CryptoKnights Show & CK Launchpad

Official Trailer

Source: CryptoKnights News

Official Press Release

Released: September 27, 2024. Source: CryptoKnights news

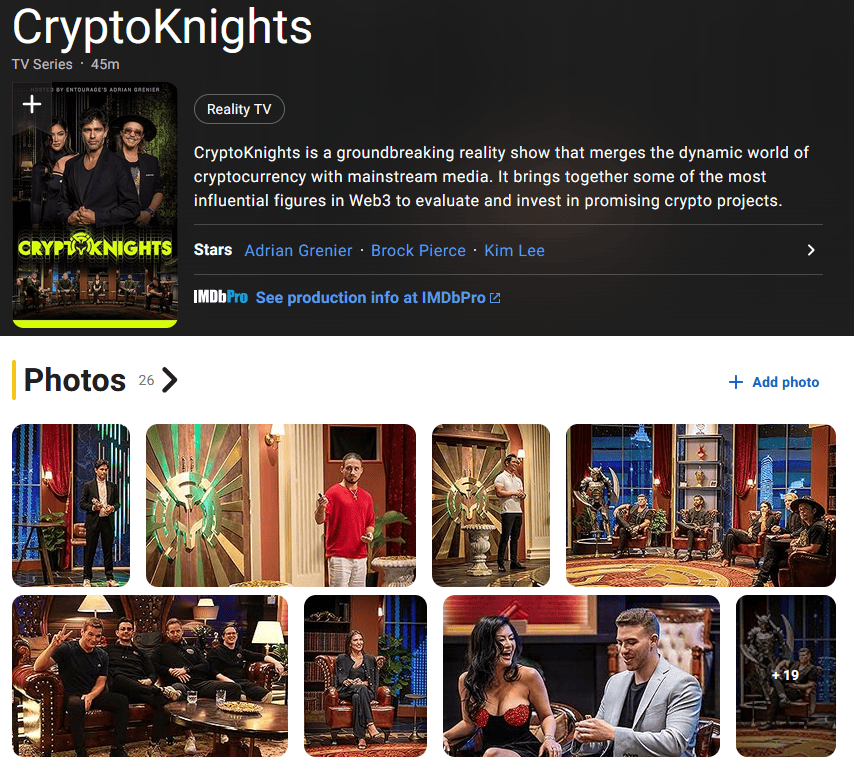

Produced by an Emmy-nominated team, CryptoKnights is the only global TV show that invites hundreds of millions of viewers to invest alongside industry titans as game-changing entrepreneurs pitch the hottest crypto projects.

Actor/entrepreneur Adrian Grenier plays host to a round table of Knights (judges) featuring Web3’s most influential figures such as Brock Pierce, flanked by celebrity co-hosts Kim Lee and Gav Blaxberg.

Set to premiere May, 2025, a new era in reality television begins with the premiere of CryptoKnights. The thrilling series showcases the brightest minds in cryptocurrency and blockchain technology, hosted by actor, environmental activist, and crypto advocate Adrian Grenier (Entourage, The Devil Wears Prada). Ride along as 20 visionary entrepreneurs compete for millions in funding. Selected from thousands of applicants, these modern-day pioneers will either secure life-changing investments or leave empty-handed.

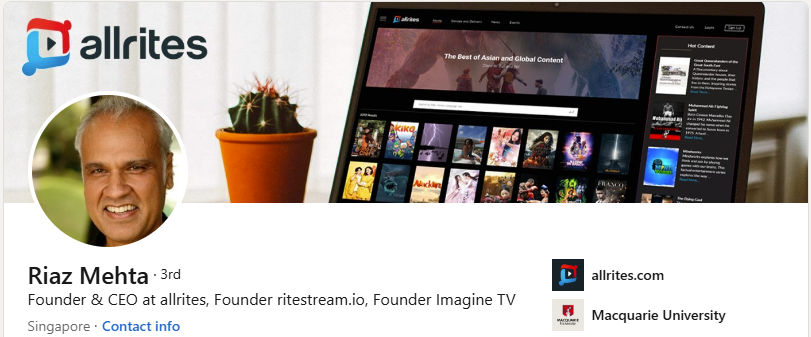

CryptoKnights is a groundbreaking reality show that merges the dynamic world of cryptocurrency with mainstream media. Conceptualized by visionary producer and serial entrepreneur Riaz Mehta, the show brings together some of the most influential figures in the Web3 space to evaluate and invest in promising crypto projects.

At the heart of CryptoKnights is an esteemed panel of judges. These heroes in shining armor are some of the most influential figures in Web3: Brock Pierce (Co-founder of Tether), Kyle Chassé (Founder of Master Ventures), Aly Madhavji (Managing Partner at Blockchain Founders Fund), Magnus Grimeland (CEO and Founder of Antler), and Nikita Sachdev (Founder of Luna Media Corp). Each brings a specialized expertise, vast network of industry connections, valuable guidance, advisory support, and enough financial muscle to transform startups into global phenomenons.

Hosted by acclaimed actor Adrian Grenier, CryptoKnights provides a unique platform where innovation meets opportunity, offering viewers a front-row seat to the future of finance and technology. By bridging the gap between complex blockchain concepts and everyday understanding, CryptoKnights aims to educate, inspire, and empower the next generation of crypto pioneers.

While these heavy-hitters deliberate on their investment opportunities, reality star Kim Lee (Bling Empire) and crypto influencer Gav Blaxberg (CEO of WOLF Financial) provide entertaining and insightful commentary in the show’s exclusive “Boiler Room” experience. Together, they dissect the most daring moves and costly missteps, keeping viewers on the edge of their seats with behind-the-scenes analyses of every entrepreneurial pitch.

Adrian Grenier stated, “CryptoKnights is more than just a competition. It’s a platform for innovation, education, and investment, where the future of finance is shaped in real-time. It’s exciting to witness how blockchain and crypto can democratize industries, and I’m thrilled to be part of this groundbreaking series.”

“I’m looking for the next Unicorn, but they often come from the most unexpected places. I believe in this show [CryptoKnights]. We will discover the Next Big Thing, the next killer app that is going to change the world, said Brock Pierce.

Riaz Mehta, CEO of Ritestream and the show’s creator, adds, “We wanted to build a show that not only entertains but educates. CryptoKnights will help bridge the gap between the often-complex world of blockchain and the mainstream audience, inspiring the next wave of innovators.”

Kim Lee stated, “I’ve always been fascinated by innovation, and CryptoKnights is where the future is happening. This show is more than entertainment – it’s about giving people a front-row seat to the next big thing.”

Exclusively created and funded by Ritestream, CryptoKnights is poised to change the way audiences engage with cryptocurrency and Web3 technology. Negotiations are currently underway with major platforms for the show’s global distribution.

So, I hope and think that you now get some understanding what CryptoKnights is all about.

Concept of the CryptoKnights show

20 Project Founders pitch in front of 5 Knights to get funded and compete to win $250K

It’s a “pilot” series of 11 episodes with average duration about 40 minutes per episode. The 20 projects pitch on stage in the round studio in front of the 5 Knights to get funded. But the projects will also navigate the Pressure Cooker (The Boiler Room). Here, a panel of respected social media influencers with deep knowledge of the crypto space will conduct pre-pitch interviews and offer insightful commentary throughout the main pitch to the judges.

It’s also a competition, and the ultimate winner will get $250K.

How is the winner selected?

If a project got funded by 3 or more Knights, they made it to the “Final” where the 5 Knights discussed these best projects and chose unanimously for the ultimate winner.

However, these game-changing entrepreneurs don’t participate to have a chance to win the prize, but they participate for 3 other mean reasons.

- To present their Web3 product/services to the “world”. As where else can you pitch in front of millions of eyeballs?

- To launch their token and get the highest publicity. Most projects have their TGE (Token Generation Event) and IDO around the period of airing of the show to get the most publicity.

- To get funding and “business support” from the Knights (just as the Shark Tank or Dragons’ Den concept).

More than a competition: innovation, education, and investment

As Adrian Grenier states, “It’s a platform for innovation, education, and investment, where the future of finance is shaped in real-time.” By showcasing the potential of blockchain technology and demystifying complex concepts, the show aims to educate and empower the next generation of crypto pioneers.

The 5 Knights invested in 15 projects with total of $35M investments

So, a very strong signal about how eager the Knights were to participate in these projects.

Watch how Kyle Chassé explains how much he is capable to invest and what he is looking for by selecting the best projects to invest in.

As you can imagine after seeing the video and images about the “quality” of the show, it’s not hard to understand that the total production costs spent so far were about $2.0M (including the $0.25M winners prize).

Invest with the Knights

As all projects will have a token, anyone can invest in the project tokens by buying tokens on the open market (after TGE/IDO and exchange listings).

Plus, the public may buy and stake $RITE, and invest in these projects via the CK Launchpad (starting in season 2).

That’s a huge difference if you compare CryptoKnights with Dragons’ Den or Shark Tank.

In these 2 shows, the “business angels” are the only ones who can invest… by buying shares in the company (or fund with loans, or royalties agreement).

And who cares how much these business angels will earn over the years?

The excitement is about whether the Founder can pitch his project and attract angel capital.

But if the public can invest in the projects themselves…

It becomes so much more interesting and important for the public to see the project progress.

Project updates and progress monitoring

All projects can only participate one time. However, the projects are followed over time. There will be updates about prior projects. Not only in new seasons via “flashbacks” but also in-between shows with follow-troughs.

So, viewers will get an idea about what happened with the project(s) after their pitch.

But as all projects will have tokens, it’s all very transparent…

The project founders have the “duty” to inform their token holders about their progress.

So, anyone can invest in the project, follow the progress, and decide to lock in profits by selling the tokens on the open market at any moment they want.

And the “market” decides about the real-time (token and project) valuation.

The filming and building of the set

CryptoKnights Show season 1 was filmed in early August 2024 in Kuala Lumpur. Below the building of the set.

The studio and Boiler Room

You can watch more photos shot during filming on the CryptoKnights Page on IMDb. For those of you who don’t know… The Internet Movie Database (IMDb) is an online database containing information and statistics about movies, TV shows and video games as well as actors, directors and other film industry professionals.

Note that many attributes in the studio, boiler room and decors are tailor-made. Just look at the Knight statue, or the round carpet with CK logo…

Created by an award winning production team

Introduction to the Hosts

Bio descriptions copied from CryptoKnight.tv

Adrian Grenier

Adrian Grenier made his acting debut in 1997 in the independent film The Adventures of Sebastian Cole. A graduate of New York City’s LaGuardia High School of Music & Art and Performing Arts, the New Mexico-born, New York-raised actor played in He is an actor and producer, played in movies like The Devil Wears Prada (2006), and went on to work with esteemed directors such as Steven Spielberg and Woody Allen before landing the coveted lead role in the award-winning HBO series Entourage.

Adrian has since added director and producer on multiple platforms to his credits. His first film, Shot in the Dark, chronicles his journey to reconnect with his estranged father. The film premiered at the 2002 Tribeca Film Festival, was distributed by HBO, and had a strong impact among its viewers. In 2007, Adrian teamed up with producer Peter Glatzer and sustainability expert Lauren Gropper to develop the television series Alter-Eco, a sustainable lifestyle series produced for Discovery Communications channel Planet Green. After the series ended, Adrian launched SHFT.com, a website with a mission to convey a more sustainable approach to the way we live through video, design, art and culture.

Kim Lee

Los Angeles native, Kim Lee has become one of the most sought after DJ/ Producer / Actress in the business. Kim graduated from Scratch Academy in Los Angeles. From the support and encouragement from Apl De Ap from The Black Eyed Peas, Kim quickly start touring the world from the U.S to Asia and becoming one of the biggest DJ’s in the industry.

She has toured and done shows with Steve Aoki, Martin Garrix, Diplo, and Skrillex. Kim also performed along with Cardi B, YG, and Tyga at Fashion Nova Event, 2021 MTV Movie & TV awards, Anastasia Beverly Hills Halloween Party, Budweiser, Johnny Walker, Hennessy, Ultra Japan, Ultra China, Ultra Korea, Life in Color Korea, Mad Decent Boat Party, It’s The Ship, EDC New York, Drai’s in Las Vegas, Marquee Vegas, Tao Las Vegas, Eleven in Miami, and Pacha NYC. Kim is now a residency at the world famous Wynn Nightlife, performing both at Encore Beach Club and XS.

From appearing on music videos for Kanye West to Katy Perry and many more. Kim was named #1 FHM sexiest women in Asia (Singapore). A girl of many hats, she was the host of Yo! MTV Raps Asia in 2019 and soon after her she won over many hearts when Netflix show Bling Empire aired. Bling Empire season 3 out now on Netflix.

Gav Blaxberg

As a keynote speaker, marketing and investment research expert, and financial influencer on 𝕏, Gav Blaxberg brings his unique perspective and energy to the show.

CEO of WOLF Financial, leading a vibrant community of 350,000+ investors. Former PWM analyst at Goldman Sachs and Private Equity at Versa.

Featured in Forbes, Yahoo, The Street, Markets Insider, & Benzinga.

Sarah Lian

Sarah Lian is the brains behind Suppagood Collective, one part boutique Talent Management empowering an exclusive female roster and one part Public Relations and the highly praised Supparetreat – women focused community that aim to educate, equip and empower women with the right tools to succeed in life, love and work.

Commonly invited on podcasts, interviews and panels to speak about inspiring the next generation of women leaders, Sarah is a popular personality on stage and in entertainment.

She has carved an illustrious career for herself across the regions of North America and Asia. Her wit and charm makes her an in-demand TV personality and master of ceremonies. Aside from hosting, she is an International award-winning actress in notable films including “Jasmine” (2015), “Already Tomorrow in Hong Kong” (2015); plus local films “Fly by Night” (2018) and Get Hard Tongkat Ali (2017).

Introduction to the Knights

Bio descriptions copied from CryptoKnight.tv

Kyle Chassé

Kyle Chassé is a true OG in the blockchain industry, having made his mark with an initial investment in Bitcoin back in 2012.

He’s been involved in over 100 projects, including big names like Coinbase and Kraken, showcasing his expertise in founding, investing, and advising.

As Founder and Chairman of MV Global, a leading blockchain venture studio, Kyle has managed a vast portfolio and co-founded multiple companies.

All while educating the crypto community through platforms like YouTube and 𝕏.

A sought-after speaker at global conferences, Kyle collaborates with industry experts to challenge conventional systems.

He’s also a prominent figure in social media spaces, hosting ‘The Roundtable’ Twitter/𝕏 Space with Mario Nawfal, engaging with industry leaders like CZ, Elon Musk, and top blockchain developers.

Based in Thailand with Master Ventures, Kyle’s commitment to blockchain’s positive impact drives his vision for mass adoption, focusing on projects with real value and inclusivity.

Ali Madhavji

Aly Madhavji is the Managing Partner at Blockchain Founders Fund which invests in and venture builds top-tier startups.

He is a Limited Partner on Loyal VC and Draper Goren Holm. Aly consults organizations on emerging technologies such as INSEAD and the UN on solutions to help alleviate poverty.

He is a Senior Blockchain Fellow at INSEAD and was recognized as a “Blockchain 100” Global Leader by Lattice80.

He is an internationally acclaimed author, publishing three books and a monthly columnist for the leading blockchain magazine. Aly serves as a board member of CryptoStar Corp. (TSXV: CSTR), Mechanical Technology Incorporated (OTCMKTS: MKTY) and has served on various advisory boards including the University of Toronto’s Governing Council, which manages a $2.5B budget. He is a mentor with Chinaccelerator, an elite accelerator program operated by the venture fund SOSV with $700M+ AUM and the Mobile Only Accelerator (MOX).

Aly holds a Master of Global Affairs as a Schwarzman Scholar from Tsinghua University, a Master of Business Administration from INSEAD (Singapore and France), and a Bachelor of Commerce with Distinction from the University of Toronto.

Nikita Sachdev

Nikita Sachdev is an Indian-American serial entrepreneur and investor who discovered her passion for the crypto and blockchain space in 2017.

Working for crypto giant Huobi ignited her interest and led her to launch Luna PR in her living room which has now metamorphosed into an award-winning public relations and marketing agency headquartered in Dubai, with offices in Miami, Singapore, and London with a team of over 100 professionals.

Luna PR’s parent company, Luna Media Corporation, also houses a web3 venture capital, a foundation that aims to educate less-privileged girls in India, and Cointelegraph MENA.

Sachdev’s expertise in crypto and blockchain has earned her a reputation as a thought leader in the industry. In 2021, the company won the “Best PR Agency in Fintech” award, and in 2022, Luna PR was recognized as the “Best Web3 Consultancy.”

Ever since, Luna PR has bagged over 10 prestigious awards and continues to gain recognition across the niche – the latest additions to the trophy case being ‘Web3 Marketing Agency of The Year’ for Luna PR and ‘Businesswoman of The Year 2023’ for Sachdev.

Magnus Grimeland

Magnus Grimeland, a titan in the world of entrepreneurship and venture capital. Magnus brings a wealth of experience and a remarkable track record of building and supporting groundbreaking ventures that redefine industries:

Founder and CEO of Antler: Leading a global team across 6 continents and 30 locations, Magnus has cultivated Antler into the world’s largest early-stage investment platform. With over 1000 portfolio companies and an unrivaled network of entrepreneurial leaders, Antler is at the forefront of shaping the future of innovation.

Co-Founder and Regional Managing Director of Zalora: Responsible for steering the ZALORA Group markets in Southeast Asia, Magnus played a pivotal role in establishing Zalora as a prominent name in the e-commerce landscape.

COO of Global Fashion Group(GFG): At GFG, Magnus spearheaded strategic market initiatives and successfully rolled out GFG’s Marketplace across 26 countries, spanning SEA, the Americas, Europe, the Middle East, and Oceania.

Alumnus of Harvard University and McKinsey & Company: Magnus brings a wealth of knowledge from his tenure at McKinsey & Company, where he served as a Junior Partner and worked extensively across North America, Europe, and Asia in the Telco, Media, and High-Tech sectors.

Royal Norwegian Navy Special Operations (Marinejegerkommandoen) veteran: Magnus’s background in elite military operations reflects his tenacity and strategic mindset, qualities that resonate in his approach to business and investment.

Brock Pierce

Brock Pierce is an entrepreneur and venture capitalist with an extensive track record of founding, advising and investing in disruptive businesses. He’s been credited with pioneering the market for digital currency and has raised more than $5B for companies he has founded.

Pierce is the Chairman of the Bitcoin Foundation and co-founder of EOS Alliance, Block.one, Blockchain Capital, Tether, and Mastercoin (first ICO). Block.one was created in 2017 and has sold over $4B tokens in the EOS crowdsale making it the largest ever.

Blockchain Capital was founded in 2013 and is the first sector-focused venture fund that invests solely in Blockchain technology companies. Pierce led the firm through the first ICO of a venture fund, which created the first security token. Blockchain Capital has made more than 100 investments in the sector across its four funds. The firm was named the most active FinTech Venture Fund by Pitchbook.

Tether is the first stable coin and asset-backed token. Pierce is an early investor in Bitcoin and one of the largest investors in the Ethereum crowdsale.

He is the founder of IMI Exchange, the world’s leading digital currency marketplace for games, with annual sales exceeding $1B and investors such as Goldman Sachs, which was sold in 2016 for more than $100M.

Pierce founded ZAM, one of the world’s largest media properties for gamers, which was acquired by Tencent in 2012. He founded IGE, the pioneer of digital currency in online games, achieving revenues exceeding $100 million in 2006 and sold in 2007.

Pierce is also a co-founder of D10e, GoCoin, Blade Payments, Five Delta (sold NASDAQ: SRAX), Xfire 2.0, Playsino, Evertune, GamesTV, and D.E.N. He also advises for companies like Airswap, Bancor, BitGo, BitGuild, BlockV, Bloq, DNA, Element Group, Metronome, Shyft, tZERO, and ODX.

Personal experience has led Pierce to become an advocate for due process and rule of law, with a focus on an efficient, fair, and coherent judicial system as the cornerstone to liberal democracy. His philanthropy in this area focuses on the American Civil Liberties Union (ACLU), the Foundation for Individual Rights in Education, the Center for Individual Rights, and the Brennan Center for Human Rights.

Pierce is a frequent lecturer at Singularity University and has spoken at the Milken Global Conference, Mobile World Congress, Wired, INK, Stanford University, USC, and UCLA. He has been featured in numerous publications including The New York Times, Forbes, Fortune, Wired, and Rolling Stone.

The 20 featured Web3 projects season 1

The CryptoKnights team has scouted the globe to bring you the most groundbreaking projects in the Web3 space. From revolutionary AI protocols to cutting-edge gaming studios and the future of the eCommerce, all poised to disrupt the crypto landscape.

For season 1, there are 20 featured projects. Click on the link(s) below to go the official websites.

| Me3 | Skillful AI | Playember | Bluwhale | GNUS AI |

| Libera | Paycio | Tordess | Another-1 | Global Settlement Network (Paxum) |

| DEIN | Pentagon Games | AmnoCrypt | Lemonade | GFIT |

| Koii | DYOR | AIJAM | EstateX | Bitwala |

Or visit them on 𝕏 and follow if you like the project.

Reality Shoots

On the CryptoKnights website, you can watch 10 reality shoots taken in the period before the actual studio filming took place in early August… https://www.cryptoknights.tv/portfolio-category/realityshoots/

Plus as marketing “teasers”, some clips were shared, covering specific projects. Below 2 examples.

Or you can watch them all on CryptoKnights’ YouTube channel, especially watch the shorts.

Note: discussing all these 20 projects (and many upcoming Web3 projects to come in the next years)… it’s just out of our scope. We just lack sufficient time to follow and discuss them the RITEFANS way.

However, we have a community profile on CoinMarketCap (don’t forget to follow us) where we have posted a Watchlist including all season 1 featured projects if “listed” on CoinMarketCap.

The projects were carefully selected. Out of about 200 projects, 20 made it to the show. Think about how much time and effort, especially by Joseph Khan, CSO, with the help of Katinka, has been spent to onboard these projects and do the contract negations. On average, it took 5 hours of “negotiations” per project. That alone took 1,000 hours of time and energy.

Most of these projects still have to do their TGE/IDO.

So, if you want to get in early right from the start… DYOR… and you’ll be prepared and ready if the tokens are launched later via CK Launchpad!

OK, because I like their project name, DYOR, watch this reality shoot…

When will these projects have their TGE and IDO?

This is different for each project. Some are product-focused and want to do their TGE when the product is “ready”. Others may want to have the most eyeballs for their IDO and will have their TGE around the airing of the show.

When and where can we watch CryptoKnights?

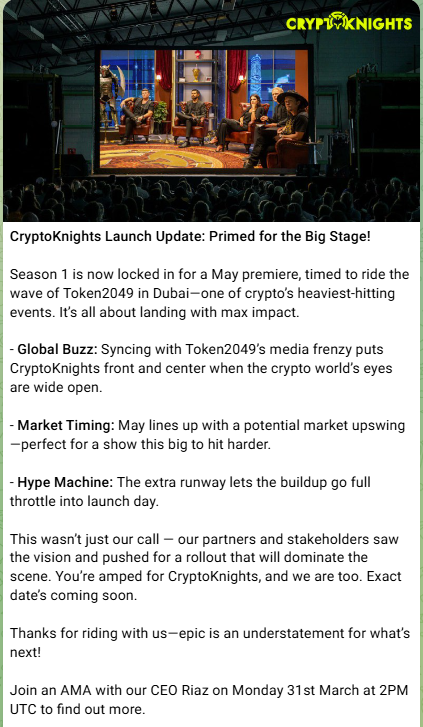

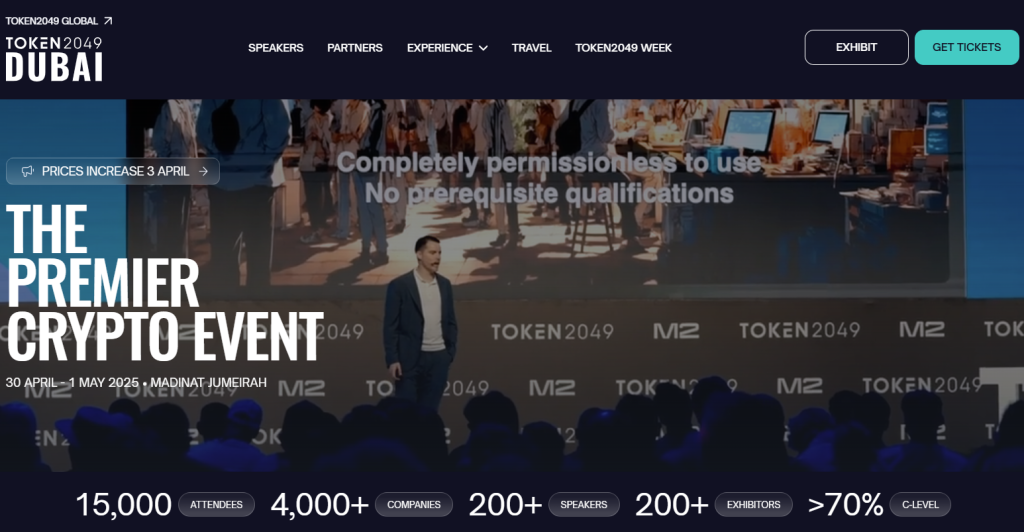

When… The contract with the main streaming platform has been signed. The official announcement will take place in March/April 2025 via a Press Release. The CK episodes will go live in May 2025 and the “frenzy media marketing” takes place around the Token2049 Dubai Event (April 30, May 1, 2025).

Where…

The CryptoKnights Show will be aired on a main streaming platform where (hundreds) of millions of their subscribers can watch the CK episodes.

Why don’t we know the name yet of the main streaming platform?

As it will be announced by the main streaming platform at the moment they want to inform their public (and also via an official press release by the team). Until that moment, there is a NDA (Non Disclosure Agreement).

However, we know that the the show will air in May 2025 and that the streaming platform is a big ‘household’ name. Think about…

- Netflix: 282.7M users (as per end Q3 2024)

- Amazon Prime: ~200M users (as per end Q2 2024)

- MAX (HBO, HBO Max, Discovery+): 103M+ (as per end Q2 2024)

Besides on one of the main streaming platforms, you can watch the CryptoKnights episodes on RITESTREAM+ and on other (“local”) streaming platforms. But the main streaming platform will (probably) get exclusivity for a specific time period.

But the interest from other streaming platforms is huge. Over 25 platforms all over the world showed interest and contracts could have been signed (but were put on hold awaiting the negotiations with the main streaming platform(s).

The (allrites) team had a frequently visited exhibition stand on MipCom Cannes in October 2025. Visitors (content distributors, broadcasters and streaming platforms) could not miss the stand as a huge entrance wall “banner” promoted the CK Show.

How fast can we watch after the announcement of the main streaming partner?

It depends on the policies of the streaming platform.

Netflix informs their audience each month what’s coming that month.

Amazon Prime (Video) uses Press Releases to introduce new content releases. And the time between announcement (press release) and actual airing varies between 1 week and 5 weeks (often about a month).

Can we watch all 11 CK episodes for Season 1 immediately?

Although Netflix and Amazon Prime (Video) have often the policy to release a new episode each week… Riaz Mehta, CEO, informed us (during the AMA on March 31, 2025) that all 11 episodes can be watched immediately from day 1 of the release.

So, you can binge watch all episodes.

As Project Founder, Why and How should you apply for next seasons?

Why?

- Marketing exposure to (hundreds) of millions of people for product/services.

- Funding and Mentorship from the Knights, experienced Web3 entrepreneurs.

- CK Token Launchpad for project funding with maximum exposure around TGE/IDO and broader distribution to (potential) investors. (Higher raises and less dependency on future market sentiment).

- Ready-to-use marketing tools such as professional video material. Think about pitches, beyond-the-scenes, reality-shoots, and all other promo material around the CK Show, such as “As seen on CryptoKnights”.

- New partnership opportunities. Projects Founders may help each other and become partners. The Knights and the RITE team can introduce Founders to their “network”, act as mentors, help each other, or become partners.

- To win the show and earn the winners prize.

The CryptoKnights Team is already actively seeking revolutionary Web3 projects for Season 2 and beyond. This is your opportunity to showcase your groundbreaking idea to a global audience of hundreds of millions.

The costs?

All featured Projects have to “contribute” project tokens. You can see this as payment for marketing contribution, a platform fee for the Launchpad, and as a way of sharing in the production costs. For more details… scroll down and read about the funding of the CK show.

So, the perfect opportunity for “new” projects who want to get maximum (marketing) exposure around their TGE/IDO and to show the “world” their unique “project” without paying cash… but spending tokens (just like “giving away” tokens to get exchange listings)… with as additional benefit… broader token distribution (among $RITE stakers).

How to apply?

Fill in the (simple) form on this page…

Do you have the courage and right attitude to pitch your project?

Watch what Brock Pierce and Magnus Grimeland have to say…

Funding and monetization CryptoKnights season 1

The CryptoKnights Show is/was the first RITESTREAM studios “original” pilot project to proof the concept of crowdfunding of Film & TV productions.

The production was funded in in 2 ways:

- CK NFTs (private sale for $RITE stakers who staked between 5K and 500K tokens)

- riteFUND (seed sale for $RITE stakers who staked 500K+ tokens)

The monetization comes from 2 main revenues streams:

- Project token sales. All featured 20 crypto projects have to “contribute” project tokens. You can see this as payment for marketing contribution, a platform fee for the Launchpad, and as a way of sharing in the production costs. Part of these tokens will be used to distribute tokens to CK NFT holders and riteFUND investors.

- Airing/Distribution rights income paid by the broadcasters and streaming platforms who buy the distribution rights to air the show.

Holders of the CK NFTs will get tokens from all 20 featured projects and got a discount in comparison to the public (IDO or agreed) token prices. The Seed sale investors got 40% discount, and the Private sale investors got a 30% discount.

Or maybe easier to understand by looking at the NFT sales price…

Each NFT is worth $250 (20 tokens valued at $12.50), and the Seed sale investors could buy the NFT for $150 (40% discount), and the Private sale investors could buy the NFT for $175 (30% discount).

Below the images of the soul-bound CK NFTs (the golden for the Seed sale investors, and blue one for the Private sale investors)

In total, almost 2 thousand CK NFTs were sold with $840K in revenues.

BTW, these are soul-bound NFTs. Hence, not tradeable. For the actual claiming of the individual project tokens, smart contracts are used.

This way of funding via NFTs were investors could invest in all the 20 project tokens at once, was a one-time event to (partly) fund the first season.

What about the revenues?

The total revenues for season 1 will be about 3x-4x the production costs ($2.0M+). So, between $6.0M+ in total. (A rough estimation of revenue split-up: $3M+ contributed by projects (20x $150K+), and $3M+ for the CK show distribution rights).

Of course, a huge part of the “margin” will be used for marketing expenses… but it should be clear that the CK show combined with CK Pad is an unique sustainable and profitable “business model”.

Funding and monetization CK season 2 and beyond

For next seasons, individual projects tokens will be exclusively offered via CK Launchpad, or (partly) again via similar CK NFT sales.

Assuming that there will be about 80 featured projects per year (2026 and beyond), you may expect the total CK revenues for a full year to be $20M or more… ($6M+ for the distribution rights and $14M+ for CK Pad project token sales, 80 * $175K).

(Note that there will also be revenues from sponsorships and partnerships, but as we have no insights in these revenues… it’s not being included for now)

And now you can calculate the…

Revenues per token

In analogy with Revenues per Share, we can calculate the (yearly) Revenues per token.

Just divide the total revenues for a year (2026) and divide by the number of tokens in circulation (=Circulating Supply).

So, with $20M revenues and Circulating Supply of 400M tokens, the Revenues per token are $0.05.

Hence, about 5x the current token price (End March 2025: 1 cent token price).

Or you can use the…

Revenues/MarketCap or MarketCap/Revenues ratio

The Revenues/MC is often easier to calculate and to use for comparison with other tokens.

With $20M in revenues and Marketcap of $4M, the current Revenues/MC ratio is 5.

So, this ratio gives the same 5x factor (and is logical as the formula is… MC = CS * price).

Just compare this ratio with other Web3 crypto projects with less revenues and often having ratios far below 1.

I hope you can understand this math, and come with the same conclusion as me about under- vs overvaluation.

“Similar” projects have 0.1 Revenues/MC ratios (or even lower)…

Or in other words… if we switch the numerator and denominator, giving the MC/Revenues ratio (aka as revenues multiplier)…

Similar fast-growing crypto or Web3 projects are valued at a 10x revenues multiplier.

In that case, the MC for $RITE should be $200M… (or 50x as high as the current $4M MC, resulting in a $0.50 token price).

Instead of the MC, we can also using the FDV (Fully Diluted Value)…

FDV/Revenues ratio

Be aware that the MC is based on the circulating supply and this number can be different for each project, making it more difficult to compare projects. Hence, by looking at the FDV, it’s often a better metric.

If the $RITE price is 1 cent, the FDV is $10M, and the FDV/Revenues ratio is 0.5 ($10M/$20M).

Again a relatively low ratio if you compare for example with other Launchpad tokens with current ratios between 5x-10x (and much higher multipliers at ATHs during bull runs).

Note: these ratios look at the total revenues (streaming platform income + CK pad sales). Below, we’ll use another model to “calculate the fundamental $RITE token price”… but by looking from the viewpoint of “staking benefits” for $RITE stakers (and wanted minimum APY).

Also, be aware that we have just looked at the CK Show and CK Launchpad revenues. We didn’t look at the revenues for the other two “narratives”, the streaming platform, and the crowdfunding platform.

Can you now understand why we are RITE fans?

Not just as we like RITE’s mission… but also because of the potential $RITE price appreciation (no investment advice, DYOR, read our Disclaimer).

Future improvements and scalability

Above we showed you everything we know about season 1… but think about what’s possible for the next seasons.

Although the “standard” is already at a high level…. there are many things that still can be “improved” or “scaled up”.

Confirmed improvements:

- The Cast will be “upgraded” by hiring even more “famous” (guest) Hosts and Knights. Just think about what will happen if for example Elon Musk or CZ (Binance) will become a Knight? Or your “favorite” global TV personality becomes Host?

- Podcasts. Besides the TV show format, the team will also come with CK Podcasts covering featured projects “progress” and other general developments in the Web3 and crypto world.

- Improvements in the show “concept”. The production team has new “secret, game-changing” ideas to make the show even more “interesting and fun” to participate for Projects.

- The filming of season 2 is planned for late Q2 or early Q3 2025 (airing probably late Q3 or in Q4 2025). So, expect at least 2 seasons aired per year… but maybe if streamlined better… we can expect either more seasons or more episodes, resulting in more featured projects per year.

Other upscale options:

- The more successful the CK show, the more “appealing”, “quality” and “game-changing” Projects can be “attracted”. Hence, the onboarding of the main streaming partner (for season 1) was very important to scale up.

- Sponsorships and Partnerships. With (potentially) hundreds of millions of eyeballs, the CK show is attractive for any business/project active in Web3/Crypto. Think about a sponsorship and/or pro-marketing campaign by a main CEX (as Binance) or main Wallet (MetaMask)… (where a main CEX can also lead to the $RITE token listing!)

- The CK Show concept can and will be “sold” to other “local” TV production, broadcasters, and streaming partners. Think about CK Show Asia (continent level) or CK Show Australia (country level), or for specific language speaking public (Spanish, French, Arabic, Chinese). Just “Google it” and you can find out how many different “local” formats (sometimes with different names) have been aired based on the Dragons’ Den format all over the world.

- Besides selling the concept… expect joint events with other Launchpads and Projects competitions. For example, April 7, 2025, KangaStarter & CryptoKnights are bringing an exciting networking & pitch event to ArtVerse, Paris, as a premier side event of the Paris Blockchain Week. This event is more than just networking. It is a launchpad for the next wave of Web3 startups, where Riaz Mehta, CEO, is one of the Panel of Judges (yes, Riaz acting as a Knight himself).

So, CK season 1 is just the start…

It’s the start of a flywheel… “better” Cast and Projects… more eyeballs, more interested partners (streaming, sponsorship, strategic partners), higher production and marketing budget… “better” show with higher entertainment level… etc.

Wishful thinking?

To succeed in business… it’s not about what you know but WHOM you know… and the RITE team has the rite connections.

Just some connections via either our CEO, Riaz Mehta, our the Knights…

Remark: I’m not saying that CZ, Richard Branson, Elon Musk, or Mark Zuckerberg will become a (guest) Knight in the CK Show in one of the next seasons… but I just give these as examples that the RITE team has the RITE network and connections to onboard “VIPS and celebrities”.

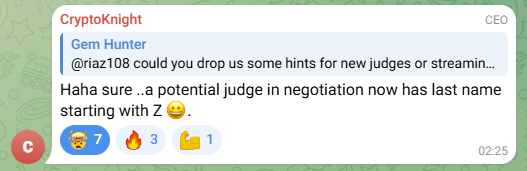

Or just look at these messages in the Ritestream Telegram Group… and what Riaz Mehta, the CEO has, announced on 𝕏…

So, we can expect an “upgraded” Knights panel (and maybe Hosts) for season 2 and beyond… we just have to wait for the exact names…

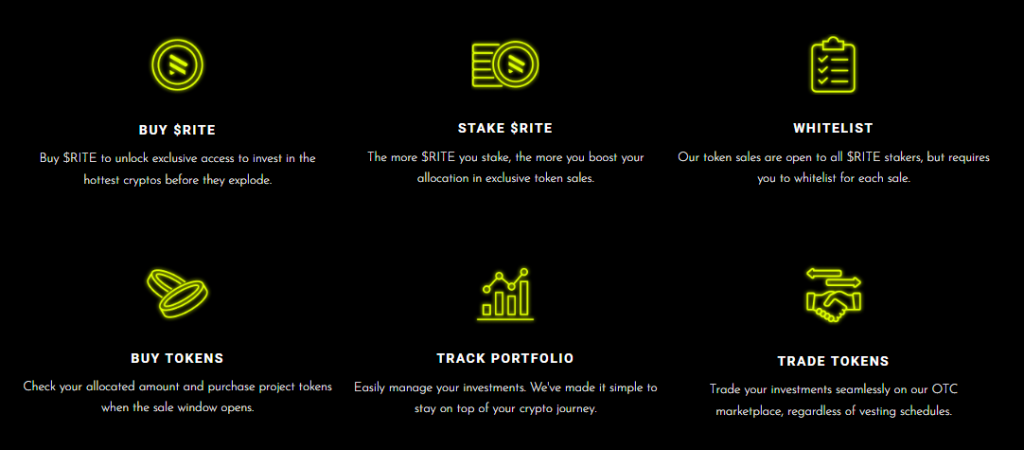

CK Launchpad – Private Token Sales

The first CK Launchpad activity was of course for the CK NFTs as described above.

The next activity will be individual token sales for featured projects in the CK episodes.

So, for now, we have to wait for the first project token to be launched on CK Launchpad. Of course, this will start around the airing of the CryptoKnights show in Q2 2025 for the best publicity and highest public interest.

As the combo CryptoKnights show with the CK Launchpad is so unique and the show may reach hundreds of millions of eyeballs… many featured crypto projects now even want to use the CK Launchpad as their (primarily) launching partner for their upcoming IDOs (or private placements).

And the more eyeballs seeing the CryptoKnights show… the projects can do larger token sales on CK Pad.

Below shows the process flow.

The staking process and requirements (Tier System) is described below in the tokenomics paragraph.

The Spring Platform (CryptoKnights/Ritestream Launchpad)

Spring.net is a platform for “Investment groups” and “Launchpad platforms” for “early and private” token raises, (vested) token distribution/claiming with optional “private” OTC marketplace for trading in vested tokens (accessible for “investment group” members who registered and passed KYC).

The investment groups often use a pooling mechanism (where you invest in a pool of tokens), while for the Launchpad platforms, you are usually investing in a single token.

The platform has 1 main activity and 2 other upcoming activities (for investors):

- Join Investment groups where you can get access to private rounds and often trade vested tokens (OTC marketplace). Inside the investor portal you can join raises (show interest), get whitelisted and allocations, have your own dashboard and activity history to see all token details (as allocation, prize (purchase and actual), vesting scheme, historical/upcoming unlocks and distributions), OTC (vested token) trading stats, and more you can expect inside an investor portal).

- [Upcoming] Pre-market. Public market for upcoming TGE/IDOs and or vested tokens.

- [Upcoming] Discount market.

Where each Launchpad has its own “public portal”, i.e. URL on the spring.net domain.

Spring now has 150K+ investors and 200+ “Investment groups”.

The public portal domain for CryptoKnights/Ritestream is https://spring.net/discover/ritestream.

For now, CK NFT holders can claim their distributed tokens inside the portal (active for SKAI tokens and soon more to come).

Of course, around the CK Show airings and beyond, you (i.e. $RITE stakers) can also participate in (private) early-stage or discounted deals for projects that appear on the CryptoKnights Show.

So, the Spring platform is a public marketplace where potential investors can find the best “investment groups” and launchpad providers. But each “investment group” has its unique “special requirements” such as investment min/max, commission/fee percentages, and/or special requirements to join (for example, staking required).

Each Investment Group publishes its number of (active trading) deals, highest ROI (based on ATH vs raising price), number of members, and short description of activities and market segments.

Hence, from a marketing viewpoint… the Spring Platform may attract more investors who may see the CryptoKnights/Ritestream portal for the first time.

And in the future, when live, the Spring Platform may be used for public Pre-market and/or Discount market (CK Pad) token sales. (Of course, after private sales for $RITE stakers for “remaining” tokens to be sold to the “public”)

Tokenomics for CryptoKnights and CK Launchpad

The $RITE token benefit is clear… staking gives access to exclusive, guaranteed, and/or higher CK Pad sales allocations. And the more $RITE you stake, the higher the allocations.

(Plus by staking $RITE, you’ll get automatically airdrops of project tokens featured in the CK show)

But it’s not just about access to regular token allocations… it’s also about getting access to selected “top” Web3/Crypto tokens with interesting (private sales) price discounts… where these tokens and discounts are otherwise only available to VCs and “insiders” (via specific seed or private sales rounds).

So, with expected 40-80 featured projects per year… all in a sudden… a new unique (IDO) Token Launchpad is in the wording… that may compete with the current biggest token Launchpad platforms.

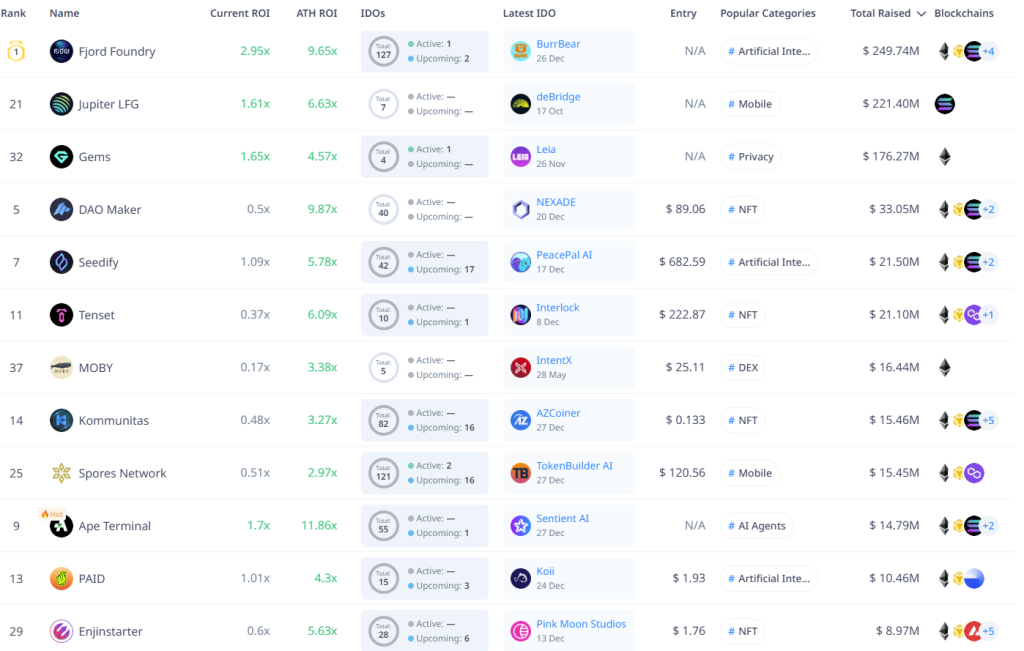

Comparison with other Launchpad platforms

How do we measure and compare CK Pad with these other Launchpads and their token valuation, to get an idea about what’s a reasonable MarketCap and “fundamental” token price for $RITE based solely on the Launchpad narrative?

If you visit CryptoRank Fundraising Platforms overview, you can analyze and compare Launchpad platforms. by looking at:

- Current ROI.

- ATH ROI.

- Number of raises.

- Total Raised dollar value.

- Narratives/Categories of offered projects.

- Supported blockchains.

- Minimum entry (dollar amount to participate).

By default CryptoRank ranks the current (listed) 125 Launchpad platforms based on (current and ATH) ROI.

But I choose to rank/filter based on Total Raised value (and 1 year filter)… and these are the top 12 Launchpad platforms (status end December 2024).

Notice that most Launchpads have a staking program where stakers get guaranteed, higher, or exclusive allocations on the concept of the more you stake the higher the allocations. Often based on a tier system.

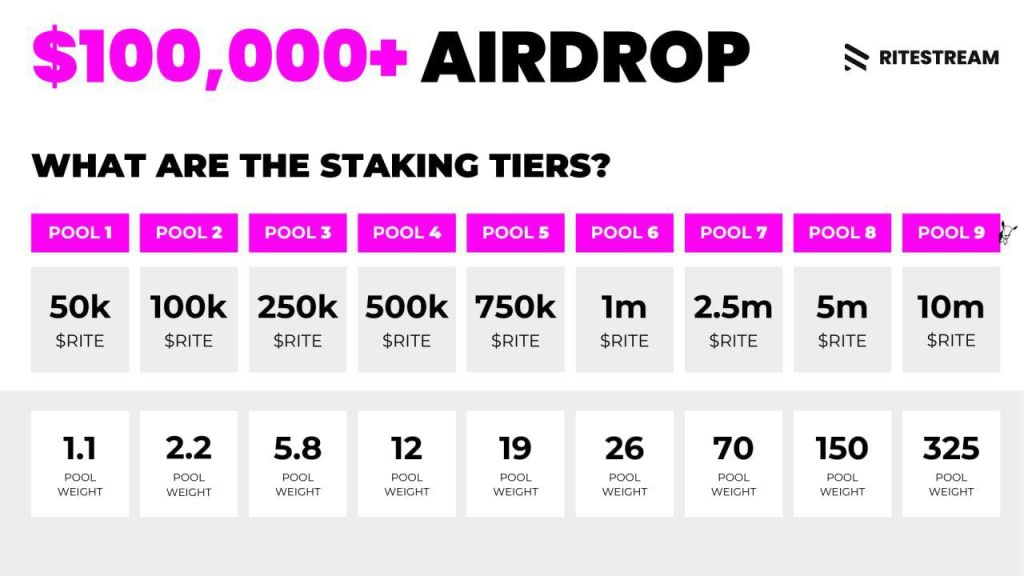

For RITE, there is a Staking Tier System that determines your staking pool weights for the (CK featured) token airdrops (worth $100K+) AND this Tier system is also used for the CK Private Token Sales.

Before we dive deeper… I want to emphasize that Launchpads act as the “middlemen” between projects who want to raise capital and investors who want to invest in interesting new Web3 or crypto projects.

Project founders select the Launchpad partners who they may think can raise the needed capital and distribute the tokens among a diverse broad public (of long-term investors) without causing high price volatility due to investors who immediately sell the received IDO tokens at a profit. So, that’s why they often choose several Launchpad partners, including CEXs where they can list the token.

Investors on the other hand are interested in new projects and rate Launchpads on ROI and look at the necessary (staking) conditions how they can participate. Hence, how many IDO’s they can participate in, and how much they need to invest and stake in the Launchpad token to make it worthwhile, and whether or not the staking tiers will give additional benefits as price discounts.

So, from an investor’s perspective, the more successful IDO (raises) and the higher (past) ROIs, the more popular the Launchpad, resulting in probably relatively higher MarketCaps and FDVs.

But for CK Pad, we can’t look at prior ROIs, and we don’t have sufficient info about all staking details yet…

So, we can’t compare CK Pad yet with these Launchpad platforms…

A model to calculate the fundamental $RITE token price (at $0.55!)

However, for CK Private Token Sales, we can look at the expected number of raises and total raised dollar value.

And by making some assumptions, we can analyze the expected $RITE staking APY, and even use the staking APY formula to calculate the “fundamental” token price… the price smart investors are willing to pay at a maximum for the $RITE token to get their “wanted” minimum APY.

As the idea is that potential investors will continue to buy and stake $RITE as long as the expected APY is higher than their minimum required APY… and they will continue until this minimum APY is reached.

OK, let’s assume that:

- Total CK Pad Raised dollar value in 2026 will be $14M (80 projects/raises with $175K average raise). However (see point 2), this raised amount is after taking into account the 30% private sales discount (A similar public IDO would raise $20M with 80 projects/raises with $250K average raise). Hence, a $6M private sales discount.

- $RITE stakers will get an average 30% (private sales) token price discount (in comparison to public IDO price or market price). (Notice that CK NFT private sales buyers also got a 30% discount)

- The maximum number of staked $RITE tokens will never be higher than 80% of all available (public) tokens. As not all $RITE tokens will be staked for obvious reasons (such as liquidity providing, trading purposes, non-custodial token holdings on CEXs, and part of the investors/traders are not willing to lock up their tokens)… we use this 80% as a maximum.

- The group of $RITE stakers “require” a minimum of 10% APY (on average).

- We don’t look at individual stakers but look at at the whole group of stakers.

- CK Show price effect. As a result of all marketing exposure around the CK episodes, we can expect a “listing premium”. You know, often the first listing price on a CEX/DEX is higher than the public IDO price. Let’s assume that this premium is 25% (25% price increase on top off public IDO price).

Some remarks about these assumptions…

Ad 1) The expected total raise amount can be (in reality) more or less than $20M. But think about the upwards potential…

A (new) project can do its IDO via several launch partners, including CK Launchpad as one of them. But CK Pad can also become the primarily or only project Launchpad partner (as it has as main advantage that it can attract hundreds of millions of “eyeballs”). So, instead of a $250K raise… the raise can also be “millions of dollars”.

Especially, if you take into account that more projects are addressing the Low Float, High FDV problem… leading to imbalanced token distribution, extreme price volatility, and community disengagement. And the solution is… offering more (or all) tokens for sale during the IDO (just as Memecoins are often doing… I mean all tokens in circulation right from the TGE start).

Ad 2) The average (private sales) token price discount may be more or less than 30%. I use the same discount that was given to CK NFT private sales buyers.

It’s also important to understand that the team may participate in the official IDO together with other Launchpad partners… in that case… often the same IDO price and vesting “conditions” will apply to all (but there is still often sufficient “space” to make a distinction between seed, private sale, or public pricing).

The team may also decide to have a token sale before the official IDO/TGE with its own unique price and vesting conditions. Or they can have a token sale after the IDO based on actual market prices. And in this last case, to succeed, the team has to give a price discount anyway… otherwise people will just buy on the open market.

Ad 3) How many $RITE tokens can (and will) be staked at a maximum?

Well, only those $RITE tokens that are (already) in circulation (i.e. not controlled by the RITE team) can be staked.

The current number is about 500M $RITE tokens… assuming that 80% of these tokens will be staked at a maximum… results in 400M $RITE tokens which can be staked at a maximum.

Of course, if the RITE team brings in more tokens into circulation (from their “treasury”)… this maximum number may be higher. But before this 80% maximum is achieved, this can take quite some time… and maybe it will never reach that maximum percentage.

Ad 4) At the moment, for single $RITE token staking, the APY is a default 5.13% (for 180 days staking). We assume that this will be the case in the future, but the RITE team may change this. So, the (total group of) $RITE stakers require an additional 5% APY in the form of CK Launchpad platform “rewards” (i.e. the 30% discount).

Ad 5) Allocations are not only based on individual staking “tiers”, the more you stake, the higher the allocations… but also based on whitelisting. Hence, it’s not necessary that each staker has to participate in each raise…

So, we assume that in that case other stakers will “fill the gap” and get a higher number of whitelisted tokens (higher than if every stakers actually participates). Or in other words… that each raise will be “placed” for 100% among the group of $RITE stakers.

Ad 6) Don’t forget that we are talking about unique tokens who participate in the CK Show with hundreds of millions of eyeballs… giving the project a head start… with as result that the first project token price at the open market after exchange listing may be significantly above (private sale) IDO price. Multiples are not uncommon. And in that light… 1.25 (25% listing ROI) is maybe conservative.

So, if we use this staking APY formula:

Staking APY = (Yearly staking “rewards”) / (Total staked $RITE dollar value)

where…

Total staked $RITE dollar value = Total $RITE staked * $RITE token price

And the yearly staking rewards consist of:

- the default 5.13% APY.

- the $100K+ token airdrops (ignored for this calculation). For scenario analysis, visit Staking Benefits.

- the 30% private sales (dollar) discount.

- the 25% listing premium.

By using above assumptions…

$RITE stakers (as a group) will get $6M in (yearly) “private sales discount rewards” (30% of $20M).

Plus they can earn 25% listing premium over the total $20M raised value… Hence, a $5M premium.

So, in total $11M as “yearly staking rewards” (on top off default 5.1% APY).

In that case…

Minimum additional required APY = 5% = $11M / $220M.

So, investors will continue to buy and stake $RITE until the total staked $RITE dollar value equals $220M (as 5% of $220M equals the $11M “reward”).

And, $220M divided by 400M (maximum) staked $RITE tokens… gives a “fundamental” minimal $RITE token price of $0.55.

Note that if we leave out the “listing premium”, the yearly reward would still be $6M, resulting in a fundamental $RITE token price of $0.30.

Compare that with the current token price (between 1 and 1.5 cent) and total staked $RITE of about 40M… and it’s clear that the price can do “easily” 20x-30x if potential investors become aware and agree with this “valuation”…

And it’s a huge step forward from 40M $RITE staked to 400M $RITE staked… if for example the staked number halts (temporarily) at 100M $RITE… the expected APY is 40%… and that should be the driver for more people to buy and stake $RITE…

So, a $0.30 $RITE token price relates to a $300M Fully Diluted Value (as the maximum token supply is 1 billion tokens)…

This should be “achievable” if you know that “competitor” Launchpad tokens earlier (in the last bull run), achieved FDVs ranging from $300M+ up to $1.5 billion.

Especially, if you look at the expected number of yearly raises… 80 projects and $14M raised total value… these are relatively high numbers… bringing CK Pad immediately in the “Top-10” Launchpad platforms, both based on the number of raises and total raised amount.

Also, be aware that this FDV valuation is just based on the CK Pad token sales (raises) for the year 2025 (i.e. season 2 and season 3) from a financial (APY) viewpoint…

Ignoring the separate “valuation” for the other 2 narratives and ignoring possible additional positive effects as a result of the huge marketing exposure around the CryptoKnights Show and CK Launchpad token sales (with high positive token ROI), and ignoring possible raise growth factors for the years 2026 and beyond.

Sidestep… Note that we use the FDV valuation method and not the MC valuation on purpose. You know if the “team” still controls 500M tokens, 400M tokens are staked, and 100M tokens are held by the public free to trade (CS)… in that case with a $0.30 RITE token price… the MC is $30M and the FDV is $300M. But what gives a “better” insight in the “project valuation”… the MC or the FDV?

Answer: the MC is lower the more tokens are staked… and for valuation purposes, this just doesn’t make sense… higher staking numbers are a proof of project (and token) strength… So, the “project valuation” should increase instead of decrease the more tokens are staked…

Now, you probably understand why MC is not the “ideal” and the “wrong” metric to value a project… the MC is a metric to value the liquidity of a token (in dollars) by multiplying all tokens free to trade by the token price… and nothing more. So, be smart if you analyze (and compare) projects, and don’t just look at the CS and MC… but analyze actual token distribution (company-controlled vs public-controlled, and from the latter how many tokens are staked), and use FDV instead of MC.

Why is the actual $RITE token price lower than the calculated fundamental price?

For me, it’s clear what’s the current “problem” is…

Not many (potential $RITE) investors are (yet) aware of the upcoming $RITE staking rewards related to the CK Launchpad token sales discounts… and/or underestimate the related numbers and/or CK marketing exposure effects.

Investors just haven’t “seen” the CK show and any CK Pad token sale (yet). The moment they understand that CK Pad will do 70-80 token sales each year, where you need to stake $RITE to get “access” to these game-changing project tokens at discounted prices… and the more $RITE you stake, the higher the allocations… it will lead to a run on $RITE.

Especially, if they do the (simple) math as above… this should open up investors’ eyes.

Sooner or later, smart investors will notice the $RITE token price potential… it’s just a matter of time.

So, take advantage while you can…. (no financial advise, DYOR, please read our disclaimer)

Of course, this fundamental analyzes of the (potential) $RITE token price is no guarantee that this price will be achieved as we are living in a “crazy crypto world” where prices may be overvalued based on hype and where “quality” projects are undervalued due to lack of knowledge (or vibe). Plus, crypto markets are very volatile… in bear markets at the lowest prices, most tokens are undervalued, and the opposite in bull markets at highs… tokens are often overvalued. So, use it as a “guide”, or maybe first goal for the $RITE token price to achieve.

Marketing and Branding CryptoKnights

CryptoKnights has its own branding with website, 𝕏-account, Discord Server, and YouTube Channel.

(Note: there is no CryptoKnights Telegram Group)

Until CryptoKnights got its own “branding” (website and social media channels), the marketing was done via RITESTREAM’s social channels. The marketing was primarily focused on informing the $RITE token holders about the CK NFTs (and riteFUND) sales and about the CK progress via:

- News and social media announcements, and…

- AMAs with CK projects, and Knights introductions. View full YouTube Playlist.

- AMA’s with Joseph/Riaz, explaining CK funding and CK Pad.

As own brand… the focus was more on the CK show itself… the content… showing reality shoots, clips, and one by one revealing of the Projects, Knights, and Hosts.

After the revealing of the full Cast and all Projects… the Press Release (see above) and later the video trailer (see below) was meant to inform a broader public about CK… and all details were added to the IMDb database… in preparation for the MIPCOM “promotion”.

Of course, the main marketing will be done just before and around the airing of the Show… but until that moment… the marketing is done via daily social media sharing of reality shoots (of Project Founders), clips (227 CK show fragments), and the official trailer.

And the “beauty” of CryptoKnights is that the team doesn’t have to do the marketing alone…

The marketing will also be done by:

- The featured projects.

- The Knights.

- The Hosts.

- The KOLs.

- The streaming platforms.

- The partners.

All have their reasons to “promote” CryptoKnights and CK Launchpad.

The projects want to get as much eyeballs for their pitches and token launches.

The Knights will at least inform their community about the selected projects they invested in, but will also promote the show in general.

The hosts (Adrian, Kim, and Gav) will also inform their followers… and attract specific audiences. Adrian and Kim will attract NetFlix viewers (and streaming platforms), while Gav attracts crypto investors.

KOLs are “hired” and “lined up” to promote both the show and individual project launches.

The streaming platforms, of course, will also inform their (in total hundreds of millions of) users that they can watch the CK show.

And finally, the (VC and Launching) partners have their own reasons to promote the show and specific projects.

The RITE/CK team will of course also do all kinds of promotions (see the examples above), but if combined with the Knights and/or featured Projects, the marketing exposure effect will be huge.

Just look at the moment of the video trailer reveal. Projects and Knights shared the trailer but also stimulated their communities to participate in the TaskOn campaign.

Below the CryptoKnights trailer reveal campaign (click on the image to participate, end date campaign January 14, 2025). By sharing and following CryptoKnights and featured Projects Telegram and 𝕏 accounts, you can earn 800 $RITE (500 winners, total prize pool 400K $RITE, lucky draw system).

This “official” trailer was the start of showing the first overall impression of the CK show… but the (marketing) team also has access to 227 (new) short clips and plot twists from moments during the show. These will be “rolled out” over time to get as much awareness (A) and interest (I) as possible… leading to desire (D) and ultimate action (A) to watch the CK show. (AIDA marketing formula).

But the marketing is not just “targeting” potential CK show viewers… but also to “attract” new projects for season 2 and beyond, new (VC) partners, new sponsors, new (guest) Knights/Hosts, new KOLs, and new $RITE token holders.

Below, 2 examples…

But also, think about cross-marketing via RITESTREAM+ (pre-roll and mid-roll commercials).

So, if you count all these efforts together…

There is only one conclusion…

CryptoKnights marketing campaigns and social sharing will be seen by hundreds of millions of unique eyeballs.

Of course, as said, the explosion of marketing will start just before and around the CK airing on the main streaming platform(s)… as it’s nice to promote some trailers… but the most effective marketing will happen if people can really watch the CK show (and for season 2 and beyond, participate in CK Launchpad sales).

And not just for this first season… but (hopefully) for many years to come.

So, for $RITE holders… just be patient… the world will soon know about CryptoKnights.

In promotions and marketing campaigns, the RITE team tries to mention this relationship between CryptoKnights as often as possible. Unfortunately, this is not always possible. Especially if the team wants to “boost” a specific post via paid advertising, for example on 𝕏, the TOS (Terms of Services) don’t allow promoting “crypto tokens”, either directly or indirectly.

So, while a regular post may mention crypto tokens… it’s even recommended as the dollar sign in $RITE has the same benefits as a # hashtag… by adding “powered by $RITE”… this post can’t be boosted anymore.

But there is another main reason…

CryptoKnights deserves its own branding as it’s the purpose to become a well-known brand. But just as Procter & Gamble has many brands such as Gillette, Oral-B, or Head & Shoulders, these brands won’t tell in each advertising campaign that they belong or “are powered by” P&G.

(BTW, smart investors will find out that these outstanding brands are part of P&G, even if not clearly visible in all ad campaigns… and it’s the same for CK and RITE)

So, the purpose of marketing and advertising is not always to promote the “conglomerate, the mother company” but to promote the individual brand and product.

Of course, if a company/conglomerate has multiple brands (or for crypto projects… narratives), you can do some cross-marketing. But the idea is that the brand should be “strong” enough to stand on its own as it has its own unique product/market proposition (often not related to the other “group” brands).

But let’s get back to CrytoKnights vs the $RITE token as the “critique” is that $RITE holders won’t benefit from CryptoKnights marketing and progress.

Of course, that’s not the case. The success of CryptoKnights will benefit $RITE in different ways:

- The CryptoKnights Launchpad “narrative” valuation. Just as for P&C, the “brand” belongs to the “concern”… and the concern is valued higher with a sustainable/profitable “subsidiary” having its own brand and brand valuation.

- There are still many direct and indirect relationships between CK Show, CK Pad, and $RITE token. The most important one… (staked) $RITE is needed for (higher) allocations on CK Pad. And as we saw above… the higher the “discounts” on CK Pad token sales platform, the more interesting to stake $RITE, and the higher the fundamental token price.

- In the “Bio” of the social channels, there the relationship with RITE is mentioned. So, for all social announcements… in the announcement itself you won’t see the “link”, but new viewers of the social “chat/message” will often see the “Bio”. Just as on the CK website, you can find info about RITE.

- The MT and team members for CK and RITE are often the same. You know, Riaz Mehta, the CEO has many “hats”… CEO/Founder of Allrites, Imagine TV (his production company), RITESTREAM, and CryptoKnights. So, in almost all circumstances… if relevant… Riaz (and other team members) will “promote” any “brand” if needed. Just see the combined ad for allrites and CryptoKnights on MIPCOM above.

So, if it’s possible, relevant, and if no boosting (advertising) is aimed… the tag “Powered by RITE” or any other link related to $RITE may be used… But often it’s irrelevant for the main message you want to communicate… and it may be even seen as “annoying” to always see the “powered by” message.

Besides that both CryptoKnights and KillerWhales are TV shows where crypto (Web3) project founders pitch their projects to a panel of judges, there are many differences. Below the main differences…

- Quality and production costs of show. The production costs for CryptoKnights season 1 was about $2 million. Everything was done to make the CK show as unique and entertaining as possible with unique Studio and Boiler room, well-known Hosts and Knights (Judges), and produced by award-winning production team. Just watch the trailers of CK and compare this with the KW episodes. CK is in short a top-quality TV show production that out beats KW in quality on all fronts.

- CK Show is aired by a top streaming platform as premium content for their monthly subscribers, reaching potentially hundreds of millions of viewers (think about Netflix, Amazon Prime, Max). So, not pay-per-view as KillerWhales can be watched, but “free” to watch for millions of eyeballs. Hence…

- The marketing for the CryptoKnights show is done besides by the Judges (Knights), KOLs, Projects and Partners (as is also the case for KW)… primarily done (for free) by the main streaming partner(s) who inform their millions of subscribers about the CK show. Compare this with pay-per-view streaming providers who just add the KW episodes to their catalogue without any marketing.

- The Knights invested/participated in 15 projects themselves with total $35M of commitments. So, this proves the quality of the projects (and pockets of the Knights). Compare this with the judges in KW…

- CryptoKnights’ aim is to inform, educate and entertain and, in doing so, bring the masses to Web3. It’ll launch a whole ecosystem around the show, including CK Launchpad for early-stage investment deals of projects featured in the show. Where $RITE stakers get guaranteed and/or exclusive allocations and/or discounts on token prices, otherwise only available to insiders and strategic partners (such as Venture Capitalists). KW has no option for viewers to invest themselves with interesting benefits for ($RITE) stakers.

- The CryptoKnights Show is the proof of concept for RITESTREAM studios, where unique content (reality TV shows) is being produced and crowdfunded via the Web3 Crowdfunding platform. This was the first TV show funded via CK NFT sales.

- RITESTREAM has its one unique Streaming Platform where you can watch the CryptoKnights episodes.

So, overall, you can’t compare CryptoKnights with KillerWhales… CryptoKnights is top of the bill, while KillerWhales falls in another (lower quality) category. The main difference is that top streaming platforms are willing to pay millions for the CK airing/distribution rights while these streaming platforms have no interest to pay for and air KW.

And sooner or later… the market will understand this difference.

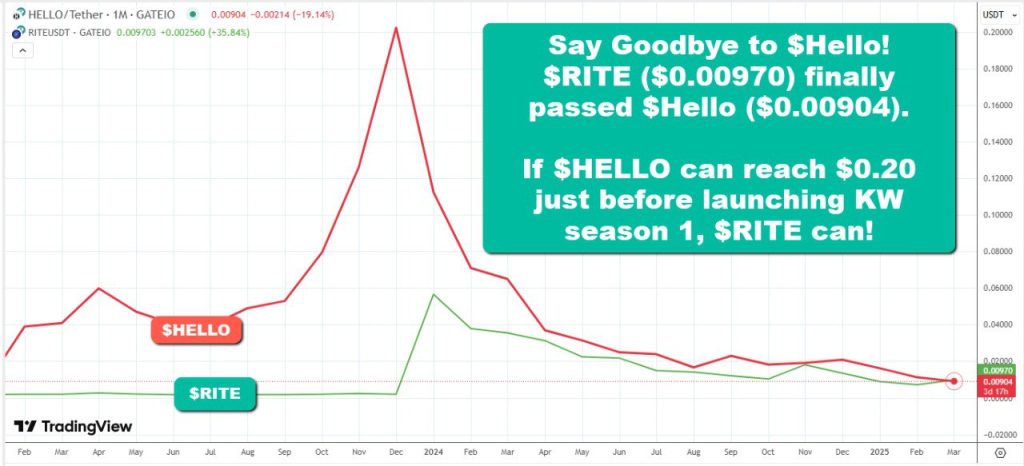

Until March 27, 2025, $HELLO outperformed $RITE in token price (and Marketcap)… but… look what’s happening now…

CryptoKnights Marketing and PR Material

Use this QR code if you want to refer people directly to the CryptoKnights.tv website.

To download the Brand Kit, click on the image below.

Suggested further reading.