item happened such as the Terra-LUNA fiasco.

So, you can’t predict how long the altcoin season will be… but it’s nonsense to expect it to happen for just a few days or weeks. Usually, it takes months… You know we speak about a season… not about a short market spike.

Hence, you are not too late to jump on board and switch BTC for altcoins… but…

Effects of new Trump Administration

If you have read our blog post Effects of Trump Administration for crypto and RITE… you’ll have noticed about all new positive effects BTC in particularly. BTC will benefit the most in the early days from new digital asset legislation, new listings (ETF, Options, Futures, Leverage), financial institutions and tradfi entering the crypto world, and Strategic BTC Reserves (National and States Digital Asset Stockpile), and companies holding BTC as hedge against inflation, or improve shareholders’ value.

So, the Trump Administration is a huge catalyst for BTC acceptance, and the Top-10 Altcoins… Of course, later followed by lower-cap tokens. But initially, the top MC tokens will benefit the most.

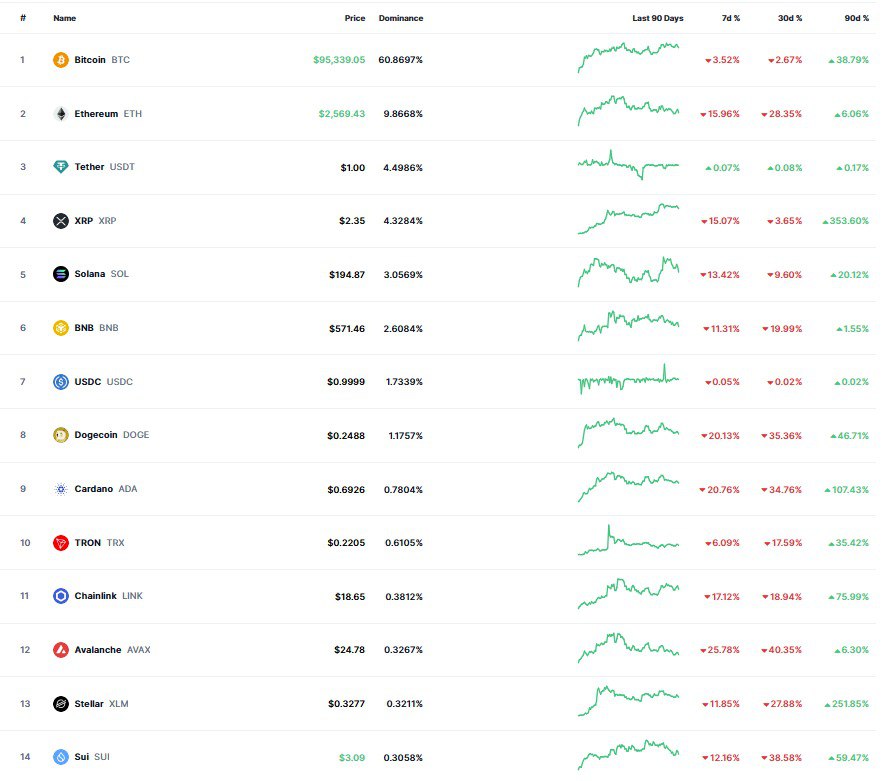

Just look at the top tokens and their performances in the last 7, 30, and 90 days…

Yes, red this week… but overall… in the plus for the last 90 days (the Trump election “bonus”).

Hence, there is a still a high chance that BTC will continue to outperform the broader group of altcoins for the coming months… especially in sideways or (temporarily) decreasing markets (red bars today as result of trade import duties).

Just because it takes time before traditional financial institutions will “implement” BTC products and services such as trading (spot, derivatives, OTC), custody, borrowing and lending, leverage products, and as payment vehicle (deposits/withdrawals/transfers). And this implementation can extend the current bull phase.

But overall, if “every” (real-world) asset is being tokenized (such as all stocks, bonds, real estate, etc) sooner or later… the total crypto market cap will explode… and it’s hard to believe that the BTC dominance percentage will stay above 40% forever as the overall crypto market is getting bigger and bigger and BTC is “just” one asset category.

Trading Tips

For the current bull phase with no clear winner between BTC and Altcoins for the last 90 days

So, my practical advise… on red days when altcoins are bleeding the most (more than BTC) such as this weekend due to the announced import trade taxes (for Canada, Mexico, and China)… shift from BTC to your favorite altcoin(s). Also, because it’s easier to purchase tokens on “bad days” as the price impact is lower and “everyone else” wants to sell.

For the accumulation phase

Start accumulating your favorite tokens (and BTC) a long time after the recent ATH when the market has tanked 75% or more… So, at least 2 years after last ATH (assuming the 4-year BTC cycle).

In the end, you’ll make both income with BTC and altcoins… maybe a little more with BTC in the end of the accumulation zone (first 10 months of 2023) and early start of the BTC bull… but your altcoins (if you choose the right ones) will catch up sooner or later and outperform BTC.

Waiting for altcoin season is often too late as you miss the early bull phase.

For the bear phase

This is the phase to avoid. So take (some) profits when everyone is excited during the bull phase.

If you kept your tokens too long and missed the opportunity to sell… just hold on to the next bull phase… but always DYOR and ensure that the project is still “building”.

What about $RITE?

So, for $RITE… if you had accumulated on time (during the accumulation phase) and bought (or dollar cost averaged) in the bear market in 2023 … you would still have a nice profit (and you didn’t miss the huge spike in the first week of January 2024)… but if you bought later in 2024… you are probably in a loss… and just have to wait for the next significant upward price appreciation (I mean a 5x multiplier or more)…

But in that case, you are a $RITE holder for a year or shorter… and who cares if you are now in a loss now?

If you have done your homework and read everything on this website… you know about the $RITE fundamentals and tokenomics… and understand that the token price can reach $0.50-$1.00 in a very short time. (Just check out this paragraph… A model to calculate the fundamental $RITE token price (at $0.55!)

For possible $RITE price triggers… read this paragraph… Historical $RITE token price and triggers.

Here, you’ll also notice that the $RITE price chart is not the typical altcoin that follows the market to the point… but the RITE token price behavior is news-driven. One “good-news” announcement can have a huge price effect.

So, you better accumulate $RITE at “low(er)” prices if the market gives you the opportunity to buy.

But please don’t blame the team for not knowing exactly when the altcoin season will start (and ends)… as you probably don’t know it yourself as nobody has a crystal bowl.

The RITE team doesn’t have the obligation to make you rich during the first upcoming altcoin season…

They are here for the long-term ensuring that you can make higher profits each and every new (higher) altcoin season cycle.

No matter whether we are in a bull, bear, or sideways market, and whether or not altcoins are outperforming BTC… the RITE team is working day in day out for you to develop all platforms and products, and to build the $RITE ecosystem with very interesting tokenomics for all participants (users, holders, and stakers).

Hence, my overall advise… don’t focus too much on altcoin seasons. First, because most altcoin seasons follow the hype, bubble, and burst cycle and are not just 4-year cycles based on the bitcoin halving… and secondly… look at tokens that will survive in the long term… not just tokens that will “pump” during the next altcoin seasons (but may fail and disappear thereafter).

So, be warned…

No investment advise, read our disclaimer.